Gross Domestic Product by Industry, December 2024

March 3, 2025

Real gross domestic product (GDP) increased 0.2% in December, partially offsetting the decline recorded in November. Both services-producing and good-producing industries were up, contributing to the fifth increase in the last six months. Overall, 11 of 20 industrial sectors rose in December.

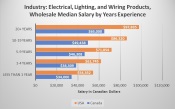

Chart 1

Real gross domestic product increases in December

Services-producing industries (+0.2%) were the largest contributors to growth in December, driven by a strong increase in retail trade. Goods-producing industries rose 0.3%, partially offsetting November’s decline. Utilities and mining, quarrying and oil and gas extraction contributed the most to growth in the goods-producing aggregate after being among the largest detractors to growth in November.

Retail trade expands

Retail trade increased 2.6% in December, representing its largest monthly growth rate since June 2021 (+5.0%) when restrictions on in-person shopping due to the COVID-19 pandemic began to ease.

Chart 2

In December, retail trade has largest increase since June 2021

All subsectors increased in December, with motor vehicle and parts dealers leading the growth and posting a third consecutive increase.

Several subsectors selling goods impacted by the temporary GST/HST tax break introduced on December 14th recorded increases in December. Food and beverage stores (+2.9%) was the second largest contributor to the sector’s growth, as retailing activity at both supermarkets and other grocery retailers (except convenience retailers) and beer, wine and liquor stores drove the increases.

Utilities sector posts a strong increase in December

The utilities sector expanded 4.7% in December, more than offsetting the previous month’s 3.6% decline, as a rebound in electric power generation, transmission and distribution led the growth. Higher hydroelectric generation resulting in large part from improving drought conditions and the completion of refurbishment at nuclear power generating facilities contributed to the growth.

Mining, quarrying, and oil and gas extraction rebounds in December

The mining, quarrying, and oil and gas sector rose 0.8% in December.

Oil and gas extraction was up 1.4% in December, more than offsetting a 0.9% contraction in November, on increases across the subsector. Following a 2.5% decline in November, when some upgraders were undergoing repair, oil sands extraction (+2.3%) led the subsector’s growth in December on higher synthetic crude oil production and crude bitumen extraction in Alberta.

Oil and gas extraction (except oil sands) rose 0.5% in December, up for the third consecutive month. Higher crude oil extraction in Alberta and Newfoundland and Labrador, along with higher natural gas extraction contributed to the increase.

Mining and quarrying (except oil and gas) was largely unchanged in December as a 5.4% increase in coal mining was fully offset by lower metal ore mining (-0.6%) and non-metallic mineral mining and quarrying (-0.5%).

Transportation and warehousing up despite postal workers’ strike

The transportation and warehousing sector edged up 0.1% in December. With lockout and strike activity ending at Canada’s ports in November, both rail (+2.9%) and water (+3.0%) transportation rebounded in December. Additionally, support activities for transportation and truck transportation rebounded in December, while cargo movement in and out of Canada’s two largest ports also resumed.

Air transportation rose 1.0% in December, up for the fifth time in the last six months, while pipeline transportation (+0.6%) rose for a third month in a row, driven by an increase in pipeline transportation of natural gas as exports grew in December.

Postal services (-25.5%) continued to contract in December as a result of the strike by around 55,000 postal service workers that lasted from November 15 until December 17. Couriers and messengers rose 7.6% in December, posting its highest monthly growth rate since June 2020, as consumers and businesses turned to alternative carriers to handle their shipping needs during the holiday shopping season.

Manufacturing continues to decline in December

The manufacturing sector was the largest detractor to growth in December, decreasing 0.9%, down for the sixth time in seven months.

