October GDP’s 0.1% Decline the First in 8 Months

Jan 6, 2020

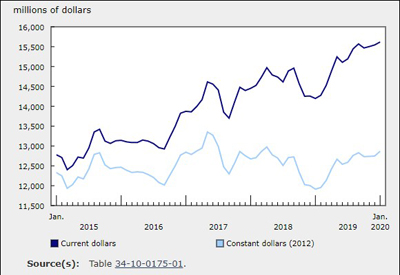

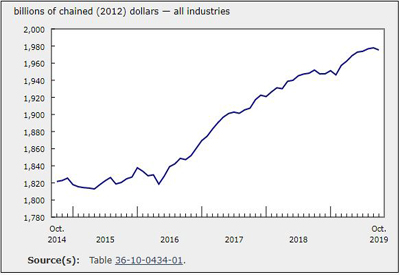

Real gross domestic product edged down 0.1% in October, the first decline in eight months. Goods-producing industries were down 0.5%, the second consecutive monthly decline. Services-producing industries were essentially unchanged as increases in most sectors compensated for declines in wholesale trade and retail trade.

Overall, 13 of 20 industrial sectors posted increases in October.

On a three-month rolling average basis, gross domestic product was up 0.2%, down from 0.4% in September.

Broad-based declines contribute to a manufacturing retreat

For the fourth time in five months, the manufacturing sector was down, contracting 1.4% in October from broad-based declines in both durable and non-durable manufacturing.

Durable manufacturing was down 2.3%, the fourth decline in five months, as 8 of 10 subsectors decreased. Contributing the most to the decline was a 2.5% contraction in transportation equipment manufacturing, largely from lower activity at manufacturers of motor vehicles and motor vehicle parts. The strike by the United Auto Workers in the United States caused some plants and parts producers in Canada to scale back their production. Both machinery manufacturing (-4.3%) and fabricated metal products (-3.3%) were down on wide-ranging declines as all industries but one decreased within each subsector. Wood products (-2.1%) were down for the third consecutive month, reflecting difficulties in the forestry sector.

Non-durable manufacturing was down 0.3% as five of nine subsectors declined. Contributing the most to the decline was a 5.1% decrease in plastic and rubber products following three months of increases. Food manufacturing edged down 0.1%, as an increase in meat products was offset by declines in industries affected by unfavourable harvesting conditions such as fruit and vegetable preservation and grains and oilseeds.

Retail decline is the largest in three years

Retail trade declined 1.1% in October, its largest decline since March 2016. The decrease was broad-based as 10 of the 12 subsectors were down. For the fourth month in a row, activity at building material, garden equipment and supplies stores was down, contracting 2.1%. Motor vehicle and parts dealers were down 2.0%, with lower activity at all types of retailers. Non-store retailers posted a 2.8% decline from decreased activity at electronic shopping and mail-order houses and fuel dealers.

Wholesale decline in October more than offsets September’s growth

Wholesale trade declined 1.0% in October, continuing its sequence of increases alternating with declines since July. The declines in October were broad-based as seven of nine subsectors contracted. Machinery, equipment and supplies wholesalers (-2.6%) posted a third decline in four months, partly due to a decrease in imports of related products. Motor vehicle and parts wholesaling (-1.4%) was down for the third consecutive month, reflecting in part summer production shutdowns at automotive assembly plants, along with the strike by the United Auto Workers in the United States. Farm products wholesaling rose 6.7%, largely offsetting a 7.8% decline in September when inclement weather across the Prairies delayed the harvest and affected exports of grains and oilseeds.

Transportation and warehousing increases

Following four months of declines, transportation and warehousing rose 0.6% in October as eight of the nine subsectors posted gains. Air transportation led the growth with a 1.8% increase, the largest growth since June 2018. Transit, ground passenger, scenic and sightseeing transportation was up 1.0%, the sixth increase in seven months. Truck and pipeline transportation each edged up 0.2%. Rail transportation edged down 0.2% following a decrease of 6.3% in September, as declines in October in intermodal and automotive carloadings more than offset gains from resumed movement of grains and fertilizers.

Mining, quarrying and oil and gas extraction edges up

The mining, quarrying and oil and gas extraction sector edged up 0.1% in October. For the second consecutive month, oil and gas extraction increased, rising 0.6%. Oil and gas extraction (except oil sands) was up 4.5% as crude petroleum production at some North Atlantic facilities resumed, following earlier disruptions. Oil sands extraction contracted for the third time in four months, declining 3.1% in October as synthetic crude oil production in Alberta was down due in part to maintenance at some facilities.

Mining and quarrying (except oil and gas) decreased slightly by 0.1% in October. Non-metallic minerals mining retreated 3.2%, the fourth decline in five months, as potash mining decreased 6.8% from a slowdown in international demand for the product. Metal ore mining grew 1.1% as growth in iron ore and gold and silver ore more than offset a decline in copper, nickel, lead and zinc and other metal ores. Coal mining rose 2.3% after two months of declines.

Support activities for mining, and oil and gas extraction decreased 1.8% from lower rigging and drilling services.

Mixed results in construction

The construction sector was flat in October as gains in non-residential construction (+0.5%) and engineering and other construction activities (+0.2%) were offset by losses in residential construction (-0.2%) and repair construction (-0.3%). The gain in non-residential construction was the fifth increase in six months, attributable solely to gains in commercial construction as public construction and industrial construction both edged down. The decline in residential construction came from lower alterations and improvements, as all other components were up.

Other industries

The professional, scientific and technical services sector was up 0.3% in October, continuing its uninterrupted growth since February 2018, as seven of nine industries were up, led by growth in computer systems design and related services (+0.9%).

Finance and insurance edged down 0.2%. Financial investment services, funds and other financial vehicles were down 1.4% from a lower volume of transactions reflecting global trade tensions and market uncertainty. Insurance carriers and related activities were down 0.5%, while depository credit intermediation and monetary authorities were up 0.3%.

Activity at the offices of real estate agents and brokers was up 0.7% from gains in Vancouver, Ottawa and the Fraser Valley.

Agriculture, forestry and fishing declined 0.2%, with the forestry and logging subsector (-3.9%) posting a fourth consecutive decrease.

Source: Statistics Canada, www150.statcan.gc.ca/n1/daily-quotidien/191223/dq191223a-eng.htm