Market Turbulences and COVID-19: The Impact on Canada’s International Investment Position

Apr 28, 2020

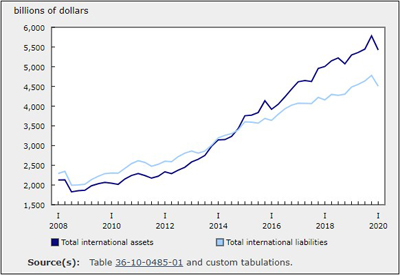

A country’s net international investment position — the difference between its external financial assets and its international liabilities — represents the external portion of a country’s net wealth. It is an indicator of financial openness and stability. Variations in the net international investment position are determined by changes in prices, fluctuations of currencies, cross-border financial transactions and other changes such as debt write-offs.

Typically, Canada’s international investment position is released about 75 days after the end of the reference period. Most of the data used in its compilation originate from surveys and from a number of administrative sources. Given the unique situation faced by the Canadian economy in the context of the COVID-19 outbreak and the demand for reliable information on the aggregate impact of this health crisis, Statistics Canada has produced a preliminary estimate of Canada’s net international investment position for the first quarter of 2020.

The high level of uncertainty that comes with shocks such as the COVID-19 outbreak results in financial market turbulences and adds a degree of stress on investors. These changing market conditions have a significant impact on overall domestic investments as well as international investments.

The methodology used for this flash estimate focused primarily on valuation effects. The value of assets and liabilities as measured at the end of 2019 was revalued based on market conditions prevailing at the end of the first quarter. These estimates should not be expected to be of the same quality as Statistics Canada’s official estimates, but can give users a good indication of the direction and magnitude of the changes.

When international assets and liabilities are relatively small, the cumulative sum of cross-border transactions closely defines the net international investment position. However, when international assets and liabilities are large, as is currently the case in Canada, valuation effects can have a strong influence on the trend of the international investment position. These valuation effects can be estimated to the extent that a detailed breakdown of the type of financial instrument and currency is available. This has been made possible in Canada thanks to the developments undertaken in recent years in the context of international work related to the G20 Data Gap Initiative.

Canada’s net foreign asset estimated position declined by approximately $90.0 billion in the first quarter from a published level of $1,006.0 billion at the end of 2019. While the decline of the net position is not considered that substantial, it is hiding significant and offsetting movements in the value of gross international assets and liabilities, highlighting the risk and the volatile nature associated with these investments.

Canada’s estimated international assets were down $360.0 billion (-6.2%) in the first quarter. This would represent the largest decline in value since the quarterly series started in 1990 and the largest percentage decrease since the third quarter of 2008. Valuation changes alone resulted in a loss of $775.0 billion (-13.4%) due to the collapse of global stock markets and a gain of $400.0 billion (+6.9%) due to a lower Canadian dollar. Meanwhile, Canada’s international liabilities declined by $270.0 billion (-5.7%), reflecting a loss of $460.0 billion (-9.6%) attributable to the meltdown of Canadian stock prices. This decrease has been moderated by an increase of $155.0 billion (+3.2%) due to a weaker Canadian dollar. The decline in international liabilities would be the highest since the third quarter of 2008, at the time of the global financial crisis.

In the first quarter of 2020, the noticeable fall in world stock markets in the context of the COVID-19 outbreak and the supply fight for oil ended up affecting more severely international assets than liabilities, as a higher proportion of assets are held in the form of equities than liabilities.

At the same time, the decline of the Canadian dollar, against the backdrop of a weaker economy and the collapse of oil prices in March, helped support Canada’s net foreign asset position. The value of assets and liabilities denominated in foreign currency is converted to Canadian dollars at the end of each period for which a balance sheet is calculated. As a result of the falling Canadian dollar in the first quarter, the increase in the value of Canada’s external assets exceeded that of its international liabilities, the dollar acting as a moderating factor in the decline of the net foreign asset position. This is due to the fact that most of Canada’s external assets are denominated in foreign currencies, while international liabilities are mainly denominated in Canadian dollars.

Over the first quarter, the Canadian stock market declined 21.6%, the US stock market decreased 20.0% and the European stock market contracted by 25.6% (as measured by the Standard and Poor’s 500 and the EuroStoxx 50). Meanwhile, the Canadian dollar depreciated 8.5% against the US dollar, 6.4% against the euro, 2.4% against the British pound and 9.0% against the Japanese yen.

Source: Statistics Canada, www150.statcan.gc.ca/n1/daily-quotidien/200427/dq200427a-eng.htm