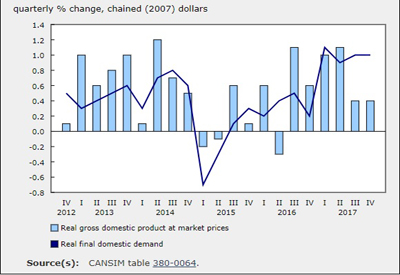

Real Q4 2017 GDP Growth Matches Q3

Mar 9, 2018

Real gross domestic product (GDP) grew 0.4% in the fourth quarter, the same rate as the previous quarter. Final domestic demand rose 1.0%.

Business investment increased 2.3%. Investment in residential structures rose 3.2% on the strength of both resale activity and new construction. Businesses also increased outlays for the fourth consecutive quarter on machinery and equipment (+3.0%) and non-residential structures (+1.3%).

Businesses accumulated $14.2 billion of inventories in the fourth quarter, as manufacturers, retailers and wholesalers all added to their stocks.

Real household final consumption expenditure slowed to 0.5% growth, following a 0.9% increase in the previous quarter. Spending was up on durable (+0.4%), semi-durable (+0.3%) and non-durable (+0.4%) goods, as well as on services (+0.6%).

Export volumes increased 0.7% following a 2.7% decline in the third quarter, while real imports were 1.5% higher. Improved terms of trade boosted economy-wide purchasing power, and real gross national income increased 1.0%. Export prices rose 3.6% in the fourth quarter on the strength of energy products, compared with a 1.5% increase in import prices.

Expressed at an annualized rate, real GDP rose 1.7% in the fourth quarter. In comparison, real GDP in the United States grew 2.5%.

Housing investment accelerates

Business gross fixed capital formation grew 2.3% in the fourth quarter, compared with 0.8% in the previous quarter. Higher investment in residential structures was the main contributor, increasing 3.2% following a flat third quarter. Ownership transfer costs rose 9.3%, indicating increased resale activity. New mortgage stress test measures were anticipated for 2018. New housing construction (+3.0%) also rose, while renovations edged down 0.1%.

Outlays on non-residential structures increased 1.3% on higher investment in engineering structures (+2.1%), while investment in non-residential buildings declined 0.8%.

Business investment in machinery and equipment rose 3.0%, primarily because of increased outlays on aircraft and other transportation equipment.

Investment in intellectual property products was unchanged overall. Increased outlays on research and development (+2.1%) and software (+1.1%) were offset by declines in mineral exploration and evaluation (-11.0%).

Inventories continue to accumulate

Businesses added $14.2 billion to inventories in the fourth quarter, following additions of $17.0 billion in the third quarter.

Non-farm inventories accounted for most of the accumulation, adding $13.1 billion to stocks. Retailers added $4.8 billion to stocks, of which $2.4 billion consisted of motor vehicles. Wholesalers added $4.1 billion to inventories.

Farm inventories rose by $1.1 billion, compared with a $498 million increase in the third quarter.

The economy-wide stock-to-sales ratio increased from 0.761 in the third quarter to 0.763 in the fourth quarter.

Household spending decelerates

Household final consumption expenditure grew 0.5%, following a 0.9% gain in the previous quarter. Increases were recorded in services (+0.6%) and in durable (+0.4%), semi-durable (+0.3%) and non-durable (+0.4%) goods.

Expenditures on insurance and financial services (+1.5%), recreation and culture (+0.9%) and food (+0.7%) increased, while purchases of vehicles were flat.

Export volumes increase

Real exports rose 0.7% following a 2.7% decline in the third quarter.

Exports of goods rose 0.6%, following a 3.4% drop in the previous quarter. The gain was led by basic and industrial chemical, plastic and rubber products (+7.9%). Forestry products and building and packing materials (+3.5%) also contributed to the gain, as did motor vehicles and parts (+1.3%).

Exports of services (+1.3%) increased for the eighth consecutive quarter, mainly travel services (+4.4%).

Real imports were 1.5% higher in the fourth quarter, after edging up 0.1% in the previous quarter.

Imports of goods increased 1.8%, with notable gains in aircraft and other transportation equipment and parts (+24.6%) and electronic and electrical equipment and parts (+6.2%).

Imports of services increased 0.4% following 1.3% growth in the third quarter. Most of the gain was in commercial services (+1.6%), while imports of travel services declined 1.6% following 4.3% growth in the third quarter.

Following a 3.9% decline in the third quarter, export prices rebounded 3.6%, notably energy products. Import prices (+1.5%) advanced more slowly and the terms of trade improved.

Growth in economy-wide income accelerates as terms of trade improve

Real gross national income (the real purchasing power of income from Canadian-owned factors of production) grew 1.0% in the fourth quarter, outpacing real GDP growth and reflecting the improved terms of trade. The GDP implicit price index, which is the overall price of goods and services produced in Canada, increased 1.2% in the fourth quarter.

Nominal earnings of non-financial corporations (gross operating surplus) rose 2.7%, following a 1.0% decline in the third quarter, while the earnings of financial corporations declined 1.2%.

Household disposable income increases

Household disposable income rose 1.3%, following a 1.4% gain in the third quarter. The growth was mainly due to increased compensation of employees (+1.5%), on higher wages and salaries in most industries, particularly in services-producing industries.

The household saving rate rose from 4.0% in the third quarter to 4.2% in the fourth quarter as household disposable income outpaced household final consumption expenditure. Because of rising interest payments (+3.0%), primarily due to increased mortgage costs, the debt service ratio of households edged up to 13.83%.

Annual GDP growth accelerates in 2017

Real GDP rose 3.0% in 2017, following 1.4% growth in 2016. Much of this growth was attributable to the first two quarters of 2017, with deceleration observed toward the end of the year. Final domestic demand advanced 3.0% with steady growth throughout the year.

Household final consumption expenditure rose 3.5%, with increased outlays on goods (+3.9%) and services (+3.2%). Increased expenditures on insurance and financial services (+5.0%) and purchases of vehicles (+6.3%) were strong contributors to growth.

Business gross fixed capital formation rose 2.6%, following a 4.5% decline in 2016. Investment in machinery and equipment (+6.0%) and residential structures (+3.1%) both increased sharply. Investment in non-residential structures rose 0.3%, following two annual declines.

Also contributing to growth was business investment in inventories, up by $13.9 billion, of which $13.6 billion was in non-farm inventories. Manufacturers, wholesalers, and retailers all added to their stocks in each quarter.

Exports grew 1.0% for the second consecutive year, with gains in both goods (+0.6%) and services (+2.8%). Imports increased 3.6% after falling 1.0% in 2016.

Compensation of employees rose 3.9% (nominal terms), contributing to a 4.8% gain in household disposable income. This was slightly faster than the growth in household final consumption expenditure (+4.6%), and the household saving rate consequently edged up to 3.6%.

The gross operating surplus of corporations increased 9.5% as earnings of both non-financial and financial corporations rose sharply.

Source: Statistics Canada, http://www.statcan.gc.ca/daily-quotidien/180302/dq180302a-eng.htm