Gross Domestic Product by Industry, June 2024

September 4, 2024

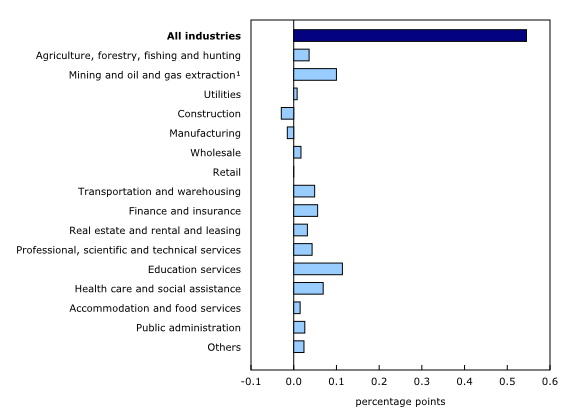

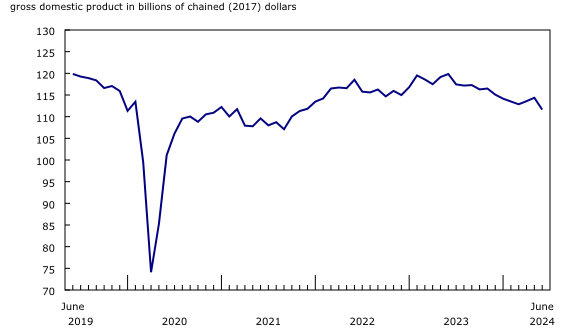

Real gross domestic product (GDP) was essentially unchanged in June, following a 0.1% increase in May. Goods-producing industries (-0.4%) saw its largest decrease since December 2023 as declines in manufacturing and construction were partially offset by increases in utilities and agriculture. Services-producing industries (+0.1%) increased for the third consecutive month in June 2024. Overall, 12 of 20 sectors expanded in June.

Chart 1

Real gross domestic product essentially unchanged in June

The manufacturing sector drives the decline in goods-producing industries

The manufacturing sector decreased 1.5% in June, more than offsetting the previous two months of growth, as both durable and non-durable goods manufacturing contributed to the decline.

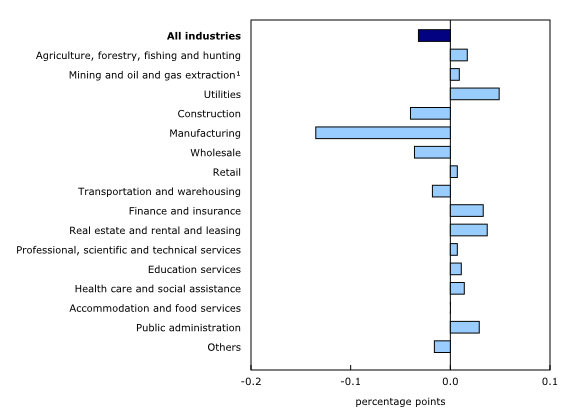

Chart 2

Manufacturing sector dampens growth the most in June

In June, durable goods manufacturing (-2.4%) experienced its largest contraction since April 2021 and reached its lowest level since November 2021. Except for wood product manufacturing (+0.5%), all durable goods manufacturing subsectors were down in June 2024 with transportation equipment manufacturing (-2.1%) recording the largest decline. Retooling at assembly plants in the United States and suspension of production at an assembly plant in Canada adversely impacted activity in the motor vehicles and parts manufacturing industry (-3.5%).

Chart 3

Durable manufacturing down in June, reaches lowest level since November 2021

Non-durable goods manufacturing contracted 0.3% in June with plastics and rubber product manufacturing (-5.4%) contributing the most to the decline.

Wholesale trade falls for a second consecutive month

The wholesale trade sector (-0.7%) decreased for the second consecutive month in June, with the machinery, equipment, and supplies (-1.1%) and motor vehicle and motor vehicle parts and accessories (-2.9%) subsectors contributing the most to the declines in both May and June.

Construction contracts for a third consecutive month

The construction sector contracted 0.6% in June to its lowest level since January 2021, as almost all subsectors were down. Residential building construction (+0.3%) was the exception, recording its first increase in three months in June 2024, driven in large part by higher activity in the construction of apartments.

