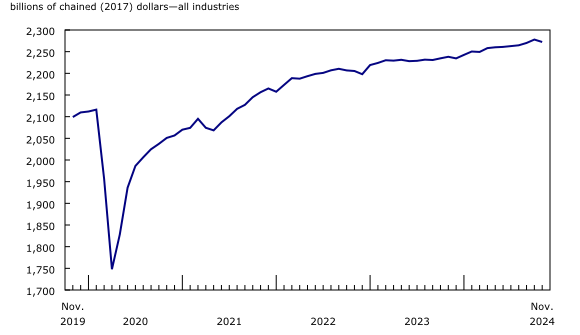

Gross Domestic Product by Industry, November 2024

February 3, 2025

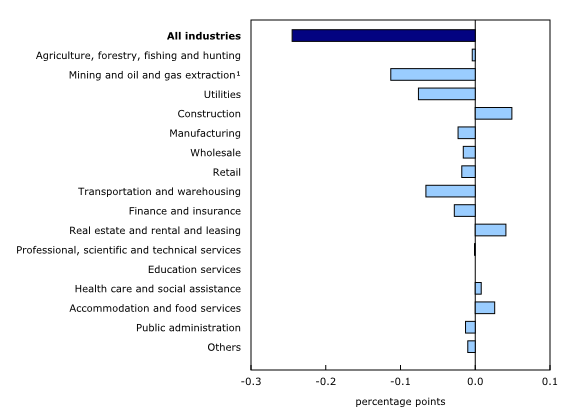

Real gross domestic product (GDP) decreased 0.2% in November, the largest monthly contraction since December 2023, following a 0.3% increase in October 2024. Overall, there were broad based declines as 13 of 20 sectors contracted in November.

Goods-producing industries contracted 0.6% in November, partially offsetting the increase recorded in October (+0.9%), with mining, quarrying, and oil and gas extraction and utilities driving most of the decline.

After five consecutive monthly increases, the services-producing industries edged down 0.1% in November. The transportation and warehousing sector was the largest contributor to the decline, in large part resulting from work stoppages. Increases in activity in real estate and rental and leasing tempered the decline in the services-producing grouping.

Chart 1

Real gross domestic product decreases in November

Mining, quarrying and oil and gas extraction contracts after strong October

Following a 2.2% increase in October, mining, quarrying and oil and gas extraction fell 1.6% in November as all three subsectors contracted in the month.

Chart 2

Mining, quarrying, and oil and gas extraction contracts in November

Oil and gas extraction decreased 1.5% in November with oil sands extraction (-3.4%) being the main contributor to overall sector decline, after being the largest contributor to growth in October. The decline in oil sands extraction was the largest monthly contraction since May 2024, reflecting lower synthetic crude production and crude bitumen extraction in Alberta.

Support activities for mining and oil and gas extraction were down 4.6% in November, the largest monthly decline since December 2022, due to declines in all types of supporting activities.

Mining and quarrying (except oil and gas) also contributed to the decline in the sector with a decrease of 0.5% in November 2024, reflecting declines in coal (-5.3%) and metal ore (-0.6%) mining. In the metal ore mining industry, copper, nickel, lead and zinc ore mining (-4.9%) was the largest contributor, mainly due to production delays at a copper mine in British Columbia. Meanwhile, oil and gas extraction (except oil sands) tempered the decline in the sector with a 0.4% increase, reflecting higher natural gas extraction.

The utilities sector contracted 3.6% in November, mostly driven by a decline in electric power generation, transmission, and distribution (-4.4%). This decline coincided with lower demand for heating resulting from a milder than typical November in parts of central and eastern Canada, as well as low precipitation and worsening drought conditions which hampered supplies of electricity.

Work stoppages stymie growth in transportation and warehousing sector

The transportation and warehousing sector declined 1.3% in November, the largest monthly decline since December 2022 when adverse weather impacted activity.

Chart 3

Transportation and warehousing falls in November

The postal service subsector (-20.3%) contracted in November 2024, as around 55,000 postal services workers went on strike on November 15, impacting letters and some small parcel deliveries, ahead of the holiday shopping season. Couriers and messengers rose 2.4% in the month, partly due to consumers and businesses turning to alternative carriers to fulfill their shipping needs.

Work stoppages also impacted activity in the rail (-3.0%) and water (-4.6%) transportation subsectors in November, both contracting in the month.

The labour actions at the port of Montréal that started in October continued into November, culminating on November 10, when the Maritime Employers Association locked out nearly all employees, bringing activities to a complete halt at almost all terminals.

On the West Coast, although the Port of Vancouver remained open, the British Columbia Maritimes Employers Association (BCMEA) locked out forepersons at all BCMEA and Local 514 member terminals at the port on November 4. Activity resumed at all ports in the days following the Canada Industrial Relations Board ruling of binding arbitration on November 12.

Additionally, support activities for transportation (-0.9%) and truck transportation (-0.8%) were also down in November due in large part to declining cargo movements in and out of Canada’s ports.

Real estate and rental and leasing up for seventh consecutive month

Real estate and rental and leasing increased 0.3% in November, up for the seventh month in a row. Activity at the offices of real estate agents and brokers and activities related to real estate (+3.4%) was the main contributor to growth for the third consecutive month, as a rise in home sales in Ontario, Quebec, and British Columbia boosted activity in the industry in November.

Legal services, which derives much of its activity from real estate transactions, increased 0.4% in November.

Construction activity increases, building up on three months of growth

The construction sector increased 0.7% in November, continuing an upward trend that began in August, driven by higher activity in residential and non-residential building construction. Residential building construction rose 1.8% in November, posting its fourth consecutive monthly increase reflecting activity in the construction of single-family dwellings during the four months. Home alterations and improvements was another large contributor to the November increase.

Non-residential building construction (+1.3%) was up in November, driven by higher activity in industrial and public building construction.

Several leisure-related industries expand in November

Multiple leisure related industries such as accommodation and food, arts, entertainment and recreation and air transportation expanded in November, coinciding with the arrival of Taylor Swift’s Eras Tour to Toronto.

Chart 4

Main industrial sectors’ contribution to the percent change in gross domestic product in November

The accommodation and food services sector increased 1.4% in November, the largest increase since January 2023, rising for a third consecutive month and shaking off the tepid growth or decline observed from June to August. Food services and drinking places (+1.1%) was up in November 2024, with activity across all types of service establishments increasing; this was the third consecutive month where the subsector increased. Accommodation services rose 2.4% in November, driven in large part by higher activity in traveller accommodation services.

Arts, entertainment and recreation increased 0.8% in November as all three subsectors contributed to the growth in the month. The increase in performing arts, spectator sports and related industries, and heritage institutions (+0.5%) was tempered by weaker activity in spectator sports on lower than usual National Hockey League attendance in November.

Air transportation increased for the second consecutive month, growing 1.3% in November. Both domestic traffic and transborder (to and from the United States) activity contributed to the increase in the month, including a strong increase in United States of America residents entering Canada by air.

Advance estimate for real gross domestic product by industry for December 2024

Advance information indicates that real GDP by industry increased 0.2% in December. Increases in retail trade, manufacturing and construction were partially offset by decreases in transportation and warehousing, real estate and rental and leasing and wholesale trade. Owing to its preliminary nature, this estimate will be updated on February 28, 2025, with the release of the official GDP by industry data for December 2024.

With this advance estimate for December, information on real GDP by industry suggests that the economy expanded 0.4% in the fourth quarter of 2024 and 1.4% in 2024 as a whole. The official estimates for the fourth quarter and the year will be available on February 28, 2025, when the official estimate of real GDP by income and expenditure is released.