GDP Unchanged in July

Oct 9, 2019

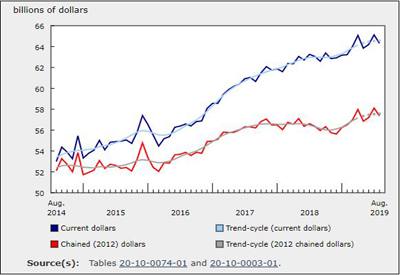

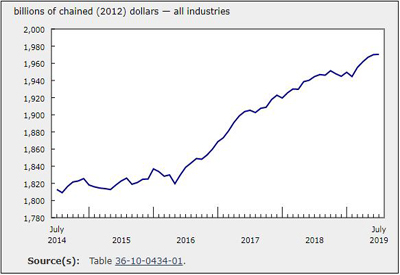

Following four months of growth, real gross domestic product was essentially unchanged in July as a decline in goods-producing industries was offset by an increase in services-producing industries.

Goods-producing industries were down 0.7% in July as output from all subsectors declined, with the exception of utilities. Services-producing industries were up for the fifth consecutive month, rising 0.3% as the majority of subsectors grew.

On a three-month rolling average basis, real gross domestic product increased 0.8%, the same growth rate as in June.

Manufacturing down for the second consecutive month

Manufacturing edged down 0.1% in July following a 1.3% decline in June, as an increase in inventory formation moderated some of the sales declines reported by the Monthly Survey of Manufacturing. A decrease in durable manufacturing (-0.9%) more than offset an increase in non-durable manufacturing (+0.7%).

Durable manufacturing was down for the third time in four months with declines in six of ten subsectors. The largest decrease was observed in fabricated metal products (-6.0%). Transportation equipment was down 0.4% as a decline in motor vehicles and parts manufacturing more than offset an increase in aerospace product and parts manufacturing.

The expansion in non-durable manufacturing was broad-based, as seven of nine subsectors expanded. There were notable gains in food (+3.7%) and plastic and rubber products manufacturing (+3.0%), while declines were posted by manufacturers of chemical (-3.3%) and petroleum and coal products (-1.5%).

Wholesale trade up for the sixth time in seven months

The wholesale sector was up for the sixth time in seven months in July, rising 1.1%. There were increases in five of nine subsectors, led by wholesalers of personal and household goods (+5.5%) and motor vehicles and parts (+3.9%). The expansion in personal and household goods wholesaling came in part from record-high imports of pharmaceutical products, mainly from Switzerland and Germany. The rise in motor vehicles and parts partly offset the declines of the previous two months, reflecting in part higher exports. The largest subsector in wholesale trade—machinery and equipment—was down 0.7%.

Mining, quarrying, and oil and gas extraction contracts

The mining, quarrying, and oil and gas extraction sector contracted 3.5% in July, as activity across all subsectors declined. This was the largest decrease in the sector since May 2016.

Oil and gas extraction contracted 3.0% in July. Following four months of growth, oil and gas extraction (except oil sands) was down 4.7%, the largest monthly decline in a decade, as both natural gas and oil extraction were down. A major factor in the decline was the shutdown of some of Newfoundland and Labrador’s offshore production facilities for a large part of the month as a result of maintenance issues. Oil sands extraction was down 1.0%, as it continued the sequence of expansions and contractions observed over the course of the last four months.

Following three consecutive months of growth, support activities for mining, oil and gas extraction dropped 11.5%, the largest decrease since December 2018, as a continued contraction in drilling services and lower rigging services both contributed to the drop.

Mining and quarrying, excluding oil and gas extraction, edged down 0.1% as declines in metal ore mining (-0.4%) and non-metallic minerals mining (-0.6%) were partly offset by a 5.3% increase in coal mining.

Construction declines

The construction sector contracted 0.7% in July, largely offsetting the growth observed in the previous two months. Residential construction was down 1.0% as an increase in single-house construction was offset by a decline in multi-unit dwellings construction and in home alterations and improvements. Engineering and other construction decreased 0.7% while repair construction was down 1.1%. Non-residential construction (+0.7%) was up for the seventh time in eight months as activity in the commercial, industrial and public sectors increased.

Real estate and related industries rise in July

Activity at the offices of real estate agents and brokers was up 4.2% in July, rising for the fifth consecutive month, mainly due to higher housing resale activity in the Greater Vancouver Area, the Greater Toronto Area, and the Fraser Valley.

The increase in real estate activity was a factor in the largest increase in professional, scientific and technical services (+0.8%) in five years. Legal services, which derive much of their activity from real estate transactions, were up 1.9%. The computer systems design and related services industry (+0.9%) continued its unabated growth of the past three years.

Retail trade edges up

Following 0.6% growth in June, retail trade edged up 0.1% in July with increases in six of twelve subsectors. The largest gains were in health and personal care stores (+2.7%) and motor vehicle and parts dealers (+1.2%), while there were notable declines at building materials and garden equipment and supplies dealers (-2.8%), clothing and clothing accessories stores (-1.5%) and gasoline stations (-1.8%).

Other industries

Utilities rose 1.5% in July, as electric power generation, transmission and distribution was up 1.4% after four consecutive declines, while natural gas distribution rose 2.8%.

The finance and insurance sector increased 0.3% in July. Depository credit intermediation and monetary authorities (+0.6%) and financial investment services, funds and other financial vehicles (+0.7%) were up, while insurance carriers and related activities (-0.4%) were down.

The transportation and warehousing sector contracted 0.5% in July as the majority of subsectors were down. Rail transportation (-3.1%) contributed the most to the decline, reflecting lower movement by rail of petroleum and chemical products and metals and minerals.

Source: Statistics Canada, www150.statcan.gc.ca/n1/daily-quotidien/191001/dq191001a-eng.htm