LSI Industries Reports Fiscal First Quarter 2022 Results and Declares Quarterly Cash Dividend

Nov 8, 2021

LSI Industries Inc. (NASDAQ: LYTS, “LSI” or the “Company”) a leading U.S. based manufacturer of indoor/outdoor lighting and display solutions, today announced results for the first quarter of fiscal year 2022.

First Quarter 2022 Results

• Net sales of $106.4 million, growth of 52% versus prior year

• Organic net sales increased 19% versus prior year

• Net income of $3.1 million; Adjusted net income $3.5 million

• EPS of $0.11 per diluted share; Adjusted EPS of $0.13

• EBITDA of $7.0 million; Adjusted EBITDA of $7.6 million

• Significant year-over-year increase in Comparable Quote/Order/Backlog levels

LSI reported strong year-over-year increases in both net sales and profitability for the fiscal first quarter, driven by a combination of organic growth in both its Lighting and Display Solutions segments, coupled with the first full quarter of financial contribution from the JSI Store Fixtures acquisition (“JSI”) completed in May, 2021.

The Company reported first quarter net sales of $106.4 million, an increase of 52% versus the prior year period. Net sales excluding the contributions from the JSI acquisition, increased 19% versus the fiscal first quarter of 2021. LSI reported net income of $3.1 million, an increase of 57% compared to the prior year period. Adjusted net income was $3.5 million, or $0.13 per diluted share, versus $2.1 million or $0.08 in the prior year period. Adjusted EBITDA increased 59% year-over-year to $7.6 million in the first quarter. A reconciliation of GAAP and non-GAAP financial results is included in this press release.

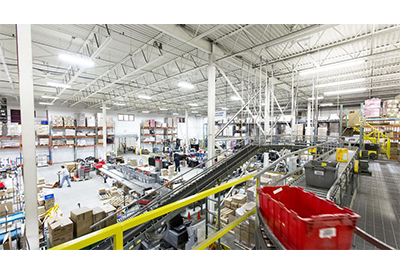

LSI capitalized on strong demand conditions across its core Lighting and Display Solutions markets, while successfully managing the escalating challenges prevalent in the industrial operating environment. In response to lengthening supplier lead-times and intensified transit reliability issues, the Company invested in additional inventory in the first quarter, minimizing material availability risks. During a period of increased demand and rising backlog, LSI effectively leveraged its vertically integrated operations platform to meet customer order commitments throughout the first quarter.

At the end of the first quarter, the Company’s total debt outstanding was $78 million, with a ratio of net debt to trailing twelve months Adjusted EBITDA of 2.5x. LSI had total cash and availability on its $100 million credit facility of $24 million at quarter end.

The Company declared a regular cash dividend of $0.05 per share payable November 23, 2021 to shareholders of record on November 15, 2021.

Management Commentary

“During the first quarter, we continued to execute on our long-term strategic priorities, while successfully navigating what continues to be a challenging macro environment,” stated James A. Clark, President and Chief Executive Officer of LSI Industries. “Quarterly net sales exceeded $100 million for the first time in the history of the company, supported by a combination of strong organic growth and JSI-related contributions. Adjusted EBITDA increased nearly 60% versus the first quarter last year, while Adjusted EBITDA margin improved both on a sequential basis and year-over-year basis. The LSI team demonstrated a strong ability to execute effectively in changing, uncertain conditions, being quick to pivot as supply and freight disruptions occurred.

“For most of last year, one of our commercial priorities involved development of an effective product pricing strategy during a period of rising input costs. However, in the first quarter, our focus shifted increasingly toward availability, specifically with respect to raw materials, key componentry, skilled labor, and freight. Normally we touch an order once in the quote to cash process, but for an increasing number of orders this has expanded to multiple touch points. This involves additional collaboration and communication with our suppliers, agency partners, and customers, to ensure delivery expectations are met.

“With order and backlog rates continuing to increase, we’ve taken proactive measures to ensure we meet our customer commitments, including an investment in additional inventory. These measures proved to be critical in generating our strong first quarter organic sales growth. Overall market conditions remain encouraging, as project quote levels in both the Lighting and Display Solutions segments remain well above prior year. Order rates are solid despite a longer quote-to-order conversion period, and our backlog, particularly for key market verticals, is considerably above prior year.

“The Lighting segment generated sales growth of 13% in the fiscal first quarter, with operating earnings improving 19% to $4.4 million. Project business increased 15% with sales improving in several key verticals including parking, automotive, and warehousing. The growth in warehousing is driven by new products launched in the second half of fiscal 2021, as our multiple price point product offering continues to gain market acceptance and quote/order levels continue to increase.

“The Lighting gross margin rate finished above 30%, improving 100 bps sequentially from the fourth quarter of fiscal 2021 and consistent with the full-year fiscal 2021 rate. Material input and supply chain costs continued to increase in the quarter, but we were successful in adjusting selling prices and driving productivity to mitigate these cost increases. Our project backlog exiting the first quarter is considerably above prior year levels, with more than $5 million of new orders within the petroleum vertical awarded in late September. These orders were influenced heavily by product availability, together with the capability to fulfill these orders by the end of the fiscal second quarter.

“Sales for the Display Solutions segment sales increased 124% to $55.1 million, reflecting a full quarter impact of the JSI acquisition. Organic growth, excluding the JSI acquisition, was also strong, increasing 29%. Adjusted operating income was $3.8 million for the first quarter, versus $1.9 million in the prior year quarter.

“JSI had a strong quarter, with total sales of $23.3 million, driven by both refrigeration and non-refrigeration products for both new and existing customers. JSI project quotation activity remains robust, reflecting the ongoing investment in merchandising solutions by national and regional chains in the grocery vertical. Revenue in our digital signage business increased 145%, year-over-year, led by the ongoing program with a large national QSR chain. The outdoor menu board portion of the program is approximately halfway complete and will continue through the first quarter of fiscal year 2023. First quarter activity in the petroleum vertical was slowed by site scheduling delays resulting from construction product shortages, all unrelated to LSI. The programs will be released in subsequent months during fiscal 2022.

“In summary, we continued to build momentum during the first quarter, advancing our market vertical driven strategy, while continuing to deliver consistent growth and profitability. While we expect the operating environment to remain challenged over the near-term, we will continue to be proactive, leveraging our diverse supply chain, maintaining strong cost discipline, and allocating resources toward higher-value vertical markets that position us to achieve both sales growth and margin expansion moving forward.

Source: LSI Industries Inc.