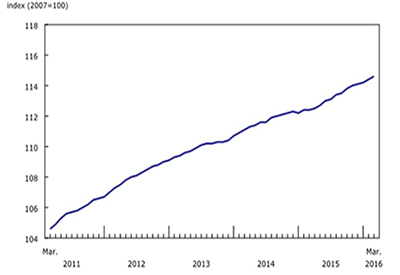

Real GDP Growth Accelerated to 0.7% in Q2

Sept 4, 2018

Real gross domestic product (GDP) growth accelerated to 0.7% in the second quarter, following a 0.4% gain in the first quarter. Meanwhile, final domestic demand rose 0.5%.

Growth was mainly driven by a 2.9% increase in export volumes — the largest gain since the second quarter of 2014. Exports of goods, led by energy products, rose 3.6% after increasing 0.3% in the first quarter. Exports of services edged down 0.2%, the first decline since the fourth quarter of 2015.

Household spending rose 0.6%, after increasing 0.3% in the first quarter. Outlays on services (+0.8%) was the largest contributor to the increase. Rebounds in semi-durable (+1.2%) and non-durable (+0.2%) goods and continued growth in durable goods (+0.5%) also contributed to the gain.

Businesses continued to accumulate inventories, adding $13.4 billion to their stock, following a $16.0 billion increase in the previous quarter. Both non-farm and farm inventories rose in the second quarter.

Business investment in non-residential structures (+0.5%), machinery and equipment (+0.3%) and intellectual property products (+0.2%) all decelerated in the second quarter. Housing investment grew 0.3%, following a 2.7% decline in the previous quarter.

Expressed at an annualized rate, real GDP was up 2.9% in the second quarter. In comparison, real GDP in the United States grew 4.2%.

Exports drive overall growth

Growth in export volumes accelerated to 2.9% in the second quarter, due in part to notable increases in energy products (+5.6%) and consumer goods (+6.3%), particularly pharmaceutical products. Exports of aircraft, aircraft engines and aircraft parts (+13.4%) increased sharply on higher shipments of business jets to both the United States and non-US countries. Exports of services edged down 0.2%.

Total import volumes rose 1.6% in the second quarter, compared with 1.0% growth in the first quarter. Imports of goods increased 1.7%. Imports of refined petroleum energy products rose 45.1% to offset the complete shutdown of four Canadian refineries in April and May. These shutdowns typically occur once every five years. Additionally, aircraft and other transportation equipment and parts grew 9.1%. Imports of services (+1.1%) rebounded following a 0.8% decrease in the previous quarter.

Consumer spending accelerates

Household final consumption expenditure increased 0.6%, twice the pace of the first quarter and reversing the downward trend over the previous three quarters. Growth was largely attributable to outlays on services (+0.8%), which outpaced outlays on goods. Housing-related expenses (housing, water, electricity, gas and other fuels), up 0.6%, contributed the most to the widespread growth.

Spending on goods grew 0.5% following a flat first quarter, with rebounds in semi-durable (+1.2%) and non-durable (+0.2%) goods. Purchases of vehicles declined 0.5%.

Housing investment increases

Investment in housing increased 0.3% in the second quarter, following a 2.7% drop in the first quarter. Declines in ownership transfer costs (-3.4%) continued, while new constructions (-0.3%) contracted for the first time since the third quarter of 2016. However, these declines were more than offset by a sharp 2.9% increase in outlays on renovations.

Business investment decelerates

Business gross fixed capital formation increased 0.4%, the slowest pace since the fourth quarter of 2016, as investment growth in non-residential structures, machinery and equipment, and intellectual property products all decelerated in the second quarter.

Machinery and equipment investment rose 0.3% following a 3.9% increase in the first quarter, with aircraft and other transportation equipment (+5.8%), industrial machinery and equipment (+0.7%) and computers and computer peripheral equipment (+1.8%) accounting for the majority of the growth.

Businesses accumulate inventories

Businesses added $13.4 billion to inventories in the second quarter, less than the $16.0 billion accumulated in the previous quarter. Most of the accumulation came from wholesalers (+$9.0 billion), with manufacturers (+$2.8 billion) also adding to their stock.

Investment in retail inventories declined to $0.5 billion, while farm inventories increased $0.9 billion.

Economy-wide income increases

The GDP implicit price index, representing the price of goods and services produced in Canada, increased 0.5% in the second quarter, while real gross national income (the real purchasing power of income earned by Canadian-owned factors of production) rose 0.7%, the same pace as real GDP.

Gross operating surplus (in nominal terms) grew 2.1%, compared with a 0.5% gain in the first quarter, as earnings of energy producers were boosted by higher crude oil prices and volumes.

Household disposable income rose 0.7%, up slightly from the previous quarter (+0.6%). Compensation of employees increased 0.7%, the slowest pace since the third quarter of 2016. The household saving rate fell from 3.9% in the first quarter to 3.4% in the second quarter, as household spending outpaced disposable income.

Source: Statistics Canada, www150.statcan.gc.ca/n1/daily-quotidien/180830/dq180830a-eng.htm