Labour Force Survey, January 2025

February 13, 2025

Employment increased by 76,000 (+0.4%) in January and the employment rate rose 0.1 percentage points to 61.1%. The unemployment rate declined 0.1 percentage points to 6.6%.

In January, employment increased for youth aged 15 to 24 (+31,000; +1.1%), as well as for women (+36,000; +0.5%) and men (+28,000; +0.4%) in the core working age group of 25 to 54 years old.

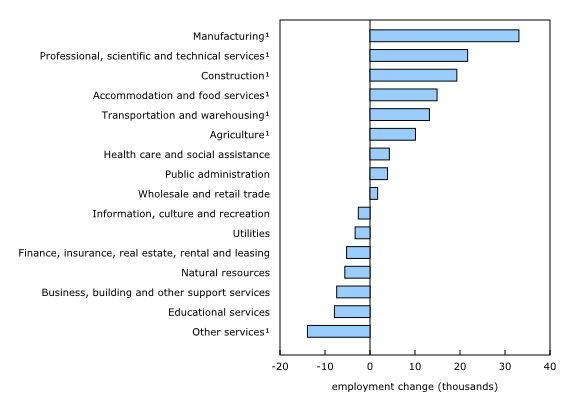

Employment gains in January were led by manufacturing (+33,000; +1.8%) and professional, scientific and technical services (+22,000; +1.1%).

Employment rose in Ontario (+39,000; +0.5%), British Columbia (+23,000; +0.8%), and New Brunswick (+2,900; +0.7%) and was little changed in the other provinces in January.

Average hourly wages were up 3.5% (+$1.23 to $35.99) on a year-over-year basis (not seasonally adjusted). This followed year-over-year growth of 4.0% in December.

Total actual hours worked rose 0.9% in January and were up 2.2% on a year-over-year basis.

Employment increases for the third consecutive month in January

Employment rose by 76,000 (+0.4%) in January, following increases in December (+91,000; +0.4%) and November (+44,000; +0.2%). Over this three-month period, there were increases both in full-time work (+147,000; +0.9%) and part-time work (+64,000; +1.7%).

The employment rate—the proportion of the population aged 15 and older who are employed—increased 0.1 percentage points to 61.1% in January, marking the third consecutive monthly increase. These recent increases follow a period in which employment growth had been outpaced by population growth, resulting in the employment rate declining 1.7 percentage points from April 2023 to October 2024.

Chart 1

Employment rate rises for the third consecutive month in January, following a downward trend throughout most of 2023 and 2024

Infographic 1

Employment rate by age group

The number of employees in the private sector increased by 57,000 (+0.4%) in January, building on an increase in December (+39,000; +0.3%). This brought year-over-year growth for private sector employment to 215,000 (+1.6%).

Employment in the public sector was little changed in January but was up 107,000 (+2.4%) compared with 12 months earlier. The number of self-employed people rose by 27,000 (+1.0%) in January and was up 94,000 (+3.6%) on a year-over-year basis.

Employment rises among core-aged men and women as well as youth

Employment growth in January was concentrated among people in the core working age group (25 to 54 years old), with increases both for women (+36,000; +0.5%) and men (+28,000; +0.4%) in this age group.

For core-aged men, this was the third consecutive month of employment growth, bringing cumulative gains since October to 90,000 (+1.3%). For core-aged women, the employment increase in January was the first since August.

Employment rates also increased both for core-aged women (+0.3 percentage points to 80.4%) and men (+0.2 percentage points to 86.8%) in January.

Employment for youth aged 15 to 24 increased by 31,000 (+1.1%) in January, led by gains among young men (+25,000; +1.8%). The employment rate among youth increased by 0.6 percentage points to 54.5% in January, the first increase since April 2024.

Among men aged 55 and older, employment fell by 20,000 (-0.8%) in January, partially offsetting a gain in the previous month (+35,000; +1.5%). Employment for women aged 55 and older was little changed in the month.

Unemployment rate ticks down to 6.6%

The unemployment rate declined 0.1 percentage points to 6.6% in January, marking the second consecutive monthly decline from a recent peak of 6.9% in November 2024. The unemployment rate had previously increased 1.9 percentage points from March 2023 to November 2024, as labour market conditions cooled after a period of low unemployment rates and high job vacancies following the COVID-19 pandemic.

The total number of unemployed people was little changed at 1.5 million in January but was up by 251,000 (+20.2%) from a year earlier. Among those who were unemployed in December, 65.4% remained unemployed in January, higher than the corresponding proportion in January 2024 (61.7%) (not seasonally adjusted). This indicates that many unemployed people are facing continued difficulties finding employment, despite recent employment growth.

Unemployment rate falls for youth, holds steady for core-aged men and women

The decline in the overall unemployment rate in January was driven by youth aged 15 to 24, whose unemployment rate fell 0.6 percentage points to 13.6%, down from a recent high of 14.2% in August and December 2024.

