Q4 GDP Slowed to 0.1%

Feb 28, 2020

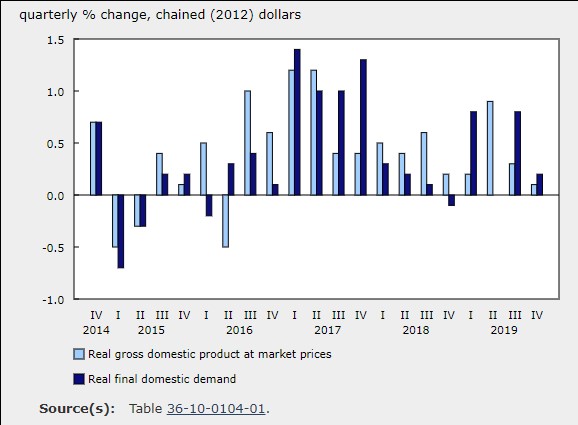

Growth in real gross domestic product (GDP) slowed to 0.1% in the fourth quarter, owing to a decrease in business investment and weak international trade. These declines were offset by increased household spending. Final domestic demand edged up 0.2%, after rising 0.8% in the third quarter.

The annual growth rate of Canada’s real GDP was 1.6% for 2019, a deceleration from the 2.0% growth in 2018. By comparison, real GDP in the United States increased 2.3%.

The slowing of Canada’s fourth quarter GDP was influenced by several factors, including pipeline shutdowns, unfavourable harvest conditions, rail transportation strikes, impacts on motor vehicle and parts manufacturing from the United Auto Workers’ strike in the United States, and continued global trade tensions and market uncertainty.

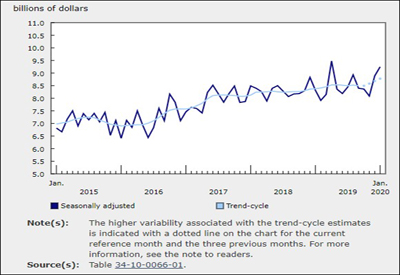

A strong increase in household spending on services (+0.8%) pushed overall growth into positive territory. Businesses accumulated $10.5 billion of inventories, partly attributable to supply chain disruptions. The economy-wide stock-to-sales ratio increased from 0.850 in the third quarter to 0.862 in the fourth quarter.

Household spending remains strong

Growth in overall household spending (+0.5%) stemmed from household spending on services (+0.8%). Notable increases occurred in imputed rents of owner-occupied housing (+0.6%), paid rents (+0.7%), food and beverage services (+0.4%), air transport (+2.3%) and telecommunication services (+1.0%).

Terms of trade improve slightly

Import prices fell 0.5% in the fourth quarter, while export prices rose 0.3% largely because of a 2.5% increase in the prices of exported crude oil and crude bitumen. Consequently, the terms-of-trade—the ratio of the price of exports to the price of imports—rose 0.8%. Improved terms-of-trade contributed to growth in gross national income (+0.4%), which captures the real purchasing power of income earned by Canadian-owned factors of production.

The GDP implicit price index, which reflects the overall price of domestically produced goods and services, rose 1.0%.

Household disposable income increases

In nominal terms, a 1.2% rise in compensation of employees boosted household disposable income by 1.3% in the fourth quarter. Household final consumption expenditure grew 1.0%, and the household saving rate was 3.0%.

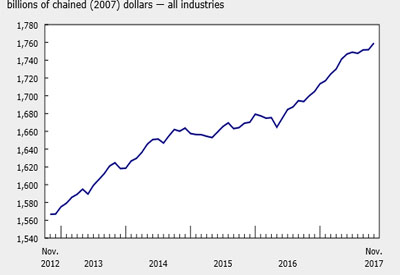

Annual GDP growth slows in 2019

The slowdown in annual growth from 2.0% in 2018 to 1.6% in 2019 was largely due to weaker international trade and investment declines.

Housing investment fell 0.6%, with a 3.4% decline in new construction partly offset by a 5.8% rise in ownership transfer costs. Business investment in non-residential structures was up 0.9%, while investment in machinery and equipment declined 1.4%, and investment in intellectual property products fell 4.7%.

Growth in export volumes slowed from 3.1% in 2018 to 1.2% in 2019, while growth in import volumes slowed from 2.6% to 0.3%. GDP growth was driven by robust household spending on services (+2.1%). Household spending on durable goods grew 0.6% in 2019, the lowest rate since 2009 (-3.0%).

In nominal terms, growth in GDP slowed slightly—from 3.9% in 2018 to 3.6% in 2019. The labour market remained resilient in 2019, resulting in a 4.4% rise in compensation of employees. This rise outpaced the increase in household spending (+3.3%) and raised the household saving rate to 2.7% in 2019.

Terms of trade improve slightly

Import prices fell 0.5% in the fourth quarter, while export prices rose 0.3% largely because of a 2.5% increase in the prices of exported crude oil and crude bitumen. Consequently, the terms-of-trade—the ratio of the price of exports to the price of imports—rose 0.8%. Improved terms-of-trade contributed to growth in gross national income (+0.4%), which captures the real purchasing power of income earned by Canadian-owned factors of production.

The GDP implicit price index, which reflects the overall price of domestically produced goods and services, rose 1.0%.

Household disposable income increases

In nominal terms, a 1.2% rise in compensation of employees boosted household disposable income by 1.3% in the fourth quarter. Household final consumption expenditure grew 1.0%, and the household saving rate was 3.0%.

Annual GDP growth slows in 2019

The slowdown in annual growth from 2.0% in 2018 to 1.6% in 2019 was largely due to weaker international trade and investment declines.

Housing investment fell 0.6%, with a 3.4% decline in new construction partly offset by a 5.8% rise in ownership transfer costs. Business investment in non-residential structures was up 0.9%, while investment in machinery and equipment declined 1.4%, and investment in intellectual property products fell 4.7%.

Growth in export volumes slowed from 3.1% in 2018 to 1.2% in 2019, while growth in import volumes slowed from 2.6% to 0.3%. GDP growth was driven by robust household spending on services (+2.1%). Household spending on durable goods grew 0.6% in 2019, the lowest rate since 2009 (-3.0%).

In nominal terms, growth in GDP slowed slightly—from 3.9% in 2018 to 3.6% in 2019. The labour market remained resilient in 2019, resulting in a 4.4% rise in compensation of employees. This rise outpaced the increase in household spending (+3.3%) and raised the household saving rate to 2.7% in 2019.

Source: Statistics Canada, www150.statcan.gc.ca/n1/daily-quotidien/200228/dq200228a-eng.htm