Wholesale trade, September 2021

Nov 15, 2021

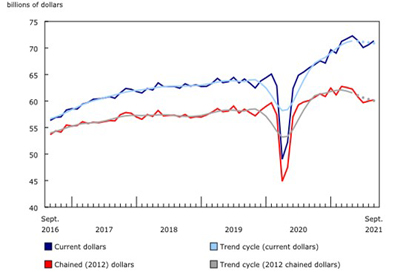

Chart 1

Wholesale sales rise in September

Wholesale sales continue growth

Wholesale sales grew 1.0% in September to $71.3 billion, the fifth increase in the past seven months. Sales of agricultural supplies (part of the miscellaneous subsector) and machinery, equipment and supplies generated the gain in September. Lower sales in the motor vehicle and motor vehicle parts and accessories subsector and the building material and supplies subsector partially offset the increase. Overall sales rose in four of seven subsectors, representing nearly 70% of the sector.

Notwithstanding the higher sales in both August and September, wholesale sales in the third quarter fell 1.6% to $212.0 billion. This was the first quarterly decline since the second quarter of 2020. The decline was entirely as a result of a drop in sales of lumber, millwork, hardware and other building supplies which was generated by a steep decline in the prices for softwood lumber. Excluding the decrease in that industry, wholesale sales rose 1.0%.

The strongest increase in the third quarter came from the miscellaneous subsector which rose 5.7%. All of the industries in the subsector posted gains in the third quarter, led by agricultural supplies and recyclable materials.

Constant dollar sales rose 0.4% in September.

Agricultural supplies sales generate growth

A 5.9% increase in sales in the miscellaneous goods subsector in September was the result of a 20.9% jump in sales in the agricultural products industry. The growth in the agricultural products industry pushed monthly sales to over $3 billion for the first time on record. The gain reflected a surge in off-season demand for potash both domestically and internationally, as potash exports rose 11.3% in September. In particular, sanctions placed on Belarus (another key producer of potash), and increased demand in China spurred the expansion of potash sales from Canada.

Sales also rose in the machinery, equipment and supplies subsector, up 2.7% in September to $14.9 billion. Sales in the subsector were up in two of the past three months. The agricultural sector also played a role in the increase as sales in the farm, lawn and garden machinery industry rose 8.2% to $1.9 billion. The increase was a bit of a rebound for the industry, which posted its lowest sales in 12 months in August 2021.

Wholesalers of motor vehicles and motor vehicle parts and accessories reported lower sales for the second consecutive month, down 2.0% in September to $10.1 billion, the lowest since June 2020. The ongoing problems with world-wide supply chains continued to have an impact on the subsector, with many assembly plants in North America in particular shut down for most or all of September. As such, declines in the subsector were widespread.

Building material and supplies wholesalers reported a 1.4% drop in sales in September to $11.2 billion. September marked the third time in the past four months that the subsector recorded lower sales of building materials. Sales in the lumber, millwork, hardware and other building supplies industry have fallen by 30.4% in the past four months, after reaching an all-time high of $8.1 billion in May 2021. Notably, exports of forestry products and building and packaging materials fell 8.1% in September. Despite the recent cooling of sales in the subsector, it is still performing at historically strong levels. Sales in September 2021 were 14.4% higher than in September 2020.

Ontario leads provinces and territories in sales

Wholesale sales increased in seven provinces and one territory in September, accounting for 68% of national sales. Wholesalers in Ontario reported the largest growth in sales, contributing 60% of the monthly increase, followed by Saskatchewan, which accounted for another 22%.

Sales in Ontario increased for the third consecutive month, up 1.8% in September to $36.3 billion, for a record-high month. Sales have increased in Ontario in 14 of the 17 months since May 2020. Five of seven subsectors recorded increased sales, led by the personal and household goods subsector, which rose 6.1% to $6.3 billion, and contributed just over half of the increase in the province. All component industries of this subsector saw gains, with the largest coming from the pharmaceuticals and pharmacy supplies industry. The machinery, equipment and supplies subsector increased 2.5% to $7.5 billion, due to a 16.5% increase in sales of farm, lawn and garden machinery and equipment.

Saskatchewan also had a record-breaking month, with sales increasing 9.7% to $2.6 billion. While six of the seven subsectors reported decreased sales in September, nearly all of the growth can be attributed to the agricultural supplies industry, which rose 28.8%. This industry had increased sales reported in all provinces and territories.

Since reaching a record high in May, sales in British Columbia have decreased for four consecutive months, down 2.3% to $7.1 billion in September. The building material and supplies subsector had the largest decrease, with sales dropping 7.2%.

Sales in Quebec fell 0.9% to $13.9 billion in September, with nearly all of the decline due to lower sales in the personal and household goods, and the motor vehicle and motor vehicle parts and accessories subsectors.

In the third quarter of 2021, seven provinces and one territory reported lower sales than in the second quarter. These provinces and territory contributed 46% of the third quarter’s wholesale sales nationally. Quebec closed the quarter with the largest decline among the provinces, down 5.5% to $41.2 billion. Sales in British Columbia were down 7.2% to $21.9 billion for the quarter. Both of these provinces’ declines were largely attributable to lower sales in the building material and supplies subsector, which reported quarterly decreases in all provinces and one territory.

Conversely, quarterly sales in Ontario reached a record high, with an increase of 1.3% to $107.5 billion, accounting for 51% of national sales. Higher sales in the personal and household goods, miscellaneous, and motor vehicle and motor vehicle parts and accessories subsectors each contributed to approximately 30% of Ontario’s quarterly growth.

Inventories sustain growth streak

Wholesale inventories increased 1.4% to $98.6 billion in September. This marks the fifth consecutive month of growth. Six of seven subsectors reported larger inventories; they comprised 89% of inventories for the sector. Inventories grew 3.5% on a quarterly basis.

Machinery, equipment and supplies wholesalers’ inventories grew 2.9% in September to $27.6 billion, the highest level since June 2019. That subsector held 28% of the sector’s inventory, and the subsector’s month-over-month growth contributed 58% of the increase in the sector. Inventories increased in all component industries. Construction, forestry, mining, and industrial machinery, equipment and supplies increased the most, adding 4.0% for a total of $12.2 billion of inventory.

Motor vehicle and motor vehicle parts and accessories inventories shrank 3.1% to $10.8 billion. The last time inventories were lower in the subsector was in March 2016. Over half of inventories in the subsector are held by motor vehicle wholesalers, and a 6.5% reduction in that industry to $5.6 billion accounted for all of the decrease. New motor vehicle parts and accessories made up 47%, or $5.0 billion, of the value of inventories in the subsector, and a 0.9% expansion of inventories moderated the subsector decrease slightly.

Inventories of agricultural supplies increased 3.2% to $5.8 billion.

Quarterly inventories declined 9.0% in the motor vehicle and motor vehicle parts and accessories subsector, $1.1 billion lower than the previous quarter due to reductions in the motor vehicle and new motor vehicle parts and accessories industries. Building material and supplies (+9.6%) and machinery, equipment and supplies inventories (+4.3%) both increased. The miscellaneous subsector added 7.6% in the third quarter to the value of inventories, of which 80% was due to agricultural supplies.

The inventory-to-sales ratio remained at 1.38 in September. This ratio is a measure of the time (in months) required to exhaust inventories if sales were to remain at their levels.

Source: https://www150.statcan.gc.ca/n1/daily-quotidien/211115/dq211115b-eng.htm