Monthly estimates of business openings and closures, September 2021

Jan 14, 2022

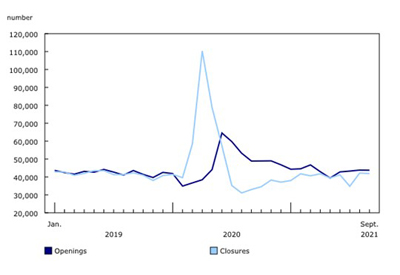

Business openings were stable in September 2021 (-0.1%; -59) after several months of increases in the number of openings. The change in business closures was also relatively small compared with previous months, decreasing by 0.6% (-252) in September following an increase of 21.2% (+7,370) in August. As a result, the number of active businesses was relatively unchanged since August but remained above February 2020 levels for the fifth consecutive month.

The number of business reopenings rose by 2.5% (+668) in September, but the number of entrants declined by 4.2% (-727). This decline coincides with rising new cases of COVID-19 and the introduction of proof-of-vaccination policies in several regions of Canada including Ontario, British Columbia, Alberta, and Manitoba. The decrease in entrants was driven by Ontario (-5.6%, -385) and British Columbia (-6.0%; -185).

Though the number of entrants was lower from August to September, most regions of Canada also saw a decrease in the number of closings, with the largest decreases occurring in Quebec (-2.0%; -149) and British Columbia (-1.4%; -104). At the national level, however, these decreases were partially offset by a relatively large number of closings in Alberta (+4.4%; +265).

Across sectors, the largest decreases in the number of active businesses were in the transportation and warehousing (-0.7%; -378) and manufacturing (-0.4%, -182) sectors. The number of active businesses in the manufacturing sector had also declined in August (-0.3%; -132), for the first time since May 2020. On the other hand, the number of active businesses continued to increase in accommodation and food services (+0.5%; 277), and in arts, entertainment, and recreation (+0.4%; 49). Nevertheless, the number of active businesses in these industries remain below the pre-pandemic level (February 2020), as these increases brought the number of active businesses in these sectors to 4.2% below and 5.7% below pre-pandemic levels, respectively.

New series on temporary business closures and exits are now available

The experimental series on monthly business openings and closures now includes monthly estimates of temporary business closures and exits (or “permanent closures”) at the national level by industry, as well as at the provincial level for the business sector.

Between January 2015 and December 2019, the number of temporary business closures has generally been higher than the number of exits by an average of about 75%, indicating that temporary closures were more common than exits. At the onset of the COVID-19 pandemic, or in April 2020, the ratio of temporary business closures to exits increased, as there were 1.2 times as many temporary business closures (76,119) as there were exits (34,251). Since the onset of the pandemic, the number of exits returned to their historical average relatively quickly, while the number of temporary closures returned more recently.

The pattern observed in the business sector is also observed at the industry level. However, variations are present across industries in terms of the increase in temporary business closures relative to exits early on in the pandemic. For instance, temporary closures were more than 5 times the number of exits in the construction and health care and social assistance sectors in April 2020, compared with 2 to 3 times the average share from 2015 to 2019. A similar increase in the number of temporary closures relative to exits is observed in industries that were heavily impacted by the pandemic, including accommodation and food services and the tourism sector. In contrast, in professional, scientific and technical services, and real estate, rental and leasing, temporary closures as a share of exits remained relatively unchanged in April 2020 compared with the historical average.

Source : https://www150.statcan.gc.ca/n1/daily-quotidien/220105/dq220105d-eng.htm?CMP=mstatcan