Wholesale trade sales rise in August

Oct 18, 2021

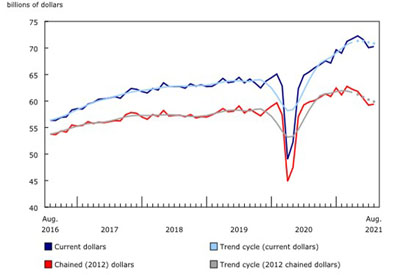

Sales in the wholesale trade sector rose 0.3% in August to $70.3 billion, the first increase following two months of declines. The modest overall increase in the sector was the result of noticeable movements among the seven subsectors. Combined, sales of food, beverage and tobacco, building materials and supplies, and miscellaneous products rose 2.9%, while sales in the other four subsectors combined fell 2.1%. Roughly one-half of wholesale sales fall into each of these two groupings.

Constant dollar sales rose 0.3% in August.

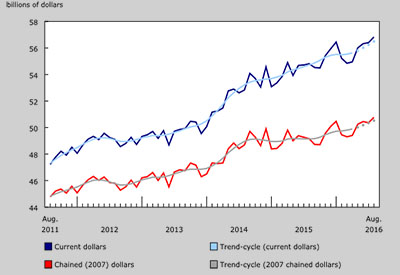

Chart 1

Wholesale sales rise in August

Food, beverage and tobacco sales top gains

Sales of food, beverage and tobacco products rose 3.8% in August to $13.1 billion, eclipsing March 2020 sales for the first time. The food, beverage and tobacco subsector tends to be the most stable of the wholesale sector. At the beginning of the COVID-19 pandemic, monthly sales in this subsector initially fell 10%, then rose quickly and stabilized at a level roughly 5% to 6% below pre-pandemic levels. This was largely the result of Canadians increasing food purchases at grocery stores, and lowering them at restaurants. As pandemic restrictions eased and more restaurants reopened with greater capacity, food sales have risen in four of the past six months, and surpassed pre-pandemic levels in August.

The building material and supplies subsector posted a 2.3% increase to $11.4 billion in August, but for the first time in more than a year it was not the sale of lumber products that drove sales in the subsector. In August, the increase was largely due to higher sales of electrical, plumbing, heating and air conditioning equipment and supplies (+6.8%) and may reflect downstream effects from a strong spring in home construction. Meanwhile, metal service centre industries rose 4.9%. Sales in the lumber and other building supplies industry fell 0.9%, the third consecutive decline, as prices for lumber in Canada continued to decrease.

Motor vehicle and motor vehicle parts and accessories sales fell 4.2% in August to $10.3 billion. The subsector has faced difficulties as a result of ongoing shortages of raw materials (particularly semiconductors), preventing it from recovering from the impact of the pandemic. Sales dropped 75% at the beginning of the pandemic, from $12.0 billion to $3.0 billion. But while sales briefly rebounded to as high as $11.2 billion in October 2020, sales in 2021 have averaged $10.5 billion monthly. The last time pre-pandemic that the subsector recorded an eight-month stretch with average sales lower than that level was from February to September 2016.

Sales of machinery, equipment and supplies fell 1.7% in August to $14.4 billion, the third decline in the past four months and the lowest monthly level of 2021. The decrease reflected lower sales of farm, lawn, and garden machinery and equipment.

Quebec leads provinces and territories in sales

Wholesale sales decreased in seven provinces and all three territories in August, however higher sales in Quebec, Prince Edward Island and Alberta were enough to offset lower sales elsewhere. Sales in provinces that reported higher sales in August accounted for 30% of national sales in the wholesale sector.

Sales in Quebec grew 5.5% to $14.1 billion. Six of seven subsectors reported higher sales in August, led by an 18.4% increase in building materials and supplies. All industries in the subsector saw higher sales, with lumber, millwork, hardware and other building supplies merchant wholesalers accounting for 51% of sales in the subsector and 56% of the increase in August for Quebec. Food, beverage and tobacco merchant wholesalers added 7.2% to monthly sales, contributing $3.0 billion or 22% of sales for Quebec. Sales of food alone made up 90% of sales in the subsector and 92% of the monthly increase for the province.

