What Is the Cost of Digitization?

Sept 13, 2019

By Rick McCarten

How much does the electrical industry have to improve to compete with upcoming disruptions in the supply chain?

In May of this year, the delegates at Electro-Federation Canada (EFC)’s annual conference voted on when our industry would be hit with supply chain disruption. The group collectively agreed that our industry in Canada has only three years to prepare for major disruption. We need to act fast!

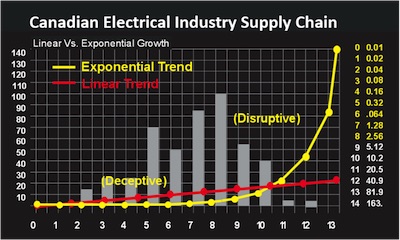

The graph below on digitization is adapted from a study by Peter Diamandis of Singular University. His study finds that digitization has a pattern that affects both products and services.

Diamandis states: “Anything that becomes digitized, enters the same exponential growth we see in computing.” The result is that digital exponential growth (yellow line) starts growing at a much slower pace then traditional linear growth (red line). If digitization grows exponentially on a yearly basis, the first 10 years of digitization are what Diamandis calls “deceptive”. It is a great opportunity for denial, to argue against it, to fight it off. Meanwhile, as the numbers on the right side of the graph show, digitization is compounded year after year.

At year 10, the compounding gets serious; it begins to grow faster than the linear model. It enters the disruptive stage. Three things happen at this stage:

- De-materialize: things start to literally disappear. Examples: CD players, cameras, video stores, printed maps, incandescent bulbs.

- De-monetize: software costs nothing to reproduce. Any form of physical product cannot compete with software. Prices fall.

- Democratize: once-held monopolies can no longer hold their position. Customers have multiple sources.

The gray bars on the graph show the vote our industry took on where we are on this graph. Individuals answered independently via a mobile app. The results varied from year 2 to year 12. The concentration was around the 7-and 8-year mark, with the average coming in close to the 7-year mark. If we were to take the average at seven, it means we have a three-year window to improve our industry to compete with potential disruption.

How much do we have to improve?

In the July 13th edition of The Economist, McKinsey and Company estimated that “40% of all procurement tasks (vendor managed inventory, order placement and invoice processing) can be automated today, and 80% will soon [be automated]; this could produce annual cost savings of 3-10%. All told, it reckons applications and manufacturing could create US$2trn of value.“

This year’s Pathfinder report has our industry sales pegged at $11.5 billion (includes non-full-line distributors).

If we assume 25% of that is cost incurred in the supply chain (across manufacturer, distributor and rep functions, shipping, warehouse, credit, freight, commissions, etc., from place of origin), multiply that by 10% savings, we come up with $290 million.

Best guess of what we need to do to prepare for the disruption is to improve our efficiencies to in the tune of $290 million in the next three years.

Recognizing this is spit-balling, it provides a target of something to aim towards, as well as points to the challenges in both dollars and time needed.

How do you begin to accomplish this?

The solution comes down to talent. Not just one at the top, but throughout your entire organization. The right people need to be in the right spots to make it happen.

At Electro-Federation Canada, we are hosting our first-ever Supply Chain Conference this November to help our members take on these tasks. Delegates will be receiving roadmaps for electronic data exchange, data sharing and vendor managed inventory, see the event ad in this publication in the coming weeks for details and to register.

EFC Supply Chain Conference: November 25-26, Pearson Convention Center, Toronto

www.electrofed.com

Rick McCarten is VP, Operations, Electro-Federation Canada.