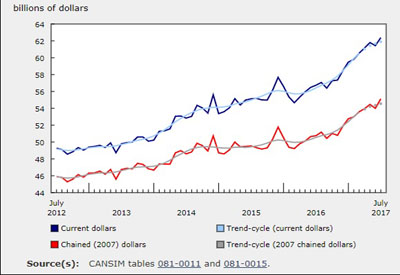

Manufacturing Sales Rose for Third Consecutive Month in July

Sept 30, 2018

Manufacturing sales increased for the third consecutive month in July, rising 0.9% to $58.6 billion. Higher sales in the transportation equipment and chemical industries drove the increase.

Overall, sales were up in 11 of 21 industries, representing 68% of total manufacturing sales. Non-durable goods rose 1.4% to $27.7 billion, while durable goods increased 0.5% to $30.9 billion.

Constant dollar sales increased 1.0%, indicating that a higher volume of goods was sold in July.

Inventory levels rise

Total manufacturing inventories increased 1.2% to $82.9 billion in July. The gains were led by higher inventories in the machinery (+3.0%) and the petroleum and coal product (+3.5%) industries. Inventories of aerospace product and parts equipment declined 1.5%.

The inventory-to-sales ratio was unchanged at 1.41 in July. The ratio measures the time in months that would be required to exhaust inventories if sales were to remain at their current level.

Unfilled orders unchanged

Unfilled orders were unchanged at $94.4 billion in July, following five consecutive monthly gains. The largest increase in unfilled orders was posted by the motor vehicle industry, followed by the electrical equipment, appliance and component industry.

These increases were offset by a decline in unfilled orders in the aerospace product and parts industry, as well as in the primary metal industry.

New orders decreased for a second consecutive month, down 1.8% to $58.6 billion in July. The decline mostly reflected lower new orders in the aerospace product and parts industry and in the machinery industry.

The transportation equipment and chemical industries drive manufacturing growth

The gain in the transportation equipment industry accounted for more than half of the total increase in Canadian manufacturing sales in July. Sales in the industry were up 2.6% to $10.9 billion, mostly as a result of gains in the motor vehicle and the railroad rolling stock industries. In July, scheduled shutdowns for some assembly plants were shorter than in previous years. Sales in the motor vehicle assembly industry rose 3.0% to $5.4 billion, a second consecutive monthly increase. Sales in the railroad rolling stock industry were up 63.4% to $275 million, following a 30.4% decline in June. Sales in this industry tend to be volatile compared with transportation equipment as a whole.

Sales in the chemical industry rose 4.6% to $4.6 billion, following a 5.4% decline in June. Gains in the basic chemical industry reflected higher production after maintenance and turnaround work at some facilities earlier in the summer. After removing the effect of price changes, the sales volume of chemical products increased 5.0% in July.

In the petroleum and coal product industry, sales were up 2.4% to $6.5 billion. With the increase in July, sales were at their highest level since October 2014 and reflected higher production in most refineries. In constant dollars, sales in this industry were up 1.5% in July.

These increases were partially offset by declines in the aerospace product and parts (-5.7%), furniture and related product (-6.9%) and fabricated metal product (-2.0%) industries.

Transportation equipment in Ontario sustains the manufacturing sector

Higher sales in Ontario were mainly responsible for the gains at the national level in July. Declines in British Columbia partially offset the increase.

In Ontario, sales rose 2.1% to $27.1 billion in July. Most of the provincial gain stemmed from a 3.6% increase in the transportation equipment industry. Sales were up in the petroleum and coal product (+9.3%), the chemical (+4.0%) and the food (+2.2%) industries. A 4.8% decline in sales of fabricated metal products offset some of the gain.

For a third consecutive month, sales rose in Alberta, increasing 1.7% to $6.6 billion in July. Higher sales in the chemical products (+7.9%) and electrical equipment, appliance and component (+49.9%) industries were the main contributors to the dollar increase.

Following two consecutive months of gains, British Columbia posted the largest monthly decrease, with sales declining 1.7% to $4.7 billion in July. Lower sales in the primary metal (-14.9%) and wood product (-2.6%) industries were responsible for the decline in the province.

Capacity utilization rates

The manufacturing sector capacity utilization rate, unadjusted for seasonal effects, decreased 4.6 percentage points, from 83.5% in June to 78.9% in July. While declines were widespread, the transportation equipment industry contributed the most to the decrease in July. The capacity utilization rate in the industry fell from 88.3% in June to 74.6% in July. Shutdowns at several auto manufacturing establishments were responsible for the lower rate.

The capacity utilization rate for the petroleum and coal product industry increased for the second consecutive month, rising from 89.6% in June to 90.5% in July. The gain was attributable to an overall ramping up of production in most refineries.

Source: Statistics Canada, https://www150.statcan.gc.ca/n1/daily-quotidien/180918/dq180918a-eng.htm