Investment in Building Construction, May 2020

July 24, 2020

Total investment in building construction:

$13.4 billion – May 2020

60.1% Monthly Change

Total investment in building construction increased 60.1% to $13.4 billion in May, partially rebounding from large declines in April. The easing of COVID-19 construction restrictions in May, most notably in Ontario and Quebec, led to growth in all components of residential and non-residential investment. Despite rebounding strongly in May, investment levels remained 16.5% below the level observed in February 2020. On a constant dollar basis (2012=100), investment in building construction increased 60.3% to $11.0 billion.

Although all provinces started to reopen their economies—including the construction sectors—in May, Ontario, Quebec and Prince Edward Island made the most impactful policy changes during the month. In Ontario, some non-residential construction projects were reopened starting May 4. Additionally, the province moved into Stage 1 of reopening on May 19, which included a full resumption of all construction projects. In Quebec, all sectors of the construction industry were authorized to resume activity on May 11 under strict guidelines of the Commission des normes, de l’équité, de la santé et de la sécurité du travail. Lastly, in Prince Edward Island, new construction projects were permitted to start on May 1, following a five-week work stoppage.

For more information on housing, please visit the Housing statistics portal.

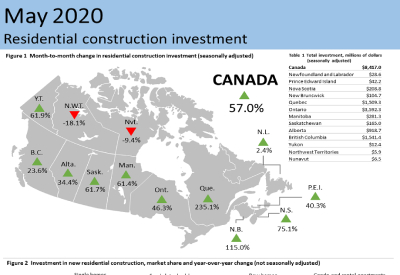

Residential construction rebounds in May

Investment in residential construction rose 57.0% to $8.4 billion in May. Investment in single-unit construction bounced back 71.7% to $4.1 billion, exceeding multi-unit growth which increased 45.2% to $4.3 billion. Although Ontario and Quebec reported the largest provincial gains for the month, all provinces bounced back somewhat from sharp declines in April. Despite these strong gains, residential investment remained 22.7% lower than February, before COVID-19-related restrictions were put in place.

Non-residential construction on track to return to pre-COVID levels

Non-residential construction investment increased 65.6% to $4.9 billion in May. All three components of non-residential investment increased, with gains in Ontario and Quebec more than offsetting declines in five other provinces.

The commercial component represented the majority of non-residential construction gains, up 99.0% to $2.9 billion. Nearly all of the increase was in Ontario and Quebec, with both provinces returning to more regular construction activity, but still remained slightly lower than February. Manitoba (+0.4%) was the only other province to report growth for the month in this component.

Gains in both the industrial (+35.1%) and institutional (+32.9%) sectors were also led by increases in Ontario and Quebec. Nationally, while reporting notable improvements, these components were still down 4.7% and 0.8%, respectively, from February levels.