The Amazon Supply Threat

Over the past couple of months the electrical industry has been talking more and more about Amazon Supply as a threat to an industry. Some are referring to it as “industry disruption.” The reality is that Amazon Supply is being built into a new competitor, on a different platform and offering a different value proposition, that distributors in the “industrial” marketplace will need to compete against.

And the market is much more than electrical. They are currently focusing in on about 14 different verticals and want to be a “one-stop shop” but at the same time can be vertical specific.

The key for distributors is understanding, enhancing and communicating their value proposition; understanding their customers’ needs (inclusive of e-commerce expectations) and making appropriate investments; and continuously seeking to improve while being cognizant of their competitive environment.

A month ago a number of distributors and some manufacturers sent me the Forbes article* that stirred much discussion regarding Amazon Supply. The article essentially appeared to be Amazon Supply’s coming out party. I was asked what I thought about the perceived “slaughter” of the industry, how it would impact the industry and what they could/should do.

So, here’s some food for thought.

o For an entity that reportedly wants little press, perhaps it didn’t want much press until it was ready for prime time? Consider this. What better outlet for Amazon Supply to unveil itself than Forbes’ reach key buying influencers.

o The $8 trillion market estimate that Forbes mentioned, as MDM mentioned, is too high. But that’s irrelevant… whether it is $5 or $8 trillion isn’t relevant… it’s a big market. But let’s also consider some other things:

I’m not saying that Amazon Supply won’t be important in a number of the industries that they are pursuing; however, our focus is on the electrical market. In my opinion, those who understand electrical distribution know that Amazon Supply will take some share but the industry won’t, in Forbes’ term, be “slaughtered”.

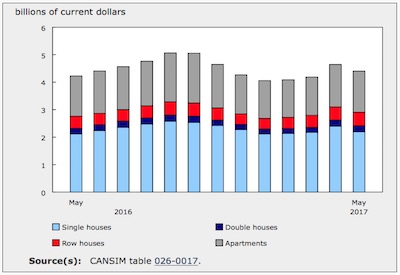

Knowing the Canadian electrical industry is about a $7-9 billion dollar market, what percent could Amazon Supply earn?

Will it capture much from the project market? They need to invest in personnel, have access to manufacturer quotation tools, develop systems to allow for multiple manufacturer product quotations, consider take-offs, etc… We’re not saying they won’t, but it may take some time and it may require manufacturers enabling them!

From the OEM market? Doubtful, unless manufacturers provide them with SPAs. Again, will manufacturers forsake those who deliver the bulk of their revenue?

From the commodity aspect of the contractor? (And speaking of which, what percentage of your contractor business is “same day” needs?)

All of the MRO market or the remainder of the contractor stock business?

And will manufacturer reps and direct people who are driving specifications promote Amazon Supply or a distributor? Much depends upon how they’re getting compensated (will manufacturers receive POS information from Amazon Supply so that they can compensate their sales organizations?)

o I agree that they have 2.25M SKUs, but remember this is multi-industry number, not the number of electrical SKUs. How many electrical SKUs do you have access to? Amazon Supply could be a significant competitor to Grainger , MSC , and WESCO’s initiative to broaden its product offering as well as to other multi-line distributors. The biggest benefit to Amazon Supply at this time is to the industrial and institutional markets, apparently for more MRO type materials and for individuals who prefer self-serve.

o Which brings up the issue that Amazon Supply currently is an “old world” distributor on a new ordering platform. They stock material, accept orders, provide a credit vehicle (credit cards) and delivery products. Their process is their value-added… they are easy to do business with if you want to order yourself.

For distributors, this means that you need to emphasize your value-addeds (and be prepared to charge for services if sales decline precipitously at an account due to Amazon Supply) and invest in a robust e-commerce platform as this will be the price of retaining accounts for distributors that are in the $50M+ range (smaller ones may be able to compete on local service and relationships).

Electrical product content efforts need to accelerate to be of value to distributors. How did Amazon Supply gain content so fast? They “requested” it and received it from manufacturers, perhaps “scrapped” sites or outsourced its development. And they are getting their customers to improve the quality of the content through crowdsourcing.

o For those distributors who are providing inventory and logistics services for Amazon Supply through their fulfillment provider program. Some leading distributors in the US have joined this initiative. It could benefit you… or it could turn you into a fulfillment center.

o Don’t forget that those customers may need additional items and/or services. Consider how to upsell these customers or mine this data that you would be receiving.

o The article mentions an item where Grainger was more expensive than Amazon Supply but, I’m sure, if that was a Grainger customer they would have had customer specific pricing when they logged into the Grainger system. Amazon Supply may not be less expensive than you… just easier to order from!

Amazon Supply will be a formidable competitor in the industry and will generate significant dollars (at some time) but consider that 5% of the overall industry would still be $700-900 million dollars in Canada. Some will lose but Amazon Supply can make many distributors stronger and teach new ways for traditional channel players to compete just like the big boxes did.

Bottom Line?

The electrical distribution industry will continue to have “newcomers” enter the market to take slices of share but none will individually slaughter the industry. The big boxes came and took some share. Grainger, MSC and others have taken a slice, many power transmission distributors dabble into the electrical business, there are catalog houses and countless other examples of non-traditional distributors (think about manufacturers that sell direct?) that compete in the electrical distribution space. The industry will survive. The more important question is, how can you thrive in a changing marketplace that will continue to have new competitors, where many manufacturers are willing to sell to any channel as they are concerned about missing out and where will customer needs/expectations will continue to evolve?

You can be the master of your destiny… and it doesn’t have to be to the slaughter house.

David Gordon is President of Channel Marketing Group. Channel Marketing Group helps manufacturers and distributors in the construction and industrial trades generate ideas to accelerate revenue through strategic planning, marketing planning and coaching and market research initiatives. He can be reached at 919.488.8635.

More in CEW by David Gordon:

Innovation Takes Culture, Not Only Books: Part 1

Innovation Takes Culture, Not Only Books: Part 2

Selling Lighting or Selling Data?

Is it Time to Hit the Reset Button?

Boosting Performance at Your Webstore

Amazon Upgrades from Supply to Business

Evolving the Role of Marketing Within Your Distributorship

Strategies in Light Observations: Distributor LED Opportunities

Are You Ready To Sell LEDs Differently?

16 Distribution Industry Trends for 2016

Lighting the Way to Demand Creation

Converting Emails Into Sales Through Thoughtful Communications

Learning from Amazon and Generating Ideas

Turning Your Staff into a Competitive Advantage

Sales and Marketing – How Can Joint Sales Calls Become More Effective

Creating Demand to Drive Profitable Growth

Is Your Company a Kool-Aid Drinker?

What Manufacturers (and Their Reps) Don’t Know About Distributor Joint Sales Calls