Wholesale Trade, July 2024

September 16, 2024

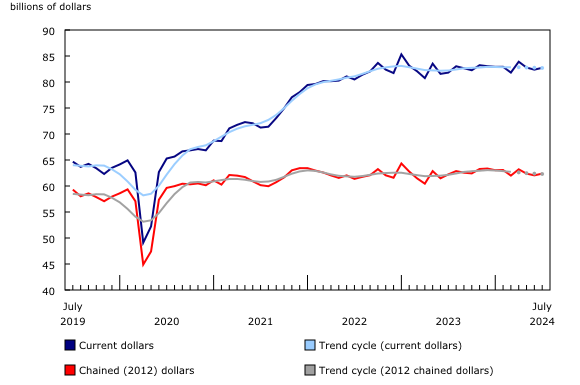

Wholesale sales (excluding petroleum, petroleum products, and other hydrocarbons and excluding oilseed and grain) grew 0.4% to $82.7 billion in July. Sales increased in four of the seven subsectors, led by the agriculture supplies industry group within the miscellaneous subsector and the food, beverage and tobacco subsector. Wholesale sales were 1.1% higher in July, compared to the same month one year earlier.

In volume terms, wholesale sales increased 0.5% in July.

Chart 1

Wholesale sales (excluding petroleum, petroleum products, and other hydrocarbons and oilseed and grain) increase in July

Sales increases in July led by the miscellaneous and the food, beverage and tobacco subsectors

Following a decline in June, sales in the miscellaneous subsector increased 3.0% to $10.5 billion in July. Although sales fell in four of the seven industry groups, significant growth in the agriculture supplies industry group (+9.2% to $3.5 billion) caused the overall subsector’s increase in July.

The food, beverage and tobacco subsector also contributed to higher sales, up 1.7% to $15.0 billion in July following two consecutive monthly declines. Sales increased in all four industry groups and were led by the food industry group (+1.3% to $13.3 billion).

The increase in wholesale sales in July was moderated by a decline in the personal and household goods subsector (-2.5% to $12.1 billion). Sales decreased in three of the five industry groups, led by the large decline reported in the personal goods industry group (-22.2% to $1.0 billion).

Quebec leads provincial sales growth

In July, seven provinces reported increases in wholesale sales, led by Quebec (+2.0%) and Alberta (+2.0%). Ontario (-0.7%) posted the largest decline.

Wholesale sales in Quebec rose 2.0% to $14.8 billion in July, marking its fifth increase in the last seven months. Sales increases were reported in six out of the seven subsectors, led by the motor vehicle and motor vehicle parts and accessories subsector (+11.5% to $1.9 billion).

Alberta saw the second-largest provincial sales growth, up 2.0% to $9.2 billion in July following a 1.3% decline in June. While sales declined in the majority of subsectors, strong growth in the miscellaneous and the motor vehicle and motor vehicle parts and accessories subsectors drove the overall increase in the province in July.

In contrast, in Ontario, wholesale sales fell 0.7% to $42.7 billion in July. Sales declined in four of the seven subsectors, led by the motor vehicle and motor vehicle parts and accessories subsector (-3.2% to $9.8 billion) and the personal and household goods subsector (-3.5% to $7.1 billion).

Inventories up in July

Wholesale inventories were up 0.5% to $127.5 billion in July, after a 0.1% decline in June.

In July, four out of the seven subsectors recorded increases, led by the machinery, equipment and supplies subsector (+1.0% to $39.4 billion). Inventory levels in this subsector in July were 3.9% above their level from one year earlier. Increases were also reported in the motor vehicle and motor vehicle parts and accessories subsector (+2.0% to $17.3 billion).

Inventory declines in the personal (-0.8% to $20.1 billion) and building material and supplies (-0.5% to $22.0 billion) subsectors tempered the increase in July.

The inventory-to-sales ratio, at 1.54, was the same in July as it was in June. This ratio is a measure of the time (in months) required to exhaust inventories if sales were to remain at their current levels.

Early estimates from the 2023 Annual Wholesale Trade Survey

Preliminary estimates for the 2023 Annual Wholesale Trade Survey are currently being processed and analyzed prior to their release. This article includes preliminary findings of key variables for two wholesale subsectors with the largest impact on Canada’s year-over-year growth. Final results will be released on December 20, 2024. Since these estimates were calculated based on a higher rate of estimated data, they may be subject to a higher revision rate than the regular annual release.

The total operating revenue of Canadian wholesalers decreased 3.6% in 2023 to $1.5 trillion. The cost of goods sold was down 5.1% to $1.3 trillion. Due to the cost of goods sold decreasing at a faster rate than total operating revenue, gross margins for wholesalers rose from 15.8% in 2022 to 16.6% in 2023. Decreases in total operating revenue and cost of goods sold were driven primarily by the petroleum, petroleum products, and other hydrocarbons merchant wholesale subsector.

Petroleum wholesalers experienced a drop in total operating revenue of 21.3% from 2022 to $407.5 billion in 2023. Over the same time period, the cost of goods sold by the petroleum subsector fell 20.2% to $392.8 billion. The Raw Materials Price Index for conventional crude oil reported decreases in 11 of the 12 months of 2023, impacting the total operating revenue for petroleum wholesalers.

Expressed as a percentage of total operating revenue, gross margins for the petroleum, petroleum products, and other hydrocarbons merchant wholesale subsector decreased from 4.3% in 2022 to 3.6% in 2023. This was due in part to the cost of goods sold decreasing at a slightly slower rate than revenues.

When removing the impact of the petroleum, petroleum products, and other hydrocarbons merchant wholesale subsector, the total operating revenue for wholesalers in Canada increased by 2.8% in 2023.

The largest increase was observed in the motor vehicle and motor vehicle parts and accessories merchant wholesale subsector, which reported total operating revenues of $184.6 billion in 2023, up 13.6% from 2022. Some of this increase can be attributed to higher retail sales of new motor vehicles which rose 12.7% in 2023. This increase of sales in new motor vehicles in 2023 was partly due to the recovery of the global semiconductor shortage, which affected the new motor vehicle industry in 2022.