In June, engineering and other construction activities (-1.4%) contracted for the first time in six months. The activity level of the subsector in June was 7.5% below its June 2023 peak. This low level of activity compared to June 2023 can be in part attributed to declines recorded in the second half of 2023, which coincided with the winding down of the Kitimat liquefied natural gas project in British Columbia.

Utilities up as all subsectors rise

The utilities sector (+2.3%) posted a second consecutive monthly increase in June 2024, reaching its highest level since April 2023.

Electric power generation, transmission, and distribution was the largest contributor to growth, rising 2.3% in June 2024. Nuclear electricity generation contributed the most to the increase as activity rebounded after the completion of maintenance activities at nuclear reactors in April and May. Hydroelectricity increased in June as drought conditions continued to ease across the country, particularly in Manitoba and Quebec.

Natural gas distribution increased 3.6% in June, driven by higher activity in residential deliveries.

Transportation and warehousing down

Transportation and warehousing contracted 0.3% in June as most subsectors recorded declines. Air transportation (-1.9%) was one of the largest contributors to the decline in June as a strike by pilots at a major Canadian air carrier began at the end of the month. This resulted in numerous flight cancellations before and during the Canada Day long weekend.

Pipeline transportation (+2.1%) and water transportation (+2.5%) expanded in June. The rise in crude oil and other pipeline transportation (+2.6%) contributed the most to the increase in pipeline transportation, as the newly expanded Trans Mountain pipeline completed its first full month of operation. More oil tankers were able to leave Western Canada, contributing to increased activity in water transportation, coinciding with a growth in exports of crude oil to Asian countries.

The real estate and rental and leasing sector expands

The real estate and rental and leasing sector (+0.3%) posted its second consecutive monthly increase in June.

The offices of real estate agents and brokers and activities related to real estate industry (+3.6%) was the largest contributor to growth in June, with home sales increasing in the month. Ontario and Quebec saw the highest increase in home sales among the provinces. Despite this rise, the industry’s activity level was 41% below its peak of September 2020.

The legal services industry, which derives much of its activity from real estate transactions, increased 0.4% in June 2024.

Finance and insurance increases for a third consecutive month

The finance and insurance sector (+0.5%) posted a third consecutive monthly increase in June. Financial investment services, funds and other financial vehicles (+2.6%) continued to be the main contributor to growth in June, driven by increases in newly issued corporate bonds and increased activity in bond markets in the month. Higher activity in mutual funds, particularly money market funds, also contributed to the increase in the subsector for a second month in a row.

Banking, central bank and other depository credit intermediation increased 0.2% in June as both mortgage and non-mortgage debt rose in the month.

The public sector continues to grow

The public sector (comprising educational services, health care and social assistance and public administration) increased for the sixth consecutive month, up 0.2% in June. This was the slowest pace of growth since the contraction in December 2023.

All three components rose in June 2024. Public administration expanded 0.4% with local, municipal and regional public administration contributing the most to growth. Educational services rose 0.2%, as elementary and secondary schools (+1.0%) posted its sixth consecutive increase following the declines in November and December 2023 that resulted from the impact of the public sector strike in Quebec. Health care and social assistance also continued to grow in June 2024, but at the slowest pace since it edged down in December 2023.

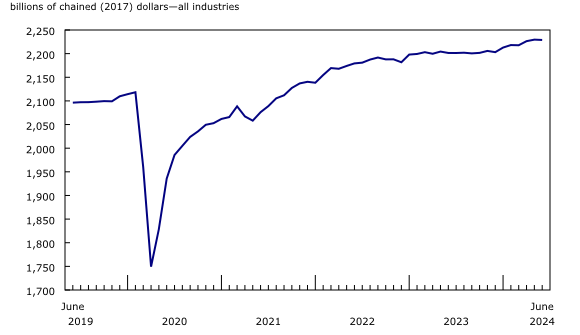

Chart 4

Main industrial sectors’ contribution to the percent change in gross domestic product in June

Advance estimate for real gross domestic product by industry for July 2024

Advance information indicates that real GDP by industry was essentially unchanged in July. The construction, mining, quarrying, and oil and gas extraction and wholesale trade sectors recorded decreases, while finance and insurance and retail trade observed increases. Owing to its preliminary nature, this estimate will be updated on September 27, 2024, with the release of the official GDP by industry data for July.

