Gross Domestic Product by Industry, March 2024

June 3, 2024

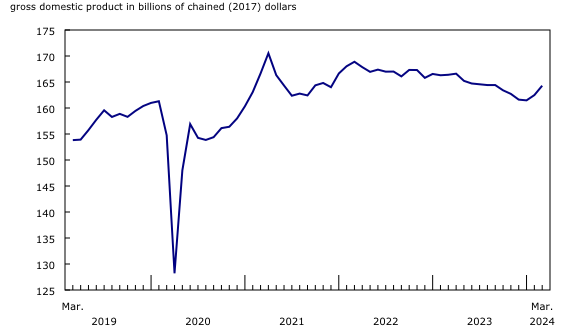

Real gross domestic product (GDP) was essentially unchanged in March, following a 0.2% increase in February. Both goods-producing and services-producing industries were essentially unchanged in March. Overall, 11 of 20 sectors increased in the month.

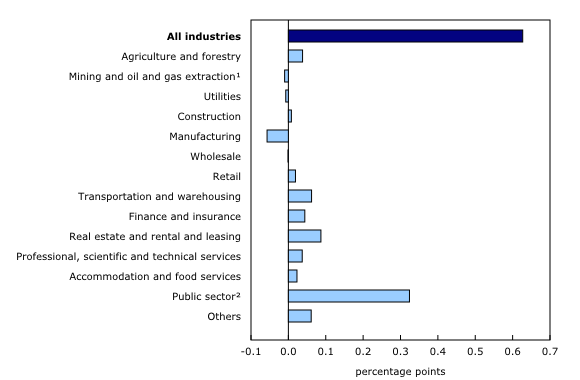

Chart 1

Real gross domestic product is flat in March

Construction up with the largest monthly increase since January 2022

Construction rose 1.1% in March, the largest monthly growth rate since January 2022, as almost all types of construction activity increased in March 2024. Repair construction (-0.3%) was the only exception, recording a second consecutive monthly decline.

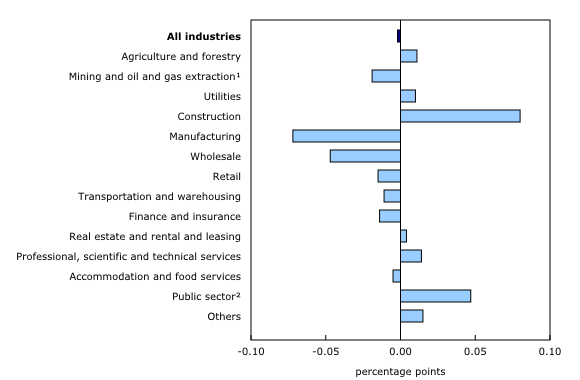

Chart 2

Construction activity increases in March

Engineering and other construction activities (+1.4%) led the growth in the sector in March. This was the third consecutive monthly increase for the engineering and other construction activities subsector. Yet these consecutive monthly gains only partially offset the declines recorded in the second half of 2023 that resulted in part from the winding down of the Kitimat liquefied natural gas project. The activity level in March 2024 was more than 6% below its June 2023 peak.

Residential building construction was up 1.4% in March 2024, largely driven by increased activity in construction of new single-detached homes and home alterations and improvement. This was the second consecutive monthly increase for the subsector, following four straight months of declines. The activity level of the subsector in March was approximately 21% below the peak seen in April 2021. Non-residential building construction increased 1.6% in March 2024 as all components expanded, with public building construction and industrial building construction contributing the most to the increase.

Public sector continues to grow

The public sector (consisting of educational services, health care and social assistance and public administration) edged up 0.2% in March, posting a third consecutive monthly increase following the declines observed in November and December 2023 that resulted in large part from the impact of the Quebec public sector workers’ strikes.

The educational services sector increased 0.5% in March 2024, driven by an increase in the elementary and secondary schools industry (+0.8%). A decline in the universities industry (-0.3%) tempered the increase in the educational services sector, as a strike that began in late February by the Canadian Union of Public Employees Local 3903 representing some 3,000 contract teachers, teaching assistants and graduate assistants continued to adversely impact activity in March.

Retooling at auto assembly plants impacts manufacturing activity

The manufacturing sector (-0.8%) was the largest detractor to growth in March, contracting for a second month in a row. Durable goods manufacturing decreased for the fourth consecutive month, down 0.9% in March, as 6 of 10 subsectors declined in the month. The transportation equipment manufacturing subsector (-2.4%) was the largest detractor to growth in March, posting its third decline in four months, as ongoing retooling activities at multiple automotive assembly plants in Ontario contributed to lower activity in the subsector. The motor vehicle manufacturing industry group was down 8.2%, while the motor vehicle parts manufacturing industry group decreased 3.0%.

Non-durable goods manufacturing (-0.6%) contracted for the third time in four months in March, with food manufacturing (-2.1%) contributing the most to the decline. Chemical manufacturing (-2.6%) was another large contributor to the contraction, largely affected by a decline in pharmaceutical and medicine manufacturing, and coinciding with a decrease in exports of pharmaceutical and medicinal products.

