GDP Rose for Third Consecutive Month in May

Aug 13, 2019

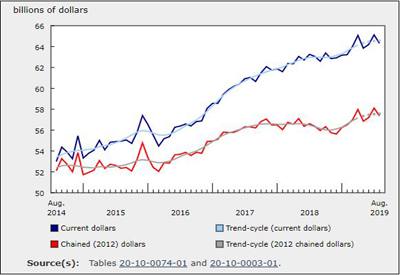

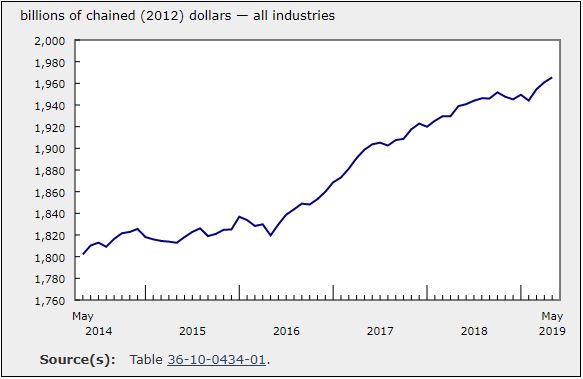

Real gross domestic product was up for a third consecutive month in May, rising 0.2%. The increase was led by a rebound in manufacturing with 13 out of 20 industrial sectors expanding. On a three-month rolling average basis, real gross domestic product increased 0.7%.

Goods-producing industries rose 0.6%, up for a third month after declining since the third quarter of 2018. Services-producing industries edged up 0.1%.

Manufacturing up, fully offsetting the decline in April

Manufacturing expanded 1.2% in May, continuing its sequence of increases alternating with small declines seen since the end of 2018.

Durable manufacturing grew 2.3% in May, more than offsetting the 1.7% decline recorded in April, as 8 of 10 subsectors expanded. The transportation equipment manufacturing subsector (+5.7%) led the increase, as motor vehicle production returned to normal levels, following temporary shutdowns and atypical production schedules at some plants in April.

Non-durable manufacturing edged down 0.1% as the nine subsectors were nearly evenly split between increases and decreases. There were gains in chemical (+1.7%), plastic and rubber products (+2.1%) and food (+0.2%) manufacturing, while decreases were posted by beverage and tobacco manufacturers (-3.5%), paper manufacturers (-2.2%) and printing and related support activities (-3.4%).

Construction continues to grow

The construction sector was up 0.9% in May as nearly all types of construction increased. This was the fourth gain in five months for the sector, following a period of declining activity during the second half of 2018.

Residential construction (+2.2%) posted its strongest growth in more than a year, with double, row and other multi-unit dwelling construction expanding, along with home alterations and improvements. Engineering and other construction (+0.5%) and repair construction (+0.1%) were up. In contrast, non-residential construction (-0.1%) edged down after five months of increases, as public and industrial construction contracted.

Activity at offices of real estate agents and brokers was up 4.8% in May, the fourth gain in five months, as housing resale activity increased across most urban markets, led by the Greater Toronto and Greater Vancouver areas.

Transportation increases mainly on rail transportation

The transportation and warehousing sector was up 1.0% in May, led by a 4.9% increase in rail transportation, which fully offset the lower activity seen at the beginning of the year, in part due to harsh weather and other factors. Increased rail movement of coal, petroleum, chemicals, metals and minerals, as well as automotive products contributed to the growth in May.

Most other subsectors were also up, led by a 1.2% rise in truck transportation. In contrast, pipeline transportation was down 0.3% as a decrease in the movement of natural gas more than offset an increase in the movement of crude oil.

Wholesale trade declines after four consecutive gains

After rising for four months in a row, wholesale trade fell 1.4% in May. All subsectors contracted with the exception of building material and supplies wholesaling (+0.4%). Wholesalers of motor vehicle and parts (-4.0%) and machinery, equipment and supplies (-0.8%) contributed the most to the decline. Miscellaneous wholesaling decreased 3.3%, mainly as a result of lower wholesaling of agricultural and other miscellaneous products.

Mining, quarrying and oil and gas extraction sector declines

The mining, quarrying and oil and gas extraction sector contracted 0.8% in May, following a 5.5% increase in April.

Oil and gas extraction decreased 2.5% in May, after two months of growth. Oil sands extraction declined 6.0%, following a 13% increase in April, when facilities scaled up production—instead of undertaking maintenance—to take advantage of easing production restrictions. Oil and gas extraction (except oil sands) rose 1.1%, as crude petroleum and natural gas extraction increased.

Mining excluding oil and gas extraction (+2.7%) was up for the third consecutive month, with most industry groups expanding. Metal ore mining grew 2.6% as iron ore, copper, nickel, lead and zinc mining increased. Non-metallic mineral mining rose 2.1% as all industries expanded, led by an export-driven gain in potash mining (+3.0%). After three months of declines, coal mining was up 8.3% on higher exports of metallurgical coal overseas.

Support activities for mining, oil and gas extraction increased 1.2% on higher activity in rigging services.

First consecutive declines in nearly a year in retail trade

Retail trade contracted 0.4% in May, posting its first consecutive monthly declines since June and July 2018, with the 12 subsectors fairly evenly split between increases and decreases.

Food and beverage stores contributed the most to the decline, down 2.2%. Less favourable weather conditions in April for springtime purchases (such as clothing and garden supplies) continued into May, as clothing and clothing accessories stores (-2.4%) and general merchandise stores (-1.1%) recorded decreases. Meanwhile, building material and garden equipment and supplies stores edged up 0.1%. Gasoline stations (+2.6%) posted the largest increase in retail activity.

Other industries

Agriculture, forestry and fishing grew 0.7% in May on increases in animal production, and forestry and logging.

The finance and insurance sector decreased 0.2% in May, a third decline in four months. Depository credit intermediation and monetary authorities (-0.2%) and insurance carriers and related activities (-0.4%) were down, while financial investment services, funds and other financial vehicles edged up 0.1%.

Utilities decreased 0.4%, as electric power generation, transmission and distribution and natural gas distribution were down.

Arts and entertainment grew 0.5%, in part because of higher attendance at spectator sports.

Accommodation and food services rose 0.4%, as accommodation services were up 0.9% and food services and drinking places edged up 0.1%.

Source: Statistics Canada, www150.statcan.gc.ca/n1/daily-quotidien/190731/dq190731a-eng.htm