Wholesale Trade, April 2024

June 14, 2024

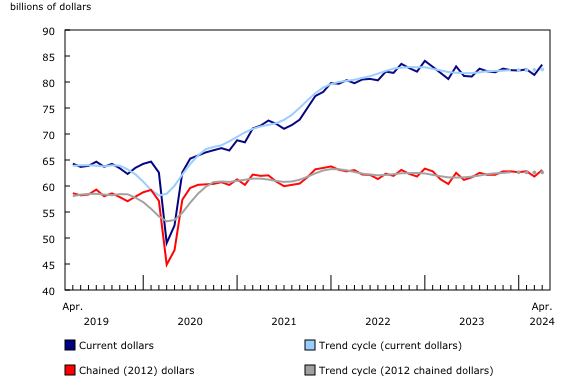

Wholesale sales (excluding petroleum, petroleum products, and other hydrocarbons and excluding oilseed and grain) grew 2.4% to $83.3 billion in April. Sales increased in five of the seven subsectors, led by the motor vehicle and motor vehicle parts and accessories subsector and the miscellaneous subsector. Wholesale sales were 3.4% higher in April compared with the same month one year earlier.

In volume terms, wholesale sales increased by 2.0% in April.

Chart 1

Wholesale sales (excluding petroleum, petroleum products, and other hydrocarbons and oilseed and grain) increase in April

Motor vehicle and motor vehicle parts and accessories lead sales increases in April

Following a decline in March, sales in the motor vehicle and motor vehicle parts and accessories subsector increased by 10.2% to $14.6 billion in April, the highest reported sales since November 2023. Sales grew in all three of the subsector’s industry groups in April 2024, led by the motor vehicles industry group (+12.4% to $11.8 billion).

The miscellaneous subsector also contributed to higher wholesale sales, up 5.1% to $10.6 billion in April. Sales increased in five of the seven industry groups, led by the agriculture supplies industry group (+6.9% to $3.6 billion), which was up following two monthly declines.

Ontario leads the way in provincial sales growth

In April, a majority of the provinces reported increases in wholesale sales, led by Ontario.

Wholesale sales in Ontario rose 2.1% to $43.0 billion in April, following three consecutive months of declines. While sales declined in four of the seven subsectors, the motor vehicle and motor vehicle parts and accessories subsector’s notable growth (+11.7% to $10.1 billion) was the driving force behind the province’s increase in April.

Alberta saw the second-largest provincial sales growth in April, up 6.2% to $9.4 billion, also following a decline in March. In April, six of the seven subsectors reported sales increases, led by the machinery, equipment and supplies (+4.6% to $3.2 billion) as well as the motor vehicle and motor vehicle parts and accessories (+17.1% to $948.4 million) subsectors.

Inventories fall in April

Wholesale inventories were down 0.5% to $126.3 billion in April, after a 0.4% uptick in March.

In April, four of the seven subsectors recorded declines, led by the building material and supplies subsector (-2.8% to $21.6 billion), as all its industry groups posted declines. Inventory levels in this subsector sat 11.1% below their level from one year earlier. Declines were also reported in the motor vehicle and motor vehicle parts and accessories subsector (-3.4% to $16.1 billion).

Inventory increases in the food, beverage and tobacco (+3.5% to $14.1 billion) and the personal and household goods (+2.1% to $21.0 billion) subsectors tempered the decline in April.

The inventory-to-sales ratio fell from 1.56 in March to 1.52 in April. This ratio is a measure of the time (in months) required to exhaust inventories if sales were to remain at their current levels.