Wholesale declines driven in large part by a contraction in motor vehicle and motor vehicle parts and accessories wholesaling

The wholesale trade sector was down 0.9% in March, its second decline in three months, as five of nine subsectors decreased. Motor vehicle and motor vehicle parts and accessories wholesaling contracted 5.3% in March and contributed the most to the overall decline in the sector. The retooling work at several automotive assembly plants in Ontario contributed to lower wholesaling activity in the motor vehicle industry group.

Machinery, equipment and supplies wholesaling posted a third consecutive monthly increase, tempering the decline in the overall sector in March.

Mining, quarrying and oil and gas extraction contracts

The mining, quarrying and oil and gas extraction sector decreased 0.5% in March as lower activity in the mining and quarrying (except oil and gas) subsector more than offset increases in oil and gas extraction as well as support activities for mining, and oil and gas extraction.

Mining and quarrying (except oil and gas) contracted 3.9% in March, recording its largest decline since January 2022 as all industry groups within the subsector were down.

A broad-based decline across industries comprising the metal ore mining industry group contributed to a 5.0% contraction in March 2024. Gold and silver ore mining (-6.7%) contributed the most to the decline as a gold mine temporarily shut down production in March due to unfavourable weather conditions.

Non-metallic mineral mining and quarrying decreased 1.5% in March, down for a third month in a row. A 2.9% decrease in potash mining, coinciding with lower exports, more than offset gains in other forms of non-metallic mineral mining in March.

Oil and gas extraction rose 0.4% in March, up for the fifth time in six months. A 2.4% increase in oil sands extraction, led by higher crude bitumen extraction and synthetic oil production, more than offset a 1.6% contraction in oil and gas extraction (except oil sands) affected by lower extractions of crude oil and natural gas. The oil and gas extraction subsector, as well as the support activities for mining and oil and gas subsector (+4.6%) tempered the decline in the overall sector in the month.

Advance estimate for real gross domestic product by industry for April 2024

Advance information indicates that real GDP rose 0.3% in April. Increases in manufacturing, mining, quarrying, and oil and gas extraction and wholesale trade were partially offset by decreases in utilities. Owing to its preliminary nature, this estimate will be updated on June 28, 2024, with the release of the official GDP by industry data for April.

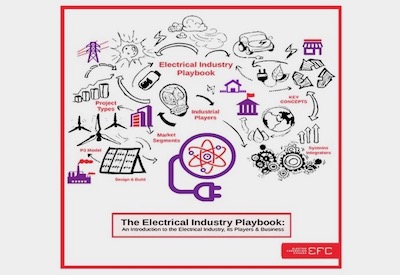

Chart 3

Main industrial sectors’ contribution to the percent change in gross domestic product in March

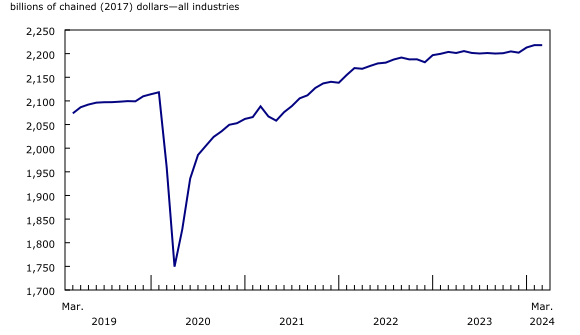

Real gross domestic product by industry expands in the first quarter of 2024

Real GDP by industry rose 0.6% in the first quarter, after edging up 0.1% in the previous quarter. The increase in the first quarter of 2024 was led by services-producing industries (+0.9%), marking the 11th consecutive quarter of growth for this grouping. Goods-producing industries edged down 0.1% in the first quarter, after being essentially unchanged in the previous quarter. Overall, 14 of 20 industrial sectors grew in the first quarter of 2024.

After being the largest detractor to growth in the final quarter of 2023 (-0.5%), the public sector (consisting of educational services, health care and social assistance and public administration) rebounded with a 1.5% increase in the first quarter of 2024 as all three components recorded gains. Educational services led the growth with a 3.5% expansion largely reflecting the conclusion of the Quebec public sector workers’ strike which had a large impact on activity in elementary and secondary schools in November and December of 2023.

The transportation and warehousing sector grew for the eighth consecutive quarter, increasing 1.2% in the first quarter of 2024. Air transportation was the largest contributor to growth, increasing 5.7%, its largest increase since the fourth quarter of 2022. Several air carriers increased their capacity to Asian markets in the run-up to the Lunar New Year celebrations, which contributed to a rise in activity in the air transportation subsector in the first quarter of 2024.

The real estate and rental and leasing sector increased 0.6% in the first quarter of 2024, rising for the seventh consecutive quarter. Offices of real estate agents and brokers and activities related to real estate led the increase in the first quarter of the year, growing 6.6% and largely offsetting a 9.3% drop in the previous quarter. Higher activity in the Greater Toronto Area and many other markets in Ontario contributed to the growth in the first quarter of 2024.

The manufacturing sector (-0.6%) was the largest detractor to growth in the first quarter of 2024, down for the fourth consecutive quarter. As in the final quarter of 2023, the transportation equipment manufacturing industry contributed the most to declines in the first quarter of 2024 as retooling activities continued at several automotive assembly plants, contributing to declines in the motor vehicle (-9.6%) and motor vehicle parts manufacturing (-3.1%) industries.

Chart 4

Main industrial sectors’ contribution to the percent change in gross domestic product in the first quarter