Wholesale Sales Rose 2.8% in March

May 14, 2021

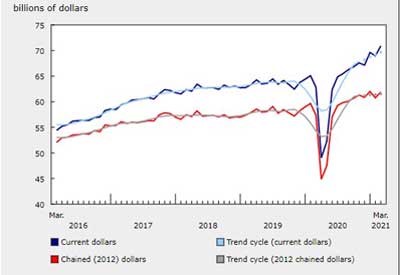

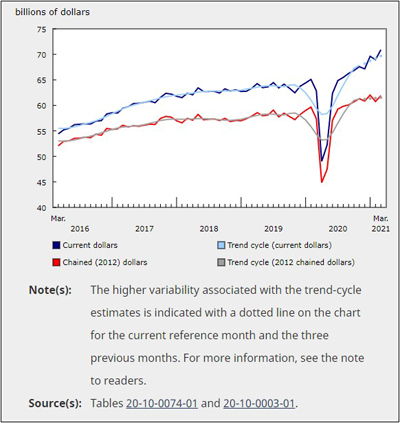

Sales by Canadian wholesalers rose 2.8% in March, the second increase in three months. The growth in March was due to increases in the building material and supplies subsector and the miscellaneous subsector.

Sales by Canadian wholesalers rose 2.8% in March, the second increase in three months. The growth in March was due to increases in the building material and supplies subsector and the miscellaneous subsector.

Wholesale sales volumes were up 1.9% to $61.9 billion. March was the eighth consecutive month where wholesale sales volumes were higher than the $59.7 billion recorded before the COVID-19 pandemic, in February 2020. Wholesale sales volumes were 3.7% higher in March 2021 than February 2020.

Wholesale sales of building material and supplies resume growth after one-month decline

Sales of building materials and supplies rose for the 10th time in 11 months, up 11.3% to $12.2 billion, an all-time high for the subsector. This subsector has been the strongest component of wholesale trade in Canada since the beginning of the pandemic, as demand for new homes and home improvements has increased. This demand has generated a sustained rise in the price of lumber in Canada. Notably, the price of lumber at the sawmill gate rose 10.2% in March 2021, according to the Industrial Product Price Index, and was up 68.2% year over year.

Sales in the miscellaneous subsector rose 3.1% in March to $9.4 billion, the fifth increase in six months. The increase in the subsector was widespread, with four of five industries reporting gains.

Sales fell in two subsectors — motor vehicles and motor vehicle parts and accessories (-0.3%), and farm products (-1.6%).

Q1 sales set record

Sales in the first quarter of 2021 were $209.5 billion, a 3.9% increase over the fourth quarter of 2020 and an 8.9% increase from the first quarter of 2020. These were also the highest sales in a single quarter on record, as the three highest monthly sales levels for the sector all came in the first quarter of 2021. If sales for the rest of 2021 remain at the same level as in the first quarter, annual sales would be 11.1% higher than those in 2020.

More than 90% of the increase in the quarter came from two subsectors: building material and supplies; and machinery, equipment and supplies. Sales of building material and supplies jumped 13.8% in the quarter on the strength of sustained demand for new homes in both Canada and the United States. Similarly, sales of wood products by Canadian manufacturers rose 21.5% in the first quarter of 2021.

Wholesale sales of machinery, equipment and supplies increased 7.4%, led by higher sales of computer and communications equipment and supplies.

Impact of ongoing semiconductor chip shortages

Since the beginning of 2021, a global shortage of semiconductor chips has been affecting businesses throughout the supply chain for computerized goods, and it has also had an impact on manufacturing, wholesaling and international trade.

The supply of semiconductor chips has been disrupted by a variety of factors, including the response to the COVID-19 pandemic, severe weather, and capacity issues at semiconductor chip manufacturing facilities. Consequently, the time it takes chip manufacturers to fulfill orders has been increasing since early 2020, but the shortage has been especially acute since January 2021.

Semiconductor chips are important because they are critical components in devices such as personal computers, cars, smartphones, gaming consoles and modern household appliances. A variety of industries are now competing for the limited supply.

The motor vehicle and motor vehicle parts industry has been particularly affected by these trends, and semiconductor chip shortages have created significant and unprecedented challenges for motor vehicle and parts makers around the world. In March 2021, motor vehicle and parts manufacturers in Canada were able to temporarily ramp up production—motor vehicle sales rose 10.5% to $3.6 billion, and sales of motor vehicle parts increased 7.7% to $2.4 billion. Despite the gains observed in March, motor vehicle sales were down 14.1% from December 2020 and 16.8% in the first quarter of 2021, following a 10.2% decline in the fourth quarter of 2020.

In March, wholesalers in the motor vehicle and motor vehicle parts and accessories subsector saw sales fall 0.3%. Sales were down 1.5% from December 2020 and 3.5% for the quarter.

