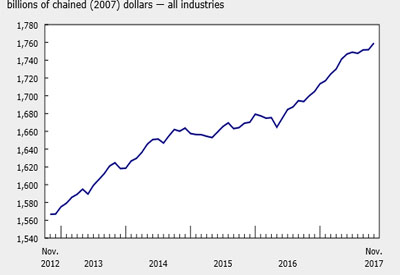

GDP Rose 0.4% in November

February 7, 2018

Real gross domestic product (GDP) increased 0.4% in November, with widespread growth across industries as 17 of 20 industrial sectors increased.

Goods-producing industries rose 0.8% after declining 0.5% in October. November’s gain was mainly due to increases in the manufacturing and mining, quarrying and oil and gas extraction sectors, partly as a result of restoration in production capacity. Meanwhile, services-producing industries rose 0.3%, led by the real estate and rental and leasing, wholesale, and retail trade sectors.

Largest manufacturing growth in three years

The manufacturing sector was up 1.8% in November, the largest monthly increase since February 2014 as the majority of subsectors grew. Non-durable manufacturing rose 1.1%, while durable manufacturing jumped 2.5%.

The rise in durable manufacturing, the largest monthly increase since December 2011, was led by a 6.5% increase in transportation equipment. Following four consecutive monthly declines, which saw the industry drop by 21.5%, motor vehicle manufacturing rose 14.3% in November. Automotive vehicle assembly increased in part due to the return to production of some plant capacity following shutdowns in September and October. This increased activity was also a factor in the 8.7% rise in motor vehicle parts manufacturing in November. Miscellaneous transportation equipment rose 0.8%, while aerospace product and parts manufacturing was essentially unchanged.

There was increased output in machinery (+3.1%) and furniture and related products (+2.9%). Wood products (-0.5%) declined for the first time in five months.

Non-durable manufacturing was up for the sixth time in seven months in large part due to the 5.3% expansion of chemical manufacturing following three months of declines. Factors contributing to the growth were the end of some plant maintenance shutdowns and higher exports of pharmaceutical and medicine manufacturing products. There was growth in plastic and rubber products (+3.1%), food (+0.9%) and paper (+2.8%) manufacturing. Petroleum and coal products manufacturing declined 6.2%, the largest decrease since May 2016.

Retail and wholesale trade continue to grow

Following 1.2% growth in October, retail trade was up 0.6% in November as 7 of 12 subsectors increased. Electronics and appliance stores gained 8.4% on the strength of promotional events such as Black Friday combined with new product releases. The increases in clothing and clothing accessories (+2.1%) and general merchandise stores (+1.5%) were also influenced by promotional events. Food and beverage stores registered a 1.1% contraction as all industry groups went down. The 0.7% drop at motor vehicle and parts dealers did not offset the 3.3% growth in October.

Wholesale trade increased for the fourth time in five months, rising 0.5% as eight of nine subsectors grew. Motor vehicle and parts wholesaling (+1.6%) led the growth, reflecting increased demand from domestic manufacturing and growth in exports and imports of motor vehicles and parts. Food, beverage and tobacco (+0.9%) and personal and household goods wholesaling (+0.7%) posted gains, while petroleum product wholesaling declined 1.7%.

Construction edges up

Construction edged up 0.1% in November. Non-residential building construction grew 0.9%, while engineering and other construction activities edged up 0.1%. There were slight declines in residential (-0.2%) and repair (-0.2%) construction.

Real estate and rental and leasing continues to grow

Real estate and rental and leasing rose 0.4% in November. The output of offices of real estate agents and brokers (+4.0%) was up for the fourth consecutive month as there was increased home resale activity in Ontario and Alberta. However, the level of activity of this subsector remains below its March 2017 level, following provincial government changes to housing regulations in Ontario that came into effect in April of that year.

This increase contributed to the 0.3% rise in professional services, as legal, accounting and related services increased 0.7%. Computer systems design and related services grew 0.7%.

Mining, quarrying, and oil and gas extraction up after October decline

Mining, quarrying, and oil and gas extraction increased 0.5% in November following a 1.1% decline in October.

The oil and gas extraction subsector was up 1.6%, led by 3.7% growth in non-conventional oil extraction. The ramp-up to normal capacity continued at some facilities following maintenance turnarounds that began in mid-September. Conventional oil and gas extraction edged down 0.2%.

Mining excluding oil and gas extraction was down 2.1%, a second monthly decline after rising the six previous months. Non-metallic mineral mining was down 3.3%, due largely to a 5.7% drop in potash mining. Coal mining dropped 7.7%, while metal ore mining was down 0.7% as all industry groups declined, with the exception of iron ore mining (+4.3%).

Support activities for mining and oil and gas extraction fell 4.1% on lower drilling and rigging services. This was a seventh consecutive decline for the subsector after a string of increases that began in the spring of 2016 and ended in April 2017.

Finance and insurance sector resumes growth

After four consecutive months of decline, the finance and insurance sector grew 0.3% in November. Depository credit intermediation and monetary authorities and insurance carriers and related activities were both up 0.3%. Financial investment services, funds and other financial vehicles were up 0.5% following four consecutive months of decline, as market activities involving securities, mutual funds and trusteed pension assets increased.

Pipeline leak tempers growth in transportation and warehousing

Transportation and warehousing edged up 0.1% in November as five of nine subsectors grew, led by support activities for transportation (+0.8%), truck (+0.4%) and rail transportation (+1.1%). Air transportation (+0.9%) rose for a sixth consecutive month as there was increased air traffic both from Canadian travellers and travellers to Canada from other countries.

Pipeline transportation was down 3.9% as a pipeline leak in the United States in November affected exports of crude oil, resulting in a 8.1% decline in crude oil and other pipeline transportation. Pipeline transportation of natural gas was up 0.6%.

Other industries

Utilities were up 0.7% in November. Electric power generation, transmission and distribution was up 0.4%, while natural gas distribution rose 3.8% from higher demand across all classes of customers.

The public sector grew 0.2% in November following essentially no change in October. Educational services rose 0.2% in November after declining 0.1% in October, partly due to the increase in the universities subsector. The community colleges and CEGEPs subsector declined 0.8% in November, following a 4.6% decline in October, as a result of a five-week strike by Ontario community college faculty staff that ended on November 19, 2017 with the government of Ontario passing back-to-work legislation. In other components of the public sector, there were slight increases in health care and social assistance (+0.2%) and public administration (+0.1%).

Accommodation and food services were unchanged in November, as growth in accommodation services (+0.3%) was offset by a decline in food services and drinking places (-0.1%).

Agriculture, forestry, fishing and hunting (-0.1%) was down for the 9th time in 12 months.

Source: Statistics Canada, www.statcan.gc.ca/daily-quotidien/180131/dq180131a-eng.htm