Chart 2

Unemployment rate declines in January

Infographic 2

Unemployment rate by age group

Despite the decline in January, the youth unemployment rate remained elevated for some groups, including racialized youth. Among the three largest racialized population groups, the youth unemployment rate was up on a year-over-year basis for South Asian (+5.2 percentage points to 15.2%) and Chinese (+3.9 percentage points to 16.6%) Canadians. Among Black youth, the unemployment rate was 18.6% in January, little changed from a year earlier. In comparison, the unemployment rate of youth who were not racialized and not Indigenous was 10.8% in January 2025, up from 9.4% in January 2024 (three-month moving averages, not seasonally adjusted).

The unemployment rates for core-aged women and men were little changed in January, both at 5.6%. Among people aged 55 and older, the unemployment rate fell 0.3 percentage points to 4.5% for women and was unchanged at 5.5% for men.

Year-over-year growth in average hourly wages decelerates for third consecutive month

Average hourly wages were up 3.5% on a year-over-year basis in January (+$1.23 to $35.99), the slowest pace of growth since April 2022. The rate of growth was 4.0% in December and 4.2% in November. Starting in the second half of 2022 and throughout most of 2023 and 2024, year-over-year wage growth hovered around 5.0%, bolstered by broad-based employment and wage growth.

In January, year-over-year wage growth slowed both for permanent employees (+3.7% to $36.83) and temporary employees (+2.5% to $28.65).

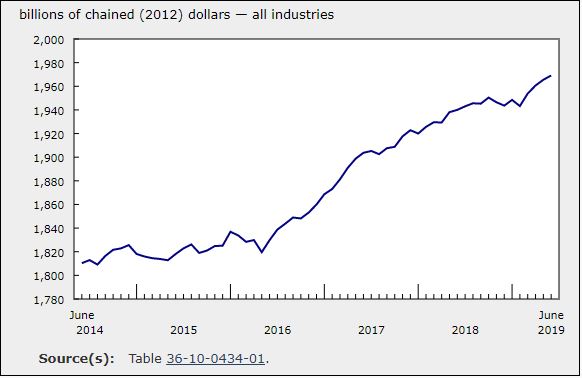

Employment gains across several industries

Manufacturing employment rose by 33,000 (+1.8%) in January, following an increase of 17,000 (+0.9%) in December. The increase in January was concentrated in Ontario (+11,000; +1.3%), Quebec (+9,700; +1.9%) and British Columbia (+8,700; +4.9%). Despite the gains in the past two months, overall employment in manufacturing was little changed on a year-over-year basis in January.

Employment rose in professional, scientific and technical services in January (+22,000; +1.1%), the second increase in the past three months. On a year-over-year basis, employment in the industry was up by 66,000 (+3.4%).

Chart 3

Employment gains led by manufacturing in January

Employment in construction increased by 19,000 (+1.2%) in January, building on a net increase of 47,000 (+2.9%) recorded from June to December 2024. On a year-over-year basis, employment in construction was up by 58,000 (+3.6%) in January.

Employment also increased in accommodation and food services (+15,000; +1.3%), transportation and warehousing (+13,000; +1.2%) and agriculture (+10,000; +4.4%) in January. At the same time, there were fewer people employed in “other services” (which includes personal and repair services) (-14,000; -1.8%).

Employment increases in Ontario, British Columbia, and New Brunswick

In Ontario, employment increased by 39,000 (+0.5%) in January, following a gain of 32,000 in December. The employment rate in the province rose 0.2 percentage points to 60.5% in January, the first increase since June 2023, while the unemployment rate held steady at 7.6%.

Employment increased for the second consecutive month in British Columbia (+23,000; +0.8%) in January, and the employment rate rose 0.4 percentage points to 61.3%. Despite the employment gain, the unemployment rate in British Columbia was little changed at 6.0% in January, as more people participated in the labour force.

Map 1

Unemployment rate by province and territory, January 2025

Employment also increased in New Brunswick in January (+2,900; +0.7%) and the unemployment rate in the province fell 1.3 percentage points to 6.4%. At the same time, fewer people participated in the labour force in January in New Brunswick, and the labour force participation rate declined 0.4 percentage points to 60.0%.

Employment in Quebec was little changed for the second consecutive month in January. On a year-over-year basis, employment in Quebec was up by 95,000 (+2.1%), with gains concentrated in the second half of 2024. The unemployment rate in the province was little changed in January at 5.4% but was up 0.8 percentage points on a year-over-year basis.

In the spotlight: Workers less likely to report planning to leave their job compared with 12 months earlier

Changing economic conditions can impact the number of employees who intend to leave their job. As labour market conditions cool and the perceived likelihood of finding new employment decreases, employees may be more likely to seek stability in their current job. While the unemployment rate in Canada has declined in the last two months, it was higher in January 2025 (6.6%) than 12 months earlier (6.1%).

