POS Integral to Rep Commission Model

Jan 22, 2020

By David Gordon

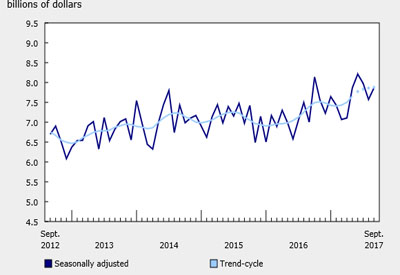

Throughout the fall Channel Marketing Group surveyed NEMRA reps and also interviewed dozens of them on behalf of NEMRA for the upcoming Rep of the Future report, which will be unveiled at the upcoming NEMRA meeting. While the objective of the research was to identify the traits needed for the rep of 2025, we also gained deeper insights into the financial model of manufacturer reps, and the importance of POS-based commissions.

Two numbers were shared

We heard:

• the average rep commission ranges, for an agency, from 3.2% to 4.24%.

• the percentage of sales to distribution that goes through RDCs or CDCs, and hence should be tracked via POS (point of sale), is between 10-40%, depending upon the agency. The range is very geographically driven based on where RDCs / CDCs are based. And reps expect this to increase due to distributor consolidation.

In other words, reps getting appropriately compensated for POS is critical to the financial viability of manufacturer reps.

It could even be argued that if reps are not appropriately compensated, they will be challenged in investing in the resources necessary to service distributors.

NEMRA POS standards

NEMRA’s POS Minimum Reporting Standards now has over 60 companies endorsing industry standards designed to facilitate the reporting of POS information to manufacturers so that they can compensate their reps. POS, in the NEMRA terminology, is “place of sale” and only zip code level information is shared… no customer-specific information. If a distributor agrees to share additional information, the information can be appended to the standard.

Recently Kirby Risk and Winsupply joined the list of endorsing distributors. Kirby Risk has already implemented the format and, as can be seen in the press release, they see it as a way to improve reporting timeliness as well as improve productivity (reduce operational costs). It will be the way that they report, unless they agree to provide additional information to a manufacturer.

Manufacturers and distributors who would like to learn more can either visit NEMRA’s website to download a copy of the standards, contact Jim Johnson, president of NEMRA or David Gordon, POS facilitator for NEMRA (and we can meet at the NAED Western, SouthCentral or at the NEMRA Annual Meeting).

POS connection

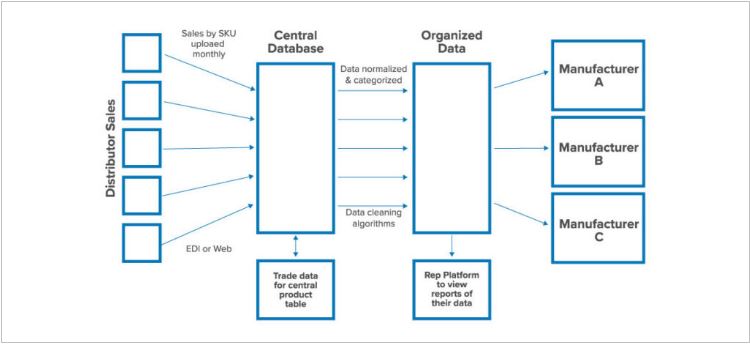

Source: https://posconnection.com/pos-connection/

NEMRA, in conjunction with SPARXiQ, is launching POS Connection. Announced last spring and now operational, POS Connection is a one-stop POS data collection highway. As the diagram shows, distributors can upload their POS information, in one file, to a central processing center where the information is normalized and then participating manufacturers will receive one file with the POS information for all of their distributors. The system is designed to streamline the information gathering process.

Manufacturers would then only receive one file to ingest into their system to calculate commissions.

While SPARXiQ may be a new name, the company is the outgrowth of Jigsaw Systems and Strategic Pricing Associates. Jigsaw supported manufacturers’ POS initiatives and has received POS files from over 200 distributors over the years. Strategic Pricing Associates was entrusted by hundreds of distributors with their customer and pricing information. It’s the combination of this expertise and commitment to privacy that makes SPARXiQ a trusted resource for handling these data… and no data will be co-mingled.

Another benefit for manufacturers is that, with POS increasing, and hence the number of files that a manufacturer could receive, the pricing model is a flat fee tied to the number of reporting distributors. So, no need to add staff to manage POS data collection.

To learn more, visit www.posconnection.com, or contact David Gordon, NEMRA POS facilitator.

Ensuring the viability of independent manufacturer sales representatives requires that point/place of sale information be reported so that local reps are compensated for their local support. Yes, in an omni-channel world there are other compensation issues that manufacturers and their reps will need to navigate. However, accurate reporting and managing of POS information is the first step.

David Gordon is President of Channel Marketing Group. Channel Marketing Group develops market share and growth strategies for manufacturers and distributors and develops market research. CMG’s specialty is the electrical industry. He also authors an electrical industry blog, www.electricaltrends.com. He can be reached at 919-488-8635 or dgordon@channelmkt.com.