Manufacturing Sales Declined for the Fourth Consecutive Month in December

Feb 24, 2020

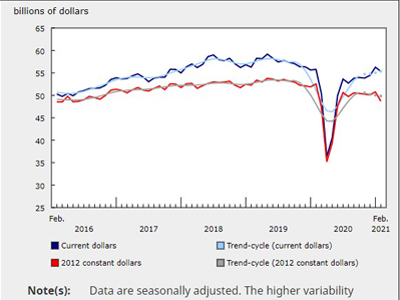

Manufacturing sales declined for the fourth consecutive month, down 0.7% to $56.4 billion in December.

Sales were down in 11 of 21 industries, representing 42.6% of the Canadian manufacturing sector. The largest declines were in the motor vehicle assembly and aerospace product and parts industries. However, these decreases were partly offset by higher sales in the primary metal industry.

Constant dollar sales declined 0.4%, indicating a lower volume of goods sold.

The motor vehicle and aerospace product and parts industries post the largest declines

Sales of motor vehicles fell 6.8% to $4.9 billion in December, reflecting lower production mostly attributable to longer seasonal plant shutdowns, and to a lesser extent, the closure of the General Motors Oshawa assembly plant.

Production in the aerospace product and parts industry decreased 15.7% to $1.9 billion, following an 8.4% increase in November. The December decline was partly due to the increase in the value of the Canadian dollar relative to the US dollar. Sales and inventories are used to calculate production in the aerospace industry and most inventories in the industry are held in US dollars.

Sales were also down in the plastic and rubber products (-5.6%), motor vehicle parts (-3.7%), fabricated metal product (-2.4%), and printing and related support activities (-6.8%) industries.

These decreases were partially offset by an 8.7% increase in the primary metal industry to $4.1 billion. This increase partly recouped the decline of 11.8% in November and was mainly attributable to higher sales in the non-ferrous metal (except aluminum) production and processing industries.

Largest declines are in Quebec and Ontario

In Quebec, sales fell 2.2% to $13.8 billion in December, down for a second consecutive month. Lower sales in the transportation equipment industry (-15.7%) were largely responsible for the provincial decline. Increases in the primary metal (+5.5%), machinery (+8.1%) and food (+2.4%) industries offset some of the declines.

Ontario manufacturers reported a 1.1% sales decrease in December, following a 0.8% increase in November. The decline was largely attributable to lower sales in the transportation equipment (-6.7%) and plastics and rubber products (-10.7%) industries. These decreases were partially offset by higher sales in the petroleum and coal product (+15.4%) and primary metal (+9.7%) industries.

Following two consecutive months of declines, sales in British Columbia increased 3.3% to $4.4 billion. Higher sales of primary metal, wood product, petroleum and coal product as well as transportation equipment were behind the provincial increase.

Manufacturing sales in census metropolitan areas

On an unadjusted basis, manufacturing sales declined in 10 of 12 census metropolitan areas (CMAs) in December, led by Toronto (-12.7%) and Montreal (-10.5%).

In Toronto, lower sales of motor vehicles (-29.5%) and food (-10.5%) were partly offset by higher sales in the beverage and tobacco as well as the machinery industries.

In Montreal, manufacturing sales were down in 19 of 21 industries, led by transportation equipment, reflecting declines in aerospace product and parts.

Manufacturing sales in Halifax were up 13.8% to $259.6 million dollars in December due to higher sales in the transportation equipment industry.

Inventory levels decline

Inventory levels fell 0.3% to $87.4 billion in December. Inventories were down in 8 of 21 industries, led by the transportation equipment (-4.3%), computer and electronic product (-6.7%) and machinery (-1.5%) industries. These decreases were partially offset by higher inventories in the petroleum and coal product (+6.4%) and chemical (+4.8%) industries.

The inventory-to-sales ratio increased from 1.54 in November to 1.55 in December. The inventory-to-sales ratio measures the time, in months, that would be required to exhaust inventories if sales were to remain at their current level.

Unfilled orders edge down

Total unfilled orders for the manufacturing sector edged down 0.1% to $97.6 billion in December. Higher unfilled orders in the ship and boat building, and the chemical industries were offset by lower unfilled orders in the computer and electronic product, and the fabricated metal product industries.