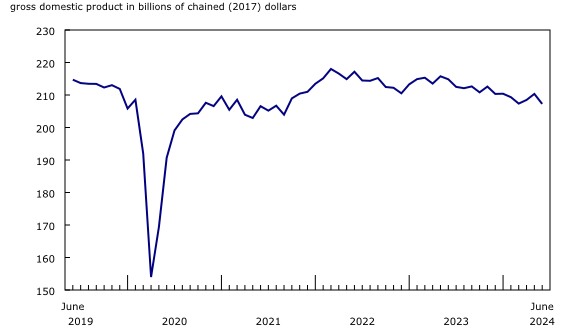

Real gross domestic product by industry continues expanding in the second quarter of 2024

Real GDP by industry rose 0.5% in the second quarter of 2024, following a 0.6% increase in the previous quarter. Both goods-producing (+0.4%) and services-producing (+0.6%) industries contributed to growth. Overall, 15 of 20 industrial sectors were up in the second quarter of 2024.

The public sector (+1.0%) (consisting of educational services, health care and social assistance and public administration) was the largest contributor to growth for a second consecutive quarter, buoyed mainly by increased activity in educational services and health care and social assistance. Educational services (+2.0%), also up for a second consecutive quarter, contributed the most to the growth, driven by increased activity in the elementary and secondary schools industry. Health care services and social assistance increased 0.8%, as all subsectors expanded, while the public administration sector rose 0.3%, led by an increase in local, municipal and regional public administration.

Mining, quarrying, and oil and gas extraction rose 2.5% in the second quarter of 2024, representing its largest quarterly increase since the second quarter of 2022, after being essentially unchanged in the first quarter of 2024. The oil and gas extraction subsector led the growth with a 2.3% increase in the second quarter, reflecting higher activity in oil sands extraction as several facilities ramped up production following a period of maintenance and turnarounds at the end of the previous quarter.

Support activities for mining and oil and gas extraction expanded 7.0% in the second quarter after five consecutive quarterly declines, reflecting a pickup in drilling and rigging activities. Metal ore mining grew for the third consecutive quarter, largely driven by higher gold and silver ore and iron ore mining in the second quarter of 2024.

The transportation and warehousing sector expanded for the ninth consecutive quarter, increasing 1.0% in the second quarter of 2024. The urban transit systems industry contributed to the sector’s growth, as Canada’s urban transit ridership levels increased in the quarter. Pipeline transportation posted its largest increase since the third quarter of 2021, as activity at the newly expanded Trans Mountain pipeline commenced in the second quarter of 2024.

Finance and insurance rose 0.8% in the second quarter of 2024, posting its highest quarterly growth rate since the third quarter of 2021. The financial investment services, funds, and other financial vehicles subsector drove the gain in the second quarter of 2024 as anticipation of policy rate cuts and the Bank of Canada’s decision to cut its policy rate in June contributed to higher activity in financial markets.

The construction sector dampened growth the most in the second quarter of 2024, declining 0.4%, as most forms of construction activity decreased in the quarter. Residential building construction (-1.9%) contributed the most to the decline, contracting for a second consecutive quarter, as weaker activity in the construction of single-family homes, apartments and home alterations and improvements continued to drive the decrease.

The manufacturing sector edged down 0.2% in the second quarter of 2024, marking the sector’s fourth consecutive quarterly decline. Fabricated metal product manufacturing (-3.1%) drove the decline in the second quarter of 2024. Transportation equipment manufacturing (-1.7%) was one of the largest contributors to the contraction in the sector as cessation of production at an Ontario motor vehicle assembly plant and retooling activities at assembly plants in Canada and the United States contributed to the decline.

Chart 5

Main industrial sectors’ contribution to the percent change in gross domestic product in the second quarter