Non-Mortgage Borrowing From Chartered Banks in March 2020 Shattered the Previous Record

July 26, 2021

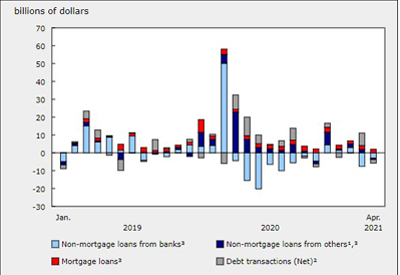

The outstanding credit debt of private non-financial corporations doubled from the height of the financial crisis in 2008 to early 2020. At the onset of the pandemic in March 2020, businesses added a record $52.1 billion in credit debt to their balance sheets. However, according to a new study, as other sources of financing became available and businesses adapted to the pandemic, outstanding loan balances with banks declined for eight consecutive months.

The outstanding credit debt of private non-financial corporations doubled from the height of the financial crisis in 2008 to early 2020. At the onset of the pandemic in March 2020, businesses added a record $52.1 billion in credit debt to their balance sheets. However, according to a new study, as other sources of financing became available and businesses adapted to the pandemic, outstanding loan balances with banks declined for eight consecutive months.

The study Trends in Canadian business debt financing: Before and during COVID-19 looks at the types of credit debt private non-financial corporations incurred prior to and during the COVID-19 pandemic, and examines how they used that liquidity to weather the economic turbulence during this period.

Outstanding credit debt of private non-financial corporations doubles from 2008 to early 2020

Business credit prior to the 2008 financial crisis was growing at a more modest pace relative to gross domestic product (GDP). By the end of 2020, business credit had more than doubled, with the debt-to-GDP ratio accelerating sharply, even prior to the emergence of COVID-19.

In nominal terms, businesses owed $600 billion at the end of 2007. From 2008 onwards, the trajectory of debt-to-GDP steepened as economic growth slowed and new crises emerged, such as the oil shock beginning in 2014, and more recently, the global COVID-19 pandemic.

At the onset of the pandemic, the outstanding credit debt of private non-financial corporations totalled $1.7 trillion and represented just under 72% of GDP.

Businesses took on a record amount of credit debt at the onset of the pandemic…

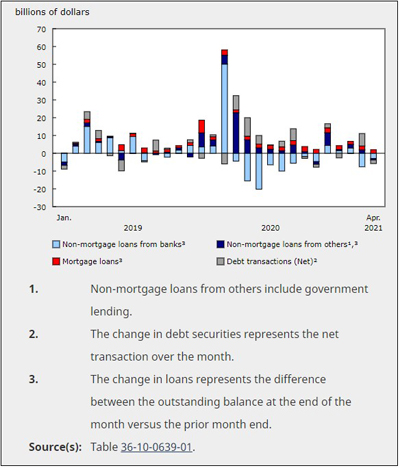

… but the sources of funds have shifted dramatically. In March 2020, businesses added a record $52.1 billion in credit debt to their balance sheets. This financing was mainly in the form of bank loans, as businesses likely drew upon existing credit facilities with financial institutions to cover current and anticipated expenses in light of the high levels of uncertainty at the beginning of the pandemic.

The spike in non-mortgage borrowing from chartered banks of $50.1 billion in March 2020 shattered the previous record of $15.0 billion set the previous year. At the same time, currency and deposit assets rose $49.1 billion to $600.9 billion at the end of the first quarter, indicating that much of this cash may not have been spent immediately, and instead accumulated as a buffer in response to the emerging crisis.

However, as other sources of financing became available, outstanding non-mortgage loan balances with banks began eight consecutive months of decline, including record paybacks in May ($15.5 billion) and June ($20.2 billion). Government programs and other borrowing facilities filled the need for financing in the months following the initial stay-at-home orders, and in many cases, did so with attractive terms, including zero-interest rates and future loan forgiveness.

On a cumulative basis, from the start of the pandemic up to December 2020, business’s non-mortgage loan liabilities with banks decreased $14.3 billion overall, despite the strong March borrowing, while total debt financing rose $89.3 billion over the same period. This was the result of increasing non-mortgage loan balances with government and the net issuance of debt securities.

Source: Statistics Canada, www150.statcan.gc.ca/n1/daily-quotidien/210726/dq210726c-eng.htm?CMP=mstatcan Study: Trends in Canadian business debt financing: Before and during COVID-19, 2020