The job changing rate, which measures the proportion of workers who remained employed from one month to the next but who had changed jobs, was 0.4% in January. This was lower than the corresponding proportion in January 2024 (0.5%) and lower than the pre-pandemic average for January from 2017 to 2019 (0.7%).

In addition, 6.1% of permanent employees in January reported that they were planning to leave their job in the next 12 months, down from 6.9% in January 2024 (population aged 15 to 69).

In recent years, workers in many health care occupations have faced pressures at work, such as high levels of stress and more overtime work. However, in January 2025, the proportion of permanent employees in health occupations who intended to leave their job in the next 12 months was 1.7 percentage points lower than a year earlier (4.8% compared with 6.5% in January 2024, population aged 15 to 69).

Dimensions of quality of employment, such as income and benefits, can have an impact on employee retention and intention to leave a job. For example, in January 2025, employees in sales and service occupations (9.0%) were the most likely to report planning to leave their job in the next 12 months, and also had the lowest average hourly wages ($23.21) among major occupational groups.

As immigrants integrate into the Canadian labour market, they often face challenges finding work well-aligned with their qualifications. In January 2025, nearly 1 in 10 (9.3%) permanent employees who were recent immigrants—that is, who had become permanent residents in the previous five years—intended to leave their job in the next 12 months, down from 11.6% in January 2024. In comparison, 5.8% of their counterparts who were born in Canada indicated in January 2025 that they intended to leave their job in the next 12 months, down from 6.7% in January 2024.

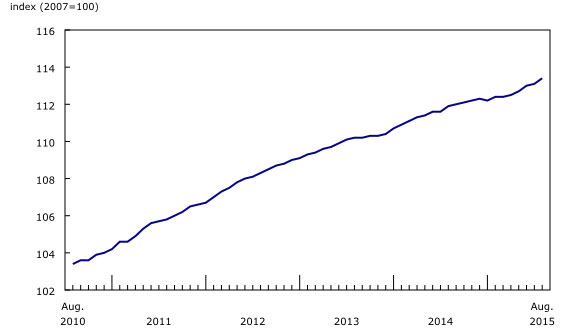

In the spotlight: The manufacturing sector, which has dependencies on US demand for Canadian exports, accounts for 8.9% of total employment in Canada

Employment in manufacturing may be particularly susceptible to changes in tariffs and foreign demand; the sector has the largest number of jobs dependent on US demand for Canadian exports. An estimated 641,000 or 39.4% of jobs in manufacturing depend on US demand for Canadian exports (based on the latest available estimates on value added in exports from the System of Macroeconomic Accounts).

According to the Labour Force Survey, there were 1.9 million people employed in manufacturing in January, comprising 8.9% of total employment—the fourth largest sector in Canada. Manufacturing employment, as a total share of employment, has trended down over the years, particularly in the 2000s, but has been more stable since 2010.

In January, private sector employees in manufacturing were more likely to work in full-time (95.3%) and permanent (95.3%) jobs compared with employees across all industries (82.6% of jobs were full-time and 89.6% of jobs were permanent). The union coverage rate for private sector employees in manufacturing (21.8%) remained higher than the average for all private sector employees (14.9%) but was down from the rate of 33.8% recorded in January 2002 (three-month moving averages, not seasonally adjusted).

In January 2025, the average hourly wage for private sector employees working in manufacturing was $34.80, slightly higher than the average of $33.97 for all private sector employees. On a year-over-year basis, wages were up 2.2% for employees in manufacturing (not seasonally adjusted).

Automotive manufacturing industries are highly integrated with US supply chains; an estimated 68.3% of jobs in these industries depend on US demand for Canadian exports. People working in automotive manufacturing (which includes motor vehicle manufacturing, motor vehicle parts manufacturing and motor vehicle body and trailer manufacturing) were concentrated in Southern Ontario, particularly in the economic regions of Toronto (which accounted for 27.7% of all auto workers), Kitchener–Waterloo–Barrie (19.8%) and Windsor-Sarnia (14.8%) in January. In Windsor-Sarnia, automotive manufacturing industries accounted for 38.3% of manufacturing employment and 7.3% of total employment (three-month moving averages, not seasonally adjusted).

Chart 4

Economic regions with highest employment in manufacturing in January 2025

Over one-quarter (26.5%) of automotive manufacturing employees were covered by a collective bargaining agreement in January 2025. In comparison, the union coverage rate in automotive industries was nearly twice as high in January 2002 (49.9%).

Food manufacturing was the largest manufacturing subsector overall and accounted for 16.4% of all manufacturing employment in January. It was also the largest manufacturing subsector across all provinces, except in Ontario. This subsector is less reliant on foreign demand, with 28.8% of jobs dependent on US demand for Canadian exports.