The Winds of Change — Blowing in the Right Direction

May 20, 2020

John Kerr

The past nine weeks have been challenge across the electrical industry, to say the least. From agents to suppliers, from end users to the electrical channel, all have been affected, all have been forced to think differently and all have begun the journey to retooling the way we operate.

This is the third report in our series quantifying and exploring how electrical wholesalers have had to adapt and how they are looking to find a way forward. For this we have taken a different approach from our previous reports in that we have incorporated the results from our recent survey alongside personal interviews and discussions with electrical distributor teams across Canada.

The consistent theme from all of what we have done here is a multifaceted approach to address the current situation across human resources, finance and credit, counter orientation, IT, web infrastructure, and inventory management. All at one time these facets of the business were smashed together, and the electrical distributors here have had to balance customer needs and reactions with product availability, and on top of that understand the dynamics of local government decisions. As one distributor said, “Our team met more often than we have ever before across all departments, all the time,” and then continued, “and this taught us how we can be faster and more customer focused moving forward. For the first time in a long time we paused and listened closely to our challenge as whole.”

Underlying this entire discussion were credit and credit extension concerns of end users and contractors.

No doubt this scenario occurred across Canada and no doubt could present a silver lining for many moving forward. Staff concerns and the impairment of the ability to plan and look forward also weighed heavily on the minds of most. Many spoke too of a refocus on a work/life balance program as they must scramble to balance the needs to deliver service and products with a new system and fewer resources. But the silver lining of more cross functional discussion and integration may be a path to increased margins in future.

How will 2020 look at year end?

The biggest question for so many in the industry is just how bad is it – how will this second quarter of the year look and how will we end the year in Canada? The numerous reports provided by the publicly traded electrical wholesalers shed some light and confirmed what we heard from the non-publicly traded firms. Early March began with a relatively consistent business level but somewhere around March 20 signs of a storm brewing became evident to all.

So, what we all must realize and consider is that late March was the start date for the business reaction to begin. Sales drops across the electrical channel approached 24% for that time for the period of March 24 to March 31. March’s result stole 0.4% from year-over-year sales, assuming 2020 would show no growth over the year previous.

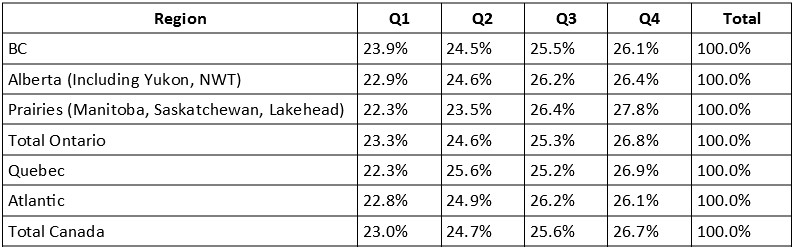

In Canada, the second quarter represents the third largest quarter of the year at 24.7 % according to the Pathfinder Report.

The table below details the average quarterly sales by region for Canada based on the average sales for the period of 2013 – 2019, courtesy of Pathfinder.

The effect of April on a year-over-year base with its overall loss of sales estimated at 35% will drop the YOY result a further 3%, and if we assume May and June are the same we could quickly estimate the overall loss year over year will approach (when you include the last week in March ) 10% or $800 million in sales. Our take based on the current survey and interviews is that May will be better than April and June better than May, dampening the net year over year loss in revenues by at least 2.5%, resulting in a potential loss around $600 million.

While it’s way too early to know exactly what June will bring and how May will finally net out, our survey and interviews have documented some interesting trends. Across the country quoting activity is up and this fact was confirmed by suppliers too. Many distributors indicated a move to acquire increased levels of inventory early in April as concerns about product availability arose.

The other big takeaways were the discussions we had around just how the end users are reacting, and is there a chance we can claw the potential loss in sales back before year end?

In the context of the quarterly sales estimates, we still have (including June) 60% of the year to go and we are entering our busy time where construction crews have more daylight hours and where projects could be accelerated, made possible by increased shifts, albeit with fewer workers per shift. Nonetheless, time can be made up on site and if the product is there work can roll on.

As we write this, car plants leading the way are reopening after their 8-week shuttering even though some retooling and plant investment in safety continued. Manufacturing plants are bringing workers back. The west has some issues still to be fixed so recovery there will be slow but based on lower volumes from the year before. So, it might not be a dark as we first thought, and clearly there is time with seven months to go to claw back much of what eluded the industry until now.

Our research and overview discussions and responses were represented across all functions but skewed to corporate leadership and branch management, which represented 56%; sales titles represented a further 33% with a solid balance across Canada.

When asked how their customers reacted to the current scenario, the responses included the facts that less than half had stopped working, while 62% of the customer based studied had maintained their full complement of staff. The good news reported projects were being delayed outweighing those cancelled by a large margin. Some distributors albeit a small number (less than 2.4%) reported their customers had closed permanently.

Differently from our previous study we witnessed several businesses/branches with larger than expected loss in sales, with 23% reporting over 40% down, of which over half of that group were over 50%. Loss of sales between 10% and 40% were indicated by 51 of respondents%. The balance reported flat to increased revenues.

The positive news came when we asked about May and how it might compare to April, where 65% responded flat to increased sales. Digging deeper this confirmed the optimism brought on by the levels of increased quoting activity and further buoyed by provincial announcements lifting restrictions.

When asked how optimistic distributors were for the summer, on a scale of 1 to 10 the index showed a solid 6.1.

When asked how things have changed at the distributor level, 54% increased a decline in the number of orders clients were placing currently, while the 44% indicated inventory levels had decreased somewhat. Receivables/collections are a bit slower that previous periods, but 58% said backlogs were consistent or increasing. Online ordering and credit card orders were growing substantially on all fronts with most participants indicating a rise in sales with credit cards and online.

Finally, we wanted to understand the underlying issues concerning product supply post COVID-19, and how distributors would react to addressing their sources of supply moving forward. When asked in light of recent events are you considering more sourcing of products made in Canadian or North American plants, 82% indicated a move to looking at North American and Canadian plant suppliers.

So, the winds of change once again shape our industry. Think positive…

John Kerr is Publisher of CEW; johnkerr@kerrwil.com