Food merchant wholesalers saw higher sales in six provinces in August, with the most growth reported in Ontario. Sales of food in Ontario grew 5.5% to $5.1 billion. Taken together, increased food sales in Quebec and Ontario represented 93% of the change observed in the industry for the whole country.

British Columbia posted the largest decline in sales, down 2.1% to $7.3 billion. Four of seven subsectors, representing 60% of wholesale sales in the province, reported lower sales. The building material and supplies subsector comprised 30% of wholesale sales in British Columbia in August. That subsector reported a 5.7% drop in sales to $2.2 billion. The decline was driven entirely by lower sales of lumber, millwork, hardware and other building supplies which more than offset increases in the other industries. Wholesalers in the miscellaneous subsector reported a 9.0% decrease in sales.

Inventories keep rising in August

The value of wholesale inventories increased for a fourth consecutive month, rising 1.7% in August to the highest level on record at $97.3 billion. Higher inventories were reported in six of seven subsectors, representing 89% of total inventories.

Inventories of building materials and supplies rose for the 11th consecutive month, up 4.2% to a record high of $18.2 billion. All three component industries posted higher inventories, with the metal service centres contributing 62% of the growth, up 10.4% to $4.8 billion. Inventories in the lumber, millwork, hardware and other building supplies industry rose 2.0% to $8.6 billion, while inventories in the electrical, plumbing, heating and air conditioning equipment and supplies industry were up 2.4% to $4.9 billion—both record highs.

The motor vehicle and motor vehicle parts and accessories subsector was the sole subsector with lower inventories in August, down 1.5% to $11.2 billion. This reflects the ongoing challenges faced by the auto sector, such as the ongoing semiconductor shortage and disruptions in global supply chains. Higher inventories were observed in the new motor vehicle parts and accessories industry (+2.3% to $4.9 billion), and the used motor vehicle parts and accessories industry (+6.7% to $115.0 million). The growth was entirely offset by the declining inventories in the motor vehicle industry (-4.5% to $6.1 billion).

The inventory-to-sales ratio increased to 1.38 in August. This ratio is a measure of the time (in months) required to exhaust inventories if sales were to remain at their levels.

Early estimates from the 2020 Annual Wholesale Trade Survey

Preliminary estimates for the 2020 Annual Wholesale Trade Survey are currently being processed and analyzed prior to their release. This article includes an early indication of some key figures. Final numbers will be released on December 21, 2021.

The operating revenue of Canadian wholesalers decreased 4.9% in 2020 to $1.1 trillion. The cost of goods sold was down 6.6% to $909.1 billion. Since the cost of goods sold declined faster than the operating revenue, gross margins for wholesalers increased from 16.5% in 2019 to 18.0% to 2020. Declines in total operating revenue and cost of goods sold were driven primarily by the petroleum and petroleum products subsector. Excluding petroleum, the wholesale trade sector saw revenues increase by 2.3% from 2019, while the cost of goods sold was up 1.5%.

Wholesalers of petroleum products saw their revenues drop 24.5% to $235.0 billion in 2020. The petroleum subsector’s share of total wholesale revenues declined from 26.7% in 2019 to 21.2% in 2020. Despite that, petroleum was still the largest contributor to wholesale revenues in Canada. The cost of goods sold by the petroleum subsector decreased 24.8% in 2020 to $225.5 billion. During that time, the Raw Materials Price Index for conventional crude oil fell by 33.4%. Gross margins for petroleum wholesalers increased to 4.1% from 3.7% in 2019 as the cost of goods sold fell slightly faster than the revenues.

Farm product wholesalers reported total operating revenue of $45.7 billion in 2020, up 1.8% from 2019. The cost of goods sold for this subsector increased by 1.0% to $41.6 billion. Oilseed and grain wholesalers accounted for over three-quarters of total revenues in the farm product subsector, with revenues growing to $35.1 billion in 2020, up 3.5% from 2019. The cost of goods sold by oilseed and grain merchants increased 2.7% to $32.0 billion, bringing gross margins up to 8.7% from 8.0% in 2019.