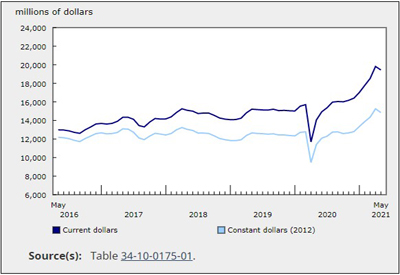

Gross Domestic Product by Industry, July 2024

September 30, 2024

Real gross domestic product (GDP) was up 0.2% in July, following essentially no change in June. Despite negative impacts from wildfires on transportation and warehousing and accommodation services, the services-producing industries grew 0.2% in July, driven in large part by increases in the retail trade sector, the public sector and the finance and insurance sector. Goods-producing industries edged up 0.1%, with the utilities and manufacturing sectors contributing the most to growth within this aggregate. Overall, 13 of 20 sectors expanded in July.

Chart 1

Real gross domestic product increases in July

Retail trade up on broad-based growth

The retail trade sector (+1.0%) was the largest contributor to overall growth in July, recording a second consecutive increase and the sector’s largest monthly growth rate since January 2023. Most subsectors expanded in July 2024 with motor vehicles and parts dealers (+2.8%) contributing the most to growth, driven by higher retailing activity at new car dealers which more than offset the previous month’s decline. A contraction at gasoline stations (-1.8%) tempered the overall growth in the sector.

Chart 2

Retail trade increases for a second consecutive month in July

Public sector continues to grow

The public sector aggregate (comprising educational services, health care and social assistance, and public administration) increased for the seventh consecutive month, up 0.3% in July.

All three components comprising the grouping rose in the month with public administration (+0.4%) contributing the most to growth in July. Local, municipal and regional public administration (+0.4%) was the largest contributor to growth in public administration for a third month in a row. Educational services (+0.2%) and health care and social assistance (+0.2%) also expanded in July with increases recorded across all subsectors and industry groups.

Finance and insurance up for second month in a row

The finance and insurance sector (+0.5%) posted a second consecutive monthly increase in July, on broad-based strength across the sector during the month.

Financial investment services, funds and other financial vehicles (+1.8%) contributed the most to growth for a second consecutive month, driven by increases in both mutual funds and financial market activity in July. Interest rate announcements, market expectations about future interest rate cuts as well as continued global geopolitical instability contributed to some volatility in North American markets in July.

Banking, monetary authorities and other depository credit intermediation increased 0.3% in July as both mortgage and non-mortgage debt rose in the month.

The utilities sector expands for the third consecutive month

Utilities rose 1.3% in July, led by a third consecutive monthly increase in the electric power generation, transmission, and distribution industry (+1.0%). Demand for electricity for cooling-related purposes rose due in part to a warmer than usual July in parts of Western Canada. Natural gas distribution rose 3.9% in July, driven by an increase in industrial use.

The manufacturing sector rises, driven by non-durable goods manufacturing

The manufacturing sector grew 0.3% in July, partially offsetting the decline recorded in June. Non-durable goods manufacturing (+1.3%) was the main source of the growth in July, more than offsetting the 0.7% decline in durable goods manufacturing.

The chemical manufacturing subsector (+4.1%) increased for the fourth consecutive month in July and contributed the most to the growth within the non-durable goods manufacturing grouping in the month. Pharmaceutical and medicine products drove the increase within the subsector, coinciding with higher exports in the month. Food manufacturing rose 1.2% in July, following two months of declines, with the grain and oilseed milling industry (+9.0%) contributing the most to the increase in the subsector as canola crushing reached a record high level in the month.

Wildfires impact multiple industries

Wildfires impacted several industries across the country in July.

Chart 3

Rail transportation falls

Transportation and warehousing (-0.4%) contracted for the second month in a row in July, driven in large part by a decline in rail transportation (-4.6%) in the month. Wildfires that spread through Jasper National Park and the Rocky Mountains caused suspension of traffic at the end of the month at a rail line passing through the park. This resulted in the halting of rail freight movements of certain commodities to and from key ports in Western Canada. Commuter rail service was also a drag on the subsector as forest fires led to the suspension of some services.

Additionally, several iron ore mines temporarily shut down their operations in July in response to wildfires burning in regions of Labrador and Northern Quebec, contributing to a 4.8% decline in iron ore mining and coinciding with a decline in iron ore carloadings. Still, the mining and quarrying (except oil and gas) subsector rose 0.4% in July, buoyed up by a 7.1% increase in copper, nickel, lead and zinc ore mining as activity rebounded following the conclusion of a labour strike at a British Columbia copper mine in June.

Accommodation services declined 2.0% in July, due in part to forest fires occurring at tourist destinations in Western Canada during the summer tourist season. Activity in recreational vehicle (RV) parks and recreational camps and rooming and boarding houses was down as the occurrence of forest fires restricted or limited activity at camping grounds due to smoke and outdoor fire bans.

Construction activity falls for the third time in four months

The construction sector (-0.4%) contracted for the second consecutive month and was the largest detractor to growth in July, as most subsectors posted decreases. Non-residential building construction (-1.7%), which posted its third decline in four months, was the largest contributor to the decline in the sector in July, with industrial and commercial building construction driving the decrease.

Advance estimate for real gross domestic product by industry for August 2024

Advance information indicates that real GDP was essentially unchanged in August. Increases in oil and gas extraction and the public sector were offset by decreases in manufacturing and transportation and warehousing. Owing to its preliminary nature, this estimate will be updated on October 31, 2024, with the release of the official GDP by industry data for August.

Chart 4

Main industrial sectors’ contribution to the percent change in gross domestic product in July