Musings on Eaton’s Lighting Spin-off

Mar 18, 2019

By David Gordon

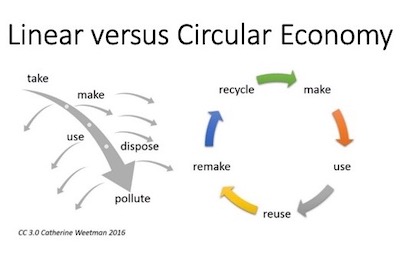

Who said lighting couldn’t go back in time? From a product side it’s moved into the future with LEDs, lighting controls and now LiFi. But to a degree we’re now going backwards in the sense of “traditional lighting companies” with Eaton’s announcement that they will be spinning off their lighting division (Eaton Lighting) into a separate, publicly traded company.

If we turn the clock back to 2012, there were Acuity (Lithonia), Cooper Lighting, Hubbell Lighting and Philips Lighting as the Big 4 fixture companies. In 2020 we’ll have these four again although they are now supplemented with a number of other fixture manufacturers (some of a significant size, others mid to small size, but no other “billion-dollar players”).

Some thoughts regarding the divestiture:

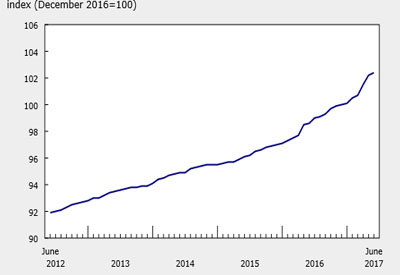

• When Eaton purchased Cooper Industries in May 2011, Cooper Lighting was doing about US$1.05 billion, according to a 2011 UBS Industrial Leadership presentation given by Cooper Industries. At the end of 2018, Eaton Lighting revenues were US$1.7 billion. So, US$650M growth in 7½ years. Some of the “modest growth” can be attributed to declining average selling fixture prices of LEDs. Some to perhaps “missing” much of the renovation market as the Big 4 are more new construction/large project-oriented. Some due to…

• Given the above, is Eaton jettisoning Eaton Lighting to improve the valuation of its stock price? Is lighting viewed as a drag on earnings? On the stock price?

• A standalone company will enable the industry, and investors, to compare fixture company financials and strategies.

• From a distributor viewpoint, financially may be a negative as lighting will no longer be an element of the Eaton distributor program.

• As a publicly held company focused on meeting shareholder expectations, management will need to decide its investor strategy… be a growth company or a cash flow/high profit company. If it goes for the growth aspect, some ideas on accelerating lighting growth:

◦ Acquire a company that is more “lamp” oriented to fashion the company similar to Philips Lighting (rather than share names based upon conjecture, we’ll leave it to others/water cooler discussion).

◦ Expand further into controls and/or automation and potentially mimic Acuity.

◦ Diversify the lighting portfolio into more architectural lines.

◦ Acquire a “fighting brand” to pursue the lower end of the market, perhaps with a different sales organization. This could be a way to capture a larger foothold in the renovation market.

◦ Perhaps acquire an industrially-focused lighting line to further build out the company’s portfolio.

• While Eaton plans to spin off the company into a publicly held entity, there is always the possibility of

◦ Private equity expressing interest in the company and taking it private?

◦ A sale… perhaps to someone like MLS, the Chinese company that owns LedVance?

◦ Or maybe the private equity firm that purchased Current could decide to double-down on the lighting business?

Lot’s of suppositions that can get made looking ahead. It will be interesting to see the IPO price for the new company, to see what the market values the lighting business at. And it will be interesting to see what spinning off the lighting group does to Eaton’s stock price and then how Eaton further integrates Bussmann, Crouse Hinds, Wiring Devices and B-Line with the core legacy gear business. Eaton has been finding some synergy with this package (and elements of gear) with manufacturer reps.

There will be time over the year for details to role out, for Eaton and the Lighting Group to evaluate strategies and “beef up” or “slim down,” “share direction” or “maintain the way.”

The more the business changes, the more it remains the same.

Distributors, what is your perspective? Lighting agents… your thoughts?

And what should the name be… Cooper Lighting? Eaton Lighting? Something else?

David Gordon is President of Channel Marketing Group. Channel Marketing Group develops market share and growth strategies for manufacturers and distributors and develops market research. CMG’s specialty is the electrical industry. He also authors an electrical industry blog, www.electricaltrends.com. He can be reached at 919-488-8635 or dgordon@channelmkt.com.