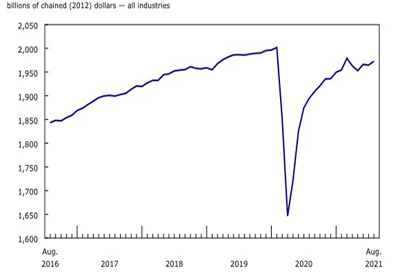

Gross domestic product by industry, August 2021

Nov 1, 2021

Real gross domestic product (GDP) rose 0.4% in August, led by increases in accommodation and food services, retail trade and transportation. The continued easing of public health restrictions and further reopening across the country increased demand across many close contact service industries.

Overall, 15 of 20 industrial sectors were up as growth in services-producing industries (+0.6%) more than offset a decline in goods-producing industries (-0.1%).

Preliminary information indicates that real GDP was essentially unchanged in September. Widespread increases led by mining, quarrying, and oil and gas extraction, wholesale trade and transportation were offset a by significant drop in manufacturing due to lower sales in transportation equipment and a decline in retail trade.

This advance estimate points to an approximate 0.5% increase in real GDP in the third quarter of 2021. Because of their preliminary nature, these estimates will be revised on November 30, with the release of the official GDP data for the September reference month and the third quarter of 2021.

Continued reopening pushes up demand for client-facing industries

The accommodation and food services sector rose 7.0% in August, continuing to recover some of the ground lost since the beginning of the pandemic.

Food services and drinking places rose 5.4% in August, following an 8.1% increase in July. The ongoing economic reopening across the country, in the form of loosened public health restrictions on indoor and outdoor dining throughout the summer, combined with warm summer weather and expanded patio capacity, all contributed positively to the third consecutive strong monthly gain. However, the subsector was approximately 15% below its pre-pandemic level of activity.

The accommodation services subsector rose 11.3% as traveller accommodation and recreational vehicle parks and recreational camps and rooming and boarding houses both recorded strong gains. Traveller accommodation led the growth, as both domestic and international travel drove demand for hotel and motel rooms. As of August 9, fully vaccinated US residents became eligible to enter Canada for non-essential reasons, including tourism.

Arts, entertainment and recreation rose 6.4% as all forms of activities were up, led by amusement, gambling and recreation industries (+7.0%). Performing arts, spectator sports and heritage institutions rose 5.2% as attendance limits at large outdoor-gathering events began to decrease.

Transportation and warehousing continues to rise

For the third month in a row, the transportation and warehousing sector was up, growing 1.2% in August as all but one subsector increased. Air transportation posted a double-digit increase for the sixth month in a row, up 24.2% in August, as movements of both passengers and goods increased in the month. Nevertheless, activity in the subsector remained suppressed and was 77% below its pre-pandemic level of activity.

Rail transportation grew 1.9% in August, as higher movement of petroleum, chemicals, metals, minerals, along with industrial and consumer products more than made up for lower movement of automotive products, grain and fertilizer.

Pipeline transportation grew 0.9%, as both crude oil and natural gas movement were up in August.

Warehousing and storage declined 1.4% in August, down for the first time since September 2020.

Retail trade grows

Retail trade rose 1.8% in August, more than offsetting the 0.6% contraction in July, with 9 of 12 subsectors posting gains. Food and beverage stores (+3.8%) led the growth, as activity at all types of stores increased in August. Clothing and clothing accessories stores rose for a third consecutive month, up 3.8% in August and led by clothing stores where activity was buoyed by easing of restrictions on in-person shopping along with back-to-school demand.

Furniture and home furnishing stores (-2.3%) and motor vehicle and parts dealers (-0.4%) both contracted in August, in part due to global supply chain constraints.

Hot and dry weather across the country continues to affect agriculture, forestry and fishing

The agriculture, forestry, fishing and hunting sector dropped 5.7%, following a 5.5% decrease in July, as all subsectors were down in August. The record-setting heat and drought conditions in Western Canada continued to severely affect production in the sector, contributing to the largest back-to-back monthly contractions since the series started in 1997.

Crop production (except cannabis) fell 10.9% in August following a 13.2% drop in July, bringing activity to levels last seen in early 2003. Forestry and logging contracted 8.7% in August, following a 4.5% decline in July, as forest fires in British Columbia’s interior and in northwestern Ontario continued to disrupt production activities.

Animal production and aquaculture contracted 3.5% in August, more than offsetting the 3.0% gain in July when more cattle were culled due to a lack of animal feed brought on by drought conditions.

Manufacturing increases

The manufacturing sector was up 0.5% in August, following a 1.6% contraction in July, with non-durable goods manufacturing contributing the most to the growth.

Non-durable goods manufacturing expanded 1.0% in August as six of nine subsectors increased. Leading the growth were chemical manufacturing (+3.1%), with broad-based growth across its industries, and plastics and rubber products (+4.1%). Partially offsetting the growth was food manufacturing (-1.3%), attributable to declines in meat product manufacturing (-7.1%), and grain and oilseed milling (-2.9%).

Durable goods manufacturing edged up 0.1% as fabricated metal product (+3.5%), computer and electronic product (+2.9%) and non-metallic mineral product (+2.4%) manufacturing were up, while transportation equipment (-1.7%), primary metal (-3.6%), and wood product (-2.7%) manufacturing were down.

Finance and insurance increases on higher market activities

Finance and insurance increased 0.5% in August, on broad-based strength across the sector.

Gains in banking and monetary authorities (+0.5%) contributed the most to the increase, with interest earned on deposits and loans at chartered banks leading the growth. Atypically higher activity in all types of mutual funds contributed to growth in banking and other depository credit intermediation as well as in financial investment services, funds and other financial vehicles (+1.1%).

Insurance carriers and related activities increased 0.3% in August, up for the third time in four months.

Mining, quarrying and oil and gas extraction unchanged

Mining, quarrying and oil and gas extraction was flat, following two months of expansion, as growth in mining and quarrying (except oil and gas) and support activities was offset by lower oil and gas extraction.

Mining and quarrying (except oil and gas) rose 1.7% in August, as coal (+6.7%), metal ore (+0.7%) and non-metallic mineral (+1.5%) mining were up.

Support activities for mining, and oil and gas extraction expanded 4.3% in August on higher rigging and support activities for mining.

Meanwhile, oil and gas extraction contracted 1.6%, with a 3.2% decline in oil sands extraction more than offsetting a 0.4% increase in oil and gas extraction (except oil sands).

Other industries

Other services increased 1.8% in August, led by the personal and laundry services (+4.5%) and repair and maintenance services (+1.2%). Continued easing of public health restrictions contributed to the growth recorded in these industries.

Utilities rose 1.5% in August, stemming from higher electric power generation, transmission and distribution (+1.4%) and natural gas distribution (+2.3%) to feed cooling demands.

Wholesale trade rose 0.6% in August, following four months of decline. Six of nine subsectors were up, led by building material and supplies (+3.8%) and food, beverage and tobacco wholesaling (+3.3%).

The public sector was unchanged in August as increases in educational services (+0.5%) and health care and social assistance (+0.1%) were offset by lower public administration (-0.6%).

Construction was essentially unchanged in August, as a 0.8% contraction in residential building construction offset growth in repair construction (+0.9%), engineering and other construction activities (+0.2%) and non-residential building construction (+0.4%).

Source : https://www150.statcan.gc.ca/n1/daily-quotidien/211029/dq211029a-eng.htm?CMP=mstatcan