Similar trends have occurred in international trade, with modest gains in March failing to reverse declines in the first quarter of 2021 of 6.2% for exports of motor vehicles and parts and 4.2% for imports of motor vehicles and parts.

These slowdowns are expected to intensify and may have a greater impact in April as some car manufacturers announced plans to reduce output of finished vehicles, in response to the lack of semiconductor chips. This will also affect the wholesale demand for motor vehicle parts and accessories, given the highly integrated nature of the North American automotive production chain.

Quebec leads rise in sales

Higher sales were recorded in nine provinces and two territories, accounting for 99.0% of total wholesale sales in March. Quebec led the gains, with Alberta and British Columbia trailing further behind. New Brunswick and Nunavut were the only regions to post a decline.

Sales in Quebec rose 8.8% to $14.0 billion, contributing 58.0% of the national increase. This was a record level and the second-largest month-over-month increase on record for the province. All seven subsectors saw gains, with the largest coming from machinery, equipment and supplies (+13.9%); building material and supplies (+12.4%); and personal and household goods (+8.6%). These three subsectors accounted for 71.6% of the provincial increase and 56.2% of sales.

In March 2021, sales rose across all seven subsectors in Alberta, up 6.0% from the previous month to $7.1 billion. The machinery, equipment and supplies subsector also led the gains (+8.6%) in this province, followed by the building material and supplies (+9.1%) and miscellaneous (+9.4%) subsectors. Both of these subsectors had increased sales in the majority of provinces and territories in March, partly because they continued to see higher demand with limited restrictions from ongoing lockdowns.

Sales in Ontario rose 0.3%, reflecting offsetting movements in key sectors. Sales in the building material and supplies subsector increased 12.6% to $4.9 billion (the second-largest increase on record), while sales in the machinery, equipment and supplies subsector declined 6.2% to $7.7 billion. These two subsectors accounted for 35.2% of sales in Ontario, which have increased in 10 of 12 months in Ontario.

Quebec and Ontario record largest quarterly increases

Sales in Quebec and Ontario had the largest growth in the first quarter of 2021. Sales in Quebec rose 6.8% over the previous quarter to $40.0 billion, accounting for 32.1% of the quarter’s increase. The building material and supplies subsector had the largest gain, up 22.1% to $7.3 billion, contributing to over half of the province’s quarterly increase in sales. This trend is consistent with the continuing rise in demand and prices for building material and supplies.

Sales in Ontario were up 2.0% in the first quarter of 2021 to $107.0 billion, accounting for 51.1% of sales in Canada. Over half of the growth came from an 8.8% increase in the machinery, equipment and supplies subsector. This gain was largely offset by the decline in sales in the motor vehicle and motor vehicle parts and accessories subsector, down 7.1% to $21.3 billion in the quarter. Specifically, the motor vehicle industry contributed to 91.8% of the decline in this subsector.

This was the third consecutive quarter with growth in all provinces.

Inventories increase for the fourth month

Wholesale inventories rose 0.7% to $93.1 billion in March, marking the fourth consecutive monthly increase. Six of the seven wholesale subsectors reported higher inventories, combining to represent 86.8% of total inventories.

The value of wholesale inventories in the food, beverage and tobacco subsector increased 2.8% to $10.8 billion. The rise was the result of higher inventories in the food merchant wholesalers industry, up 3.4% to $9.4 billion, while the remaining three industries had declining inventories.

Inventory levels in the building material and supplies subsector increased for the sixth consecutive month, up 1.2% to $15.1 billion. The metal service industry contributed 93.9% of this increase, its inventory rising 4.6% to $3.7 billion. Inventory levels in the lumber, millwork, hardware and other building supplies industry, which accounted for half of March’s total inventory for this subsector, were unchanged at $7.2 billion.

The lone subsector with decreasing inventory in March was the miscellaneous subsector, falling 1.0% to $12.3 billion. This decrease was predominantly attributable to the drop in the agricultural supplies industry (inventory down 4.8% to $4.8 billion).

The inventory-to-sales ratio was 1.31 at the end of March, down from 1.34 in February. The inventory-to-sales ratio is a measure of the time (in months) required to exhaust inventories if sales were to remain at their current level.

Inventory up from fourth quarter

For the first quarter of 2021, inventory levels closed at $93.1 billion, a 2.5% increase over the previous quarter and a 1.6% increase compared with the first quarter of 2020. Six of the seven subsectors saw gains over the previous quarter. The personal and household goods subsector rose 3.4% and contributed one-quarter of the inventory growth. Inventory levels in the motor vehicle and motor vehicle parts and accessories subsector were flat in the first quarter, following four quarters of decline.

Source: Statistics Canada, www150.statcan.gc.ca/n1/daily-quotidien/210514/dq210514b-eng.htm?CMP=mstatcan