New orders fell 0.6% to $56.4 billion in December. The decline was mostly attributable to lower new orders in the aerospace product and parts, motor vehicle and fabricated metal product industries.

Capacity utilization rate

The unadjusted capacity utilization rate for the manufacturing sector decreased from 80.0% in November to 76.3% in December. Declines were widespread and may reflect to some extent regular seasonal variations. The transportation equipment as well as the plastics and rubber products industries posted the largest declines in December.

The capacity utilization rate for the transportation equipment industry declined for the second consecutive month, falling 8.0 percentage points to 76.8% in December. The decline was attributable to lower production in most of the transportation equipment industries, particularly in the aerospace product and parts, motor vehicle and motor vehicle parts industries.

The capacity utilization rate of the plastics and rubber products industry fell 10.8 percentage points to 64.0% in December. The decrease reflected lower production of plastics and rubber products due to lower orders and seasonal shutdowns at some facilities.

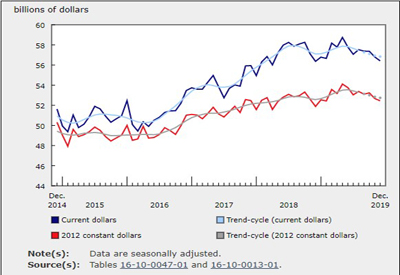

Manufacturing: Year in Review, 2019

Canadian manufacturing sales increased 0.5% to $688.5 billion in 2019. This marks the fourth consecutive year of growth, however the pace has been much slower than in 2018 (+5.4%) and in 2017 (+6.0%).

During the first half of 2019, manufacturing sales exhibited a positive trend, supported by higher sales for petroleum and coal products and growth in the transportation equipment industry. These gains subsided during the latter half of the year, and declines in other industries, primarily wood product manufacturing, also limited sales over the course of 2019.

In constant dollar terms, sales increased by 1.1% to $637.4 billion in 2019, mostly attributable to higher sales volumes in the petroleum and coal product, the transportation equipment, and the fabricated metal product industries.

Monthly total inventories increased steadily from January to May of 2019, continuing the trend from the previous year. Inventories then remained stable during the second half of the year, resulting in a year-end seasonally adjusted increase of 3.5% compared with 2018. After increasing significantly over the course of 2018, the monthly value of unfilled orders remained relatively stable throughout 2019, settling at $97.6 billion at the end of the year.

Key industries

Petroleum and coal product manufacturing sales increased 0.4% in 2019 compared with 2018. Gains were primarily driven by Western refineries. Industry sales rose in March and April, in the wake of price gains due to world supply constraints and global demand concerns. Monthly sales then hovered around the same level for the remainder of the year. In constant dollar terms, sales increased by 5.5% in 2019. Petroleum and coal manufacturing sales were affected by an industry average monthly price decline of 5.2% in 2019.

Manufacturing sales of durable goods increased 1.0% compared with 2018. Sales of durable goods were driven by gains in the transportation equipment industry, which grew by 3.2% to $132.7 billion in 2019. The Quebec transportation equipment industry, largely consisting of aerospace product and parts, posted its third consecutive year of growth (+6.9%), albeit at a slower pace than in 2018 (+12.1%) and in 2017 (+10.7%). This contributed to the province having the largest total manufacturing sales increase in 2019, with sales up $5.4 billion.

The gain in transportation equipment was partly fuelled by a modest recovery in Ontario’s motor vehicle manufacturing, following two consecutive years of falling sales. The transportation equipment manufacturing industry’s unadjusted capacity utilization rate ranged from 70.9% to 87.5%, sitting near the top of the range in months where sales grew.

The wood product manufacturing sector saw the largest decrease (-14.7%) of any industry in 2019, following seven consecutive years of growth. Canadian wood product manufacturing was hit by lower global prices, continuing import duties and mill closures. This negative trend was reflected in Canada’s exports of forestry products and building and packaging materials, down 10.2% in 2019. The industry’s capacity utilization rate fluctuated within the range of 73.8% to 82.7%, declining somewhat in the latter half of the year. Production in British Columbia was especially impacted by mill closures, particularly in the interior region.

Source: Statistics Canada, www150.statcan.gc.ca/n1/daily-quotidien/200218/dq200218a-eng.htm?HPA=1