Joint Business Planning: The Key to Accelerating Growth, Part 2

December 13, 2016

Part 1 of this article reported on research that found most companies go through joint business planning with their major partners, but the process is not optimal. Of the six steps in the process, three function relatively well and three need major improvement. The research was based in part on a survey of manufacturers and electrical distributors, in-depth interviews with key decision-makers and a deep dive into the important topic of rebates, which is also a driver of joint business planning. Here in Part 2, opportunities identified through the research for improving the process.

The research, conducted by Channel Marketing Group in partnership with Verde Associates, identified these three areas for improvements:

1. Topics covered by JBP

· focus on value-add issues

· broaden customer needs discussions

· extend time horizon

2. Quality and granularity of market research used to generate insights

· regional and trading area-level insights

· end-customer research

3. Value received from the process

· meaningful and actionable outcomes

· minimize efforts/maximize results

4. JPB effectiveness

· implementation in the field

· periodic measurement and accountability

What we found is that manufacturers and distributors are looking for more relevant and meaningful topics that truly uncover joint opportunities. This is directly connected to the quality of research that goes into finding these opportunities, especially local market and end-customer research. Increasing the value of the process is of high importance, again, because of its resource intensity, but, more importantly, a lost opportunity to find growth where there is very little of it occurring naturally. And, finally, the effectiveness of the process that comes from measurement, accountability, and holding all parties responsible for results.

In a nutshell, the process does exist and is exercised but it has a ways to go to produce the results that companies want and expect from it.

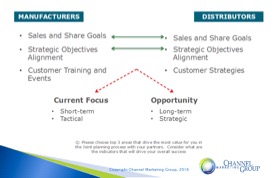

When asked about top value topics that drive the JBP process, manufacturers and distributors agreed that sales, market share and strategic alignment were the key contributors.

The third area of value centred on customers, specifically customer training, events and account-specific strategies – in essence, all customer engagement and relationship-oriented tactical elements. The focus is clearly tactical. There is an opportunity to extend the discussion to include strategic, long-term objectives, such as customer loyalty, customer acquisition and revenue retention.

Our research showed that rebates have a very special place in the JBP process. In particular, over 50% of distributors feel that planning improves their potential of achieving goals tied to rebates. We discovered that rebate achievement is a “hope” strategy for many rather than a carefully planned and executed plan. We also saw that, in some instances, a rebate is table stakes for manufacturers to engage distribution.

Market research is an underutilized strategic and joint business planning tool. Few use it to uncover opportunities to achieve incremental growth. Resources do exist to facilitate this, however, typically manufacturer sales personnel are not exposed, educated, or trained on the tools or information.

There is also a marketing research dichotomy. Manufacturers think they do a better job leveraging research during the planning process with distributors than distributors feel they do. While distributors were either Dissatisfied or Very Dissatisfied with the market research that manufacturers put into JPB presentations, almost half of distributors feel the research is only adequate. So the issue becomes – how do you amplify knowledge without amplifying costs? The key is to determine what information is needed to address the issue and drive the business and then seek appropriate information. Every industry / market has information available. Sometimes it helps to have a third party to help decipher and find it.

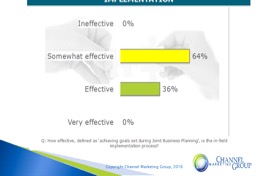

Much opportunity lies in measurement and accountability, as both are integral to a successful JBP. None of the survey participants said that any of their implementations were Extremely Effective. The overall feeling is that while in-field implementation (sales planning) does take place, it could use improvements to really deliver on agreed upon goals (see Figure 4)

On the positive side, it works if the plan is executed correctly and measured consistently and if follow through and periodic reviews takes place.

Our research showed that there is inconsistency in JBP development and execution within a company and nationally. JBP is highly dependent on distributor and manufacturer engagement and can be directly proportional to the level of management involved as well as pre-meeting information sharing. Respondents also pointed out that implementation needs follow-through and accountability, coupled with razor-sharp focus to achieve desired results.

The takeaway from the research is that individual companies that seek above average growth need to change their JBP planning process to capture sales and market share. The question becomes “Are companies committed to making a change or is it lip service?”

When asked about their willingness to change their joint business planning process for the 2017 planning cycle, the majority of manufacturers and half of distributors said yes. In particular, the following improvement opportunities were identified:

· more transparency

· pro-activity

· more granular information sharing

· making the process more valuable and selective, implementing a clear set of metrics with rigid periodic reviews

· require higher efficiency through better preparation and better tools, build in tracking and accountability, and focus on most valuable opportunities

To summarize, here are some recommendations to improve your joint business planning effectiveness:

· Commit to extract value from planning and to remember that it’s a revenue driver, not an obligation. Without accountability there will be no delivered value and that others will not respect what is not expected… and compensated or recognized. Hope is not a viable strategy.

· Come to meetings prepared and expect the same of your planning partner.

· Determine if the meeting objective is revenue generation or profit improvement (or what % each). Research shows that manufacturers always want to focus on sales, whereas distributors are primarily focused on profitability and secondarily on sales growth.

· Excellent ability to develop and deliver on JBP plans can be a differentiator and reputation builder for both manufacturers and distributors. People, and companies, want to work with those who are committed to helping them grow… and can do it by executing upon a plan.

· Engage at appropriate levels and drive communications downstream.

· Remember: data identify, quantify and prioritize opportunities. Discussion determines if there is a desire to pursue them.

· Consider selective and customized planning approach. Not all “partners” are created equal.

· Planning must be important to management and be management-driven, otherwise it is usually poorly executed and a waste of time.

The key to JBP? Develop the plan, implement it, measure achievement to identify areas ongoing improvement and you’ll get the planned results.

Read part 1 here: http://electricalwholesaler.electricalindustry.ca/latest-news/1408-joint-business-planning-the-key-to-accelerating-growth-part-1.

David Gordon is President of Channel Marketing Group, a strategic planning, marketing planning and market research firm focused on supporting manufacturers and distributors in the construction and industrial trades. He can be reached at dgordon@channelmkt.com or 919-488-8635.

Victoria Gustafson is a partner at Verde Associates. Verde works with companies to accelerate growth through data-driven decision-making and process improvement. The two collaborate on clients to bring multiple perspectives and skill sets to bear on client challenges.