Durable-goods manufacturing contracted 1.4% in December as most subsectors declined in the month. Miscellaneous manufacturing (-12.5%) and furniture and related products manufacturing (-8.5%) were the main contributors to the decrease after recording increases in the previous month. Transportation equipment manufacturing (-1.1%) continued the downward trend that began in the fall of 2023 and posted its seventh monthly decline of 2024, resulting in large part from weaker activity in motor vehicles and parts manufacturing (-1.4%).

Non-durable goods manufacturing was down 0.3% in December, posting its sixth decline in seven months. Beverage and tobacco product manufacturing (-5.0%) contributed the most to the decline in the aggregate in December, with activity reaching its lowest level since April 2020. Petroleum and coal product manufacturing decreased 1.8% in December 2024, as repair work at a few refineries throughout the month led to the decline.

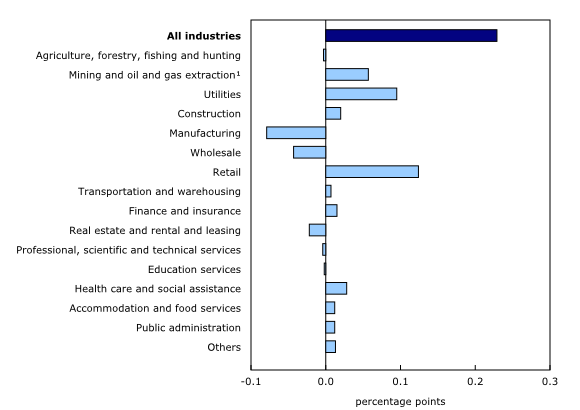

Chart 3

Main industrial sectors’ contribution to the percent change in gross domestic product in December

Advance estimate for real gross domestic product by industry for January 2025

Advance information indicates that real GDP increased 0.3% in January. Increases in mining, quarrying and oil and gas extraction, wholesale trade and transportation and warehousing were partially offset by decreases in retail trade. Owing to its preliminary nature, this estimate will be updated on March 28, 2025, with the release of the official GDP by industry data for January.

Real gross domestic product by industry continues to grow in the fourth quarter

Real GDP by industry expanded 0.5% in the fourth quarter, following a 0.4% increase in the third quarter. Services-producing industries was the main driver of growth for the 11th consecutive quarter, increasing 0.5% in the fourth quarter. Goods-producing industries increased 0.4% in the fourth quarter, more than offsetting a 0.3% contraction the previous quarter. Overall, 13 out of 20 industrial sectors were up in the fourth quarter.

The real estate and rental and leasing sector led the growth in the fourth quarter with a 0.9% expansion. Offices of real estate agents and brokers and activities related to real estate (+8.8%) was the largest driver of growth, increasing for the second consecutive quarter, as the Bank of Canada cut its policy rate in October and December of 2024, lowering mortgage related costs.

The construction sector expanded for the second consecutive quarter, up 1.1% in the fourth quarter as most types of construction activity expanded. Residential building construction expanded 1.9% in the fourth quarter as higher activity in the construction of single-family homes and apartments as well as home alterations and improvement drove the increase in the quarter. Non-residential building construction (+2.4%) was another large contributor to growth in the quarter, mainly driven by increased activity in public and industrial building construction.

Retail trade expanded 1.6% in the fourth quarter as 7 out of 12 subsectors increased. Motor vehicle and parts dealers (+5.8%) drove the growth for the second consecutive quarter as activity at new car dealerships remained robust and consumers continued to take advantage of more favourable financing rates.

Wholesale trade expanded 1.1% in the fourth quarter, following a 0.4% contraction in the third quarter, as most subsectors increased. Machinery, equipment and supplies wholesalers (+1.6%) was the largest contributor to growth in the fourth quarter after being one of the largest detractors to growth in the sector in the previous two quarters. A rebound in farm product merchant wholesalers further contributed to the growth in the sector, posting a 9.7% increase in the fourth quarter, which more than offset the decline observed in the previous quarter.

