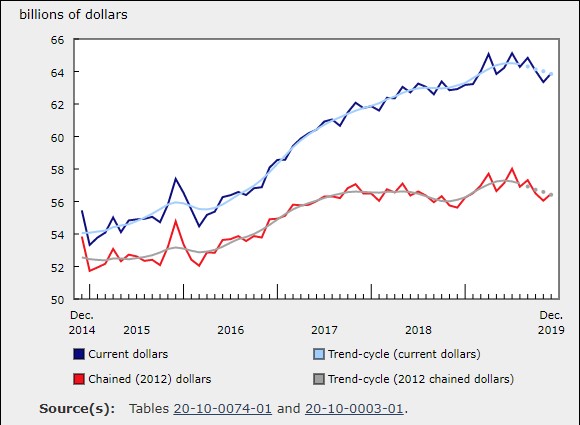

Wholesale Sales Up 0.9% in December

Feb 24, 2020

Wholesale sales rose 0.9% to $63.9 billion in December, following two consecutive monthly declines. Four of seven subsectors recorded higher sales, accounting for 63% of wholesale sales. In dollar terms, the motor vehicle and motor vehicle parts and accessories subsector led the increase.

In volume terms, wholesale sales rose 0.8%.

In the fourth quarter, sales declined 1.5%, following 14 consecutive quarterly increases. Lower sales were recorded in five of seven subsectors, led by the motor vehicle and motor vehicle parts and accessories (-3.1%) and the miscellaneous (-4.0%) subsectors.

Increase in December attributable to higher sales in four of seven subsectors

Higher sales were recorded in the motor vehicle and motor vehicle parts and accessories subsector, up 1.9% to $10.9 billion, following four consecutive monthly declines. Two of three industries had higher sales, with the motor vehicle industry (+3.0%) leading the increase. Quarterly sales in the subsector fell for a second consecutive quarter, as sales slowed in the second half of 2019.

Sales increased 2.5% in the miscellaneous subsector, to $8.1 billion in December, following three consecutive monthly declines. Most of the rise was attributable to gains in the other miscellaneous (+6.1%) and the agricultural supplies (+4.8%) industries.

On a quarterly basis, the other miscellaneous industry recorded its highest level of quarterly sales in the fourth quarter of 2019 (+4.0%), while the agricultural supplies industry declined 13.6%, its lowest level of quarterly sales since the first quarter of 2018.

Higher sales in five provinces

Sales were up in five provinces in December, representing 76% of total wholesale sales in Canada. In dollar terms, Ontario and Quebec accounted for most of the gain.

Sales in Ontario recorded the largest increase in December, up 1.0% to $33.3 billion, following a decline of 1.3% in November. Sales were led by the machinery, equipment and supplies (+3.0%), miscellaneous (+2.7%) and motor vehicle and motor vehicle parts and accessories (+1.1%) subsectors. Quarterly sales in Ontario fell for the first time since the third quarter of 2018.

Wholesalers in Quebec reported the second largest gain, up 1.8% to $12.0 billion, the first increase in three months. Five of seven subsectors recorded gains in December, led by the food, beverage and tobacco (+3.5% to $3.0 billion) and the building material and supplies (+3.7% to $1.9 billion) subsectors. For both subsectors, December was the sixth monthly gain in 2019.

The miscellaneous subsector contributed the most to the increase as inventories in this subsector increased by 3.9% to $11.8 billion, following five consecutive monthly declines. Partially offsetting the increase, the machinery, equipment and supplies subsector decreased by 0.3% to $26.9 billion.

The inventory-to-sales ratio decreased from 1.45 in November to 1.44 in December. The inventory-to-sales ratio is a measure of the time (in months) required to exhaust inventories if sales were to remain at their current level.

Wholesale trade sector in 2019

Wholesale trade in Canada rose for a 10th consecutive year in 2019, up 2.3% to $769 billion. This was a slower rate compared with 2018 (+3.7%) and 2017 (+7.5%). Moreover, this was the lowest growth rate since 2013. Although sales grew in the first three quarters of 2019, a 1.5% decline in the last quarter contributed to the comparatively lower growth in 2019.

After removing the price effect, wholesale sales were up 1.0% to $682.0 billion in 2019.

Wholesale sales increased in six subsectors in 2019, led by the machinery, equipment and supplies subsector. The sole subsector to decline was the building material and supplies subsector.

