The New Look Forward… Kerr’s Crystal ball!

Aug 13, 2018

By John Kerr

This article is being written immediately after we have put Volume 34 of the annual Pathfinder report to bed. Pathfinder is produced together by Kerrwil and EFC.

Over 13,000 plus words later, the takeaways and overview present a possible look to the future. Or is this future view just history repeating itself?

I say this because we see the control and automation channel continue to grow and grab share from the full-line distributor. Driven by open control systems, technology and demands of the end users for a more integrated solutions package, automation and control distributors are adding technical staff, adding branches, and quite frankly bringing in new players and solutions to the market. Their foundation and business model all started in the mid ’80s and grew quickly as recessions carved out internal engineering staff and outsourcing became the new way to reengineer plants and facilities.

I say history is repeating itself because lighting may be going the same way. The advent of LEDs, rapid product development, obsolescence, control integration, numerous control platforms, and a need to provide a total integrated solutions approach is starting to drive lighting specialists and integrators, who are slowly growing into a force and who could be taking a page from the control and automaton houses.

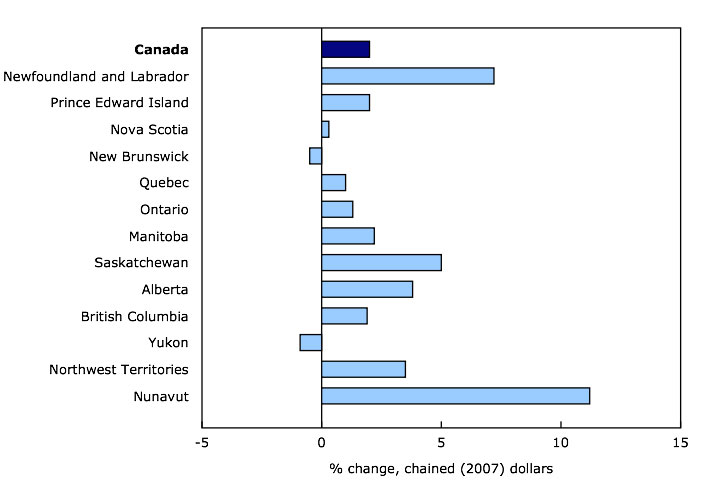

Consider the relative shares control and automation comprise: 44% of the total available market, up considerably from 10 years ago when they were approaching 20%. Lighting on the other hand has a smaller share at 20%, while full-line dominates with $1.5 billion of the $1.9 billion market we know about.

But lighting, like control was 10 years ago, is getting more complicated, more effective. Add on Llow voltage, DC, and the numerous new connected platforms like the connected lighting technologies levering ZigBee, Bluetooth, Wi-Fi and 6LoWPAN and others, and you can see the stars align.

Customers will want solutions, customers will want technical partners, and they want someone to demystify and bolt all this stuff together in a way that’s seamless, measurable and justified with an ROI.

Aggressive electrical wholesalers in the recent years have begun to acquire integrators. One just needs to look at the unique Franklin Empire model, or the recent move by E.B. Horsman & Son in its most recent acquisition of an integrator in the Prairies. My take is there will be more of this moving forward. That is where the next wave of consolidation will be.

But isn’t there an opportunity in lighting? You bet. There are some hugely successful EFC members that have been in lighting for some time, have strong project teams, have bought lighting wholesaler companies, and have mulitple lighting show rooms. They know it and have controlled the market for years, so the foundation is in place.

While lighting has driven the market in the past few years by giving wholesaler revenue a lift across Canada through mid 2017, this current year it’s a bit flat primarily due to LED pricing, integrated control, and lower revenues per unit. That’s not necessarily a bad thing either.

Lighting does control 20% of the typical full-line wholesalers’ sales. In future it could have a high revenue share, and should have a higher margin share. I think it’s time to take a page out of the other channels to market. Integrated solutions will beat Amazon any day, and while Amazon might be a factor in the “stuff “business, lighting like control could be a great driver of change for the business moving forward.

Lighting and control today are more than just selling the products alone.

John Kerr is Publisher of Canadian Electrical Wholesaler.

Photo source: keialein at Pixabay