The manufacturing sector (-0.3%) posted its sixth consecutive quarterly decline and was the largest detractor to growth in the fourth quarter. Chemical (-1.7%), primary metal (-2.9%) and fabricated metal product (-1.5%) manufacturing contributed the most to the decline in the quarter.

The utilities sector dropped 1.3% in the fourth quarter, following two consecutive quarterly increases. Natural gas distribution fell 6.9%, as all components declined in the fourth quarter, led by residential and industrial billings. Electric power generation, transmission and distribution also contributed to the decrease, down 0.6% in part due to worsening drought conditions in parts of the country.

Chart 4

Main industrial sectors’ contribution to the percent change in gross domestic product in the fourth quarter

Real gross domestic product by industry grew in 2024 on broad based increases

Real GDP by industry rose 1.6% in 2024. Services-producing industries (+2.2%) were the main drivers of growth, despite growing at the slowest pace in four years. Goods-producing industries (+0.1%) edged up in 2024, after a 0.6% contraction in 2023. Overall, 15 out of 20 sectors increased in 2024.

Services-producing industries drove growth in 2024

The real estate and rental and leasing sector contributed the most to the increase in services-producing industries, rising 2.3% in 2024 as all industries expanded in the year. Real estate agents and brokers contributed to the growth, posting its first annual increase in three years, as home resale activity rose 6.8% following declines of 25.9% in 2022 and 10.6% in 2023. Rental and leasing services and lessors of non-financial intangible assets (except copyrighted works) (+6.0%) also expanded with automotive equipment rental and leasing leading the increase. After reaching an all-time low in 2021, this subsector has continued its recovery, as rental fleets and tourism related demand continued to improve in 2024.

Health care and social assistance (+3.6%), educational services (+4.1%) and public administration (+2.3%) were among the largest drivers of growth within the services-producing industries in 2024, with all three sectors expanding for a fourth consecutive year.

The finance and insurance sector increased 2.8% in 2024, as all subsectors grew in the year. The geopolitical context, the US election and announcements on policy rate decisions contributed to increased activity in the financial markets. Financial investment services, funds and other financial vehicles led the growth in large part resulting from increases in equity and fixed-income activity. Credit intermediation and monetary authorities (+1.7%) further contributed to the sector’s growth as both mortgage and non-mortgage loans along with deposits at chartered banks expanded in the year.

The transportation and warehousing sector was another large contributor to growth in the services-producing industries in 2024. Air transportation (+9.2%) and urban transit systems (+10.5%) were among the largest drivers of growth as they continued to recover from pandemic-related disruptions, with both expanding for a third consecutive year. Pipeline transportation also contributed to the sector’s increase as both pipeline transportation of natural gas and crude oil and other pipeline transportation expanded. Pipeline transportation of crude oil grew at its fastest pace in four years, with the beginning of Trans Mountain pipeline expansion operations in the spring of 2024 contributing to this increase.

Goods-producing industries edge up in 2024

The mining, quarrying, oil and gas extraction sector was the largest driver of growth within the goods-producing aggregate, rising 4.6% in 2024, as all subsectors were up. The oil and gas extraction subsector (+3.7%) contributed the most to the increase, expanding for the fourth year in a row, as higher crude oil and natural gas extraction pushed the level of activity up in 2024.

Chart 5

Main industrial sectors’ contribution to the percent change in gross domestic product in 2024

In 2024, the manufacturing sector (-3.2%) was the largest detractor to growth for a second year in a row and posted its largest decline since 2020. Durable-goods manufacturing, which accounted for most of the decline, contracted 4.9% in 2024. The transportation equipment manufacturing subsector (-7.0%) was the primary contributor to the contraction as activity at motor vehicle parts manufacturing decreased in the year.

The construction sector (-0.3%) contracted for the second consecutive year. Residential building construction (-1.6%) contributed the most to the decline in 2024, in large part driven by lower activity in the construction of single detached homes and alterations and improvement. This was the third consecutive year of decline in residential building construction.