Investment in Building Construction, June 2022

August 17, 2022

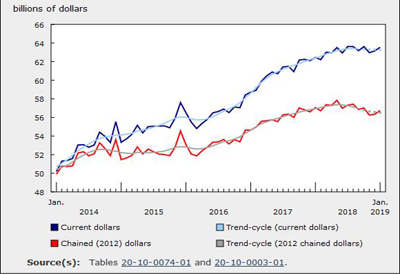

Investment in building construction edged up 0.3% to $20.8 billion in June. Gains in the non-residential sector (+2.4%) helped keep overall investment up. The majority of strength for the month came from Ontario, reporting gains in all building components following a weak May resulting from a construction workers strike in the province.

On a constant dollar basis (2012=100), investment in building construction declined 0.6% to $12.5 billion.

Residential construction breaks growth streak

Despite six provinces reporting growth, residential construction investment declined 0.4% to 15.5 billion in June, with Quebec (-6.7%) causing most of the fall. This was the first decline in nine months for residential investment.

Multi-unit construction investment fell 1.6% to $6.9 billion in June. Despite this decrease, investment in multi-unit construction has shown an overall upward trend since October 2021.

Investment in single-family homes continued to show strength, having outpaced multi-unit construction since the COVID-19 pandemic downturn. It increased 0.7% to $8.6 billion in June, with gains in six provinces.

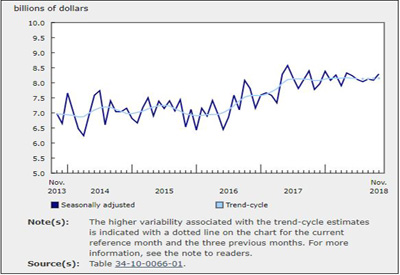

Non-residential sector rebounds in June

Non-residential construction investment increased 2.4% to $5.3 billion in June.

Commercial investment advanced 2.7% to $3.0 billion, led by Ontario (+4.1%). After falling for the first time in 13 months in May, as a result of Ontario construction workers strike, the commercial component made up for the temporary decline and continued its upward trend.

Institutional construction investment rose 0.7% to $1.4 billion with six provinces reporting gains, led by Ontario (+3.8%).

Investment in the industrial component increased 3.7% to $974 million, the highest monthly value increase since May 2020, just after pandemic-related shutdowns.

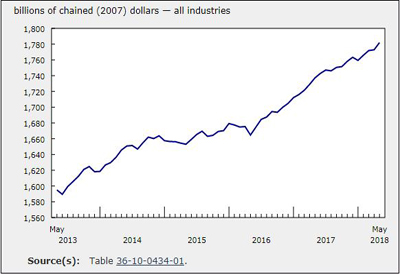

Second quarter of 2022 in review

The total value of investment in building construction rose 3.3% to $62.3 billion in the second quarter, the third consecutive quarterly increase. Investment for residential buildings reached $46.4 billion, largely due to increased spending on multi-unit construction. The non-residential sector rose 2.6% to $15.8 billion.

Ontario’s growth in the second quarter remained flat when compared with the first quarter of the year, with the strike impacting investment in all components. Industrial construction was the only component to show notable growth for this province.

Residential investment in the single-unit component increased for the third quarter in a row, rising 2.6% for the quarter to $25.7 billion. The multi-unit component has increased for the previous three quarters, rising 4.5% this quarter, with most of the growth coming from Quebec.

Investment in the non-residential sector was up 2.6% to $15.8 billion, continuing growth from the previous quarter. The commercial component, which contributed the most to the non-residential sector, gained 2.8% to $8.8 billion, its fifth consecutive quarterly growth. Institutional construction edged up 0.5% to $4.2 billion, up for the sixth consecutive quarter. The industrial component rose 5.4% to $2.9 billion, with Ontario (+8.3%) leading the gains.