Regionally, seven provinces posted higher sales in 2019, led by Ontario and Quebec. Both of these provinces have recorded continuous annual increases of wholesale sales since 2009.

According to the Survey of Employment, Payrolls and Hours, there were on average 823,000 payroll employees in wholesale trade in Canada from January 2019 to November 2019, up 2.6% following a 3.1% rise in 2018 for the same period. Average weekly earnings (including overtime) of payroll employees in wholesale trade grew 1.3% to $1,261 from January 2019 to November 2019, after a 2.1% increase over the same period in 2018.

Machinery, equipment and supplies subsector leads higher wholesale sales in 2019

Sales in the machinery, equipment and supplies subsector increased at a slower pace in 2019 compared with the previous two years, as sales grew 4.1% to $162.2 billion after increasing 8.1% in 2018 and 8.2% in 2017. Similar movements are recorded by the Canadian international trade data, which showed that the imports of industrial machinery, equipment and parts grew 1.7% in 2019, after increasing 8.6% in 2018 and 2.8% in 2017.

Within this subsector, in dollar terms, the computer and communication equipment and supplies industry contributed the most to the increase, followed by the construction, forestry, mining, and industrial machinery, equipment and supplies industry.

Sales in the computer and communication equipment and supplies industry grew 10.8% to $51.4 billion in 2019. The Industrial Product Price Index (IPPI) for computers and computer peripheral equipment (+0.8%) and communication and audio and video equipment (+2.1%) also increased in the same year. Since 2009, sales in this industry have increased each year except for 2017. The IPPI for computers and computer peripheral equipment and communication and audio and video equipment also declined in 2017.

The construction, forestry, mining, and industrial machinery, equipment and supplies industry, which had the largest share in the subsector, increased 3.6% to $52.2 billion after increasing 11.0% in 2018 and 10.9% in 2017. Some wholesalers in this industry are involved in selling machinery and equipment to companies in the oil and gas industry.

Higher oil prices in 2017 and 2018 may have contributed to greater wholesale sales in the subsector in 2017 and 2018; generally, higher oil prices are associated with increased activity in the oil and gas industry and, consequently, higher sales of machinery and equipment. Although oil prices were lower in 2019 compared with 2018, they reached their 2019 peak in the second quarter, during which wholesale sales grew 3.3%, leading to positive growth for the year.

The building material and supplies subsector is the sole subsector to decline

In the building material and supplies subsector, sales declined 2.8% to $107.5 billion in 2019. This was the first yearly decline since 2009 for this subsector. The top contributing industry to the decline was the lumber, millwork, hardware and other building supplies industry (-5.6% to $51.9 billion). Lower prices of lumber and other sawmill products have been contributing to lower sales in this industry, as can be seen from the IPPI for lumber and other wood products, which declined 2.5% in 2019 and overall has been following the same trend as the wholesale sales in the lumber, millwork, hardware and other building supplies industry.

Export of lumber and other sawmill products (-18.7%) also declined in 2019.

Ontario leads the provinces

Sales in Ontario grew 3.0% to $397.2 billion, the 10th consecutive yearly increase. The machinery and equipment subsector (+6.0% to $84.2 billion) contributed the most to the higher sales in Ontario. Other contributors were the personal and household goods (+3.8% to $63.7 billion) and the motor vehicle and motor vehicle parts (+2.5% to $92.6 billion) subsectors. In Ontario, exports and imports of industrial machinery and equipment (+2.4% and +0.7%, respectively), consumer goods (+5.8% and +3.7%, respectively) and motor vehicle and parts (+1.4% and +1.7%, respectively) increased in 2019.

Higher inventory-to-sales ratios in 2019

Wholesale inventories reached their peak at $93.5 billion in July 2019. Decreases in three of the next five months resulted in inventories declining to $92.2 billion in December. The average inventory-to-sales ratio in 2019 was 1.43 compared with 1.36 in 2018 and 1.30 in 2017. At the subsector level, on average, the highest inventory-to-sales ratio was observed in the machinery, equipment and supplies subsector (1.98), followed by the building material and supplies (1.71) and the personal and household goods (1.70) subsectors in 2019. Wholesale companies in these subsectors sell durable goods.

Source: Statistics Canada, www150.statcan.gc.ca/n1/daily-quotidien/200224/dq200224b-eng.htm