Should Distributors Sell Robots?

By Rick McCarten, vice president, Electrical Council, Electro-Federation Canada

For anyone in a hurry, the answer to the question posed in the title of this article, is yes. If you have a little more time, I have four reasons why it might be a good idea for distributors to sell robots.

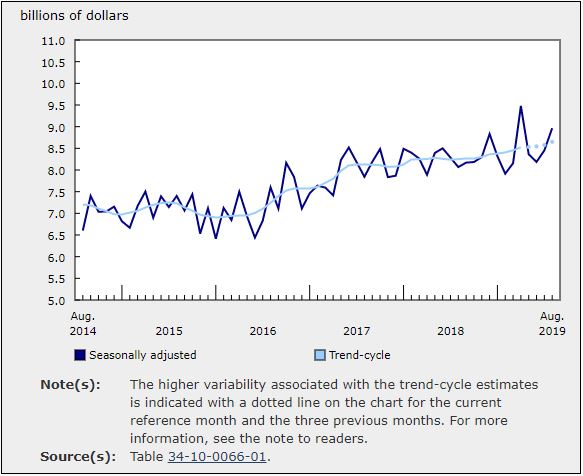

Reason #1: Across the world, companies are in a mad rush to automate. The Economist recently published an index that tracks the number of robots/automation devices in each country. This measurement is tracked by robots per capita. Korea is in the lead, followed by Japan and the United States. Canada is not on the list.

There may be a number of reasons for why Canada is absent from this list. One reason could be due to the lack of initiative on the part of Canadians, their companies and the subsidiaries that are located here. My concern is that Canadians think we are competing globally with cheap labour; we are going to wake up one day and realize that we are now competing with cheaper automation. In my opinion, the opportunity in automation for distributors is to help make their customers more competitive and to help keep customers in your trading area.

Reason #2: Robots are advancing. The original automation factory was built from scratch. Each piece had been designed for a specific purpose. Today, automation is becoming more generic. One robotic arm can be used in a number of different situations and then used again when that job is finished. Robots are becoming more like computers — flexible in their application.

Henry Ford once said he hired people for their hands and ended up getting all the other baggage with it. Today, we can just get the hands! These hands work faster, longer and better than the hands that Ford hired. There is no getting around the fact that productivity and performance will be enhanced with automation. The opportunity for distributors is that expertise in application is required with the sale.

Reason #3: The Internet of Things. We need to stop thinking of robots looking like metal people and start thinking of them as mechanical extensions of the Internet. When plastic first began to be used, the first thing that was made was a substitute for something else. So we saw plastic flowers, plastic paneling that looked like wood. Today, plastic has found its own strengths and applications. Plastic bags are a perfect example of this.

Robots can be anything from flying drones to programmable ovens, providing they can function on their own. The Internet of Things allows ‘things’ to talk to other ‘things’, which greatly expands the use of robotics. Now, devices on a factory line can actually instruct the robot on what needs to be done to them. The opportunity for distributors is a huge growth area that needs coordination.

Reason #4: Prices are coming down, robots are becoming standardized. There is a test model of a robot, programmable, able to be used in most robotic applications to be sold for $25,000. Prices will continually come down, flexibility will continue to improve and technical expertise will continue to be “dumbed down”. Eventually, we will be able to buy our robots at Walmart.

Traditionally, distributors and their main customer — the electrical contractor — have made their mark and their best margins on the cutting-edge, where technology still requires expertise.

Read more in Canadian Electrical Wholesaler by Rick McCarten

Should Distributors Sell Robots?

Agility: Knowing Your Competition

The Big Picture

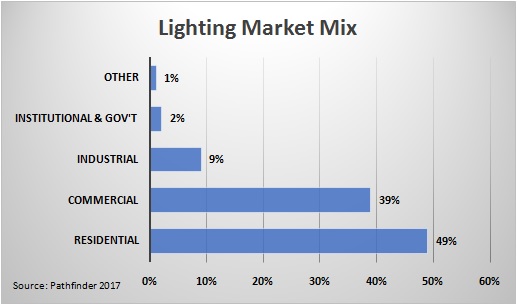

Could our Industry Lose the Lighting Market?

Adapting to the Future with Young Talent

If Your Customers Can See More, You Might Want to Help Them See Even Further

Health and Sciences Could take a Lesson from the Electrical Industry

Change is About to Hit Our Industry

Challenges of the Digital Age

Agility: The Customer Landscape

Agility is the New Lean: Alexander Defeats the Persians

Agility is the New Lean

The Gap Between “Us” and “Them”

Our Industry Needs to Help Canada Skate to Where the Puck is