Investment in Building Construction Down 1.2% in March

May 25, 2019

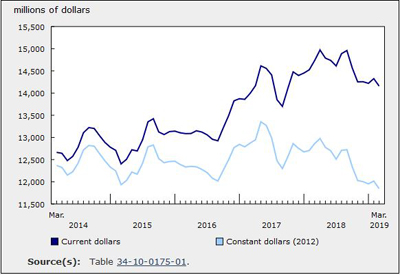

Total investment in building construction decreased 1.2% in March to $14.2 billion. Losses in the residential sector (-2.0% to $9.4 billion) were partially offset by a small increase in the non-residential sector (+0.5% to $4.7 billion). On a constant dollar basis (2012=100), investment in building construction fell 1.4% to $11.8 billion.

Investment in multi-unit dwellings overtakes investment in singles

For the first time, investment in multi-unit dwelling construction exceeded that of singles, making it the largest component for investment in building construction. Although multi-unit investment exceeded single family investment, it remained well short of the record $6.4 billion set in May 2017. While both sectors declined in March, investment in single family homes (-3.4%) did so at a faster rate than investment in multi-unit dwellings (-0.5%).

Investment in commercial construction continues to climb

Within the non-residential sector, investment in commercial building construction marked its 14th consecutive monthly increase to reach a high of $2.7 billion. Gains for the month were concentrated in British Columbia, where the redevelopment of Vancouver’s historic post office is well underway. The mixed use development will have two new office towers, which will be partially occupied by Amazon.

The industrial component rose 1.3% to $896 million in March on the strength of projects in Ontario and Quebec. Two projects that made notable contributions were the McNicoll Bus Garage in Scarborough and the new Radio Canada building in Montréal.

Following 11 consecutive monthly declines, institutional construction investment posted a small overall increase to settle at $1.1 billion. Notably, strength in Nunavut helped to moderate the decline as work on a new $40 million school in Kugaaruk continued.

First quarter 2019: Investment in new singles drops

Year over year for the first quarter, investment in new singles declined $2.1 billion (-29.8%) to $4.9 billion. This value represents an all-time low for the current series, which is available back to 2010. From a provincial perspective, nine provinces reported double-digit declines with the exception of Prince Edward Island (-6.3%). The provinces hit hardest were Ontario (-36.9%), Alberta (-38.1%) and British Columbia (-21.1%).

By contrast, investment in new apartments continued to increase, up 17.8% to $6.4 billion, with growth primarily concentrated in Central and Eastern Canada, as well as in British Columbia.

On an unadjusted basis, non-residential investment in new construction has been quite strong—increasing 8.1% year over year to $6.6 billion, on gains in the commercial (+$499 million) and industrial (+$201 million) components.

Source: Statistics Canada, https://www150.statcan.gc.ca/n1/daily-quotidien/190521/dq190521a-eng.htm?CMP=mstatcan