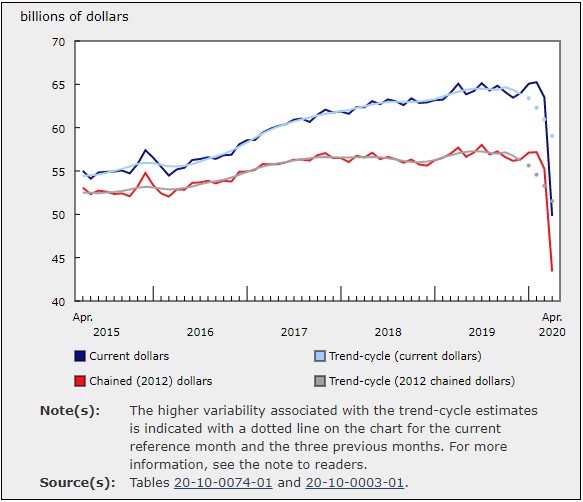

Wholesale Sales Plummeted 21.6% in April

June 24, 2020

As the effect of the COVID-19 pandemic continued to spread throughout the economy, wholesale sales plummeted an unprecedented 21.6% to $49.8 billion in April, the lowest level since July 2013. All seven subsectors recorded lower sales for the first time since November 2008. In dollar terms, the motor vehicle and motor vehicle parts and accessories subsector contributed the most to the decline. Excluding this subsector, wholesale sales were down 14.2%.

Wholesale sales volumes dropped 21.5%, a record monthly decline, to their lowest level since September 2009.

COVID-19 impact in April

Respondents reported that the COVID-19 pandemic pushed sales $16.9 billion (unadjusted) lower in April, with four-fifths (79.5%) of wholesalers reporting an impact to their business.

The motor vehicle and motor vehicle parts and accessories subsector recorded the largest dollar-value impact from the COVID-19 pandemic in April, down $5.4 billion (unadjusted). Many of these companies noted that COVID-19 caused manufacturing stoppages, dealership closures and disruptions in consumer demand.

Over nine-tenths (90.1%) of wholesalers in the personal and household goods subsector reported that their businesses were affected by COVID-19, the highest proportion among all subsectors for a second consecutive month. Respondents in the subsector reported that the COVID-19 pandemic resulted in $2.6 billion (unadjusted) of lost sales in April, led by the textile, clothing and footwear industry (-$943 million, unadjusted). Respondents in the industry indicated that the lower sales volumes were mainly attributable to retail closures.

Lower sales driven by motor vehicle industry

With the Canadian motor vehicle industry highly reliant on motor vehicle imports, the widespread shutdowns in motor vehicle manufacturing throughout the world and a reduced demand due to the pandemic, continued to impact wholesale sales in April. The motor vehicle and motor vehicle parts and accessories subsector fell for a second consecutive month, dropping 64.7% to $3.3 billion—eclipsing the previous month’s record decline of 21.7%. While all three industries in the subsector recorded declines in April, the motor vehicle industry accounted for about 90% of the decrease; sales in the industry were down 74.8% to $1.8 billion, their lowest level since March 1993.

Sales in the personal and household goods subsector recorded a second decline in three months, dropping 21.5% to $7.7 billion in April. While all six industries posted lower sales, the largest drop came in the pharmaceuticals and pharmacy supplies industry (-22.9% to $4.5 billion). Widespread declines were also reported in the building material and supplies subsector, resulting in a record 22.2% decline in sales to the lowest level since June 2013.

While all seven subsectors recorded lower seasonally adjusted sales in April, there were some sub-industries where sales increased on an unadjusted basis in April, including nursery stock and plants, alcoholic beverages, cigarettes and tobacco, and a handful of agriculture-related sub-industries.

Ontario leads April declines

Nine provinces recorded lower sales in Canada, with Ontario posting the largest drop. Saskatchewan recorded the only provincial increase.

Sales in Ontario were down 30.2% to $23.0 billion in April, following a 4.2% decline in March. Every subsector in the province had lower sales, with the majority of the decline coming in the motor vehicle and motor vehicle parts and accessories subsector, falling 85.7% to $930 million. Excluding the motor vehicle and motor vehicle parts and accessories subsector, provincial sales declined 16.6% in April.

Sales in Saskatchewan rose 1.6% to $2.3 billion, following a 6.8% increase in March. Higher sales were recorded in four of seven subsectors, led by the machinery, equipment and supplies subsector, up 5.0% to $653 million. The sole increase in this subsector was observed in the farm, lawn and garden machinery, equipment and supplies industry.

Wholesale inventories rise

Wholesale inventories increased 1.2% in April to $93.0 billion. Five of seven subsectors recorded gains, accounting for more than half of total wholesale inventories.

The personal and household goods subsector led the gains in April, with inventories rising 6.9% to $17.0 billion. While three of the subsector’s six industries recorded higher stock, the pharmaceutical and pharmacy supplies industry rose the most (+15.0% to $7.7 billion). With most retail stores closed as a result of the pandemic, wholesale companies in the textile, clothing and footwear industry saw their inventories rise as they were unable to move product.

Following an increase to 1.45 in March, the inventory-to-sales ratio jumped to 1.87 in April, the highest value on record, as all subsectors experienced gains. The motor vehicle and motor vehicle parts and accessories subsector contributed the most to the rise, as its inventory-to-sales ratio climbed from 1.38 in March to 3.83 in April.

Looking forward: Impacts of COVID-19 on wholesale trade in May 2020

Statistics Canada remains committed to providing an accurate picture of the social and economic impacts of COVID-19.

As the largest component of Canada’s service sector, wholesale trade impacts the whole economy, while acting as the “invisible” intermediary.

May marks the second month of widespread lockdown and it is anticipated that reported impacts on businesses for the month will not be as severe as seen in April.

The motor vehicle industry faced another difficult month as the widespread global manufacturing shutdowns continued and production did not begin to resume until late May or early June. While Ontario dealerships were given the green light to reopen on May 4, by appointment only, market analysts anticipate another decline in May, but one that is far less pronounced than April’s record-setting drop.

In addition, an increase in May employment for the wholesale and retail trade sector, as shown in the Labour Force Survey, and the appreciation of the Canadian dollar are providing some evidence that the Canadian economy may have started the slow road to recovery.

Source: Statistics Canada, www150.statcan.gc.ca/n1/daily-quotidien/200618/dq200618a-eng.htm