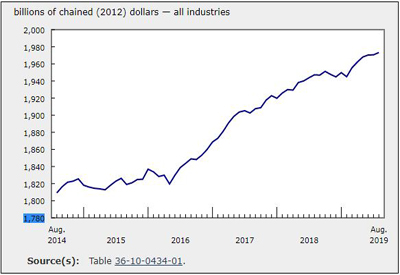

GDP Rose 0.1% in August

Oct 31, 2019

Real gross domestic product edged up 0.1% in August, following no change in July. Goods-producing industries were up 0.2% after two months of declines, led by a rebound in manufacturing, while services-producing industries edged up 0.1%. Overall, there were gains in 14 out of 20 industrial sectors.

On a three-month rolling average basis, real gross domestic product rose 0.5% in August, compared with a 0.8% increase in July.

Manufacturing resumes expansion

The manufacturing sector grew 0.5% in August, following essentially no growth in July. Durable manufacturing rose 1.0%, while non-durable manufacturing declined 0.2%. The rise in manufacturing production was primarily due to increased sales, as the inventory-to-sales ratio declined in August according to the Monthly Survey of Manufacturing.

The rise in durable manufacturing partly offset the declines of the previous two months, with 6 of 10 subsectors expanding. Fabricated metal product manufacturing (+5.9%) and non-metallic mineral product manufacturing (+5.3%) contributed the most to the growth, reflecting in part higher international demand for these products. For the first time since January 2012, transportation equipment manufacturing (+1.0%) was up for the fourth month in a row, with growth in aerospace products and parts, other transportation equipment and motor vehicle body and trailer manufacturing.

The decline in non-durable manufacturing was widespread as six of nine subsectors were down, led by a 1.5% decline in food manufacturing. The largest increase in terms of output came from plastic and rubber products (+2.5%).

Professional services keep growing

The professional, scientific and technical services sector was up 0.7%, continuing its uninterrupted growth since February 2018. It is the sector with the second-largest growth in employment since the beginning of 2019 and accounts for about 6% of both gross domestic product and employment. The majority of the sector’s industries were up in August, led by computer systems design and related services (+1.3%).

Legal, accounting and related services grew 0.8%, reflecting in part a 1.8% increase in the activity at offices of real estate agents and brokers. Housing resale activity was up in the majority of Canadian urban markets.

Finance and insurance expands

The finance and insurance sector expanded 0.5% in August, rising for the fourth month in a row, led by a 2.9% growth in financial investment services. The S&P/TSX Composite Index volatility contributed to the highest volume of transactions in August since 2012, as global trade tensions affected markets throughout the month. Depository credit intermediation and monetary authorities expanded 0.3%, while insurance carriers and related activities were down 0.2%.

Construction growth resumes

The construction sector was up 0.3% in August, the third increase in four months. Residential construction rose 0.6%, offsetting July’s decline, as growth in single-unit and multi-unit dwellings more than offset a decline in home alterations and improvements. Non-residential construction (+0.2%) was up for the eighth time in nine months as activity in the commercial, industrial and public sectors increased. Engineering and other construction increased 0.2%, while repair construction edged down 0.1%.

Mining, quarrying, and oil and gas extraction edges up

Following a 3.6% decline in July, the mining, quarrying and oil and gas extraction sector edged up 0.1% in August.

Support activities for mining and oil and gas extraction rose 8.6% in August, following a 13.1% drop in July, as all types of supporting activities rebounded.

Oil and gas extraction was down for the third time in four months, contracting 1.6% in August. Oil sands extraction (-3.6%) was down for a fourth consecutive month, in part due to maintenance shutdowns at some facilities. Oil and gas extraction (excluding oil sands) edged up 0.3% as growth in natural gas extraction more than offset lower crude petroleum extraction, resulting in part from continued production disruptions at some offshore facilities in Newfoundland and Labrador.

Mining and quarrying (except oil and gas) edged down 0.2% as the majority of the industries contracted. Metal ore mining was down 1.7% in August, continuing its sequence of increases alternating with declines since February, as all industries were down except for iron ore mining (+5.4%). Coal mining declined 5.0% in August, fully offsetting July’s growth. Non-metallic mineral mining rose 2.5% in August, as a result of growth in potash mining (+5.1%), which increased for the fourth time in five months following three monthly declines in the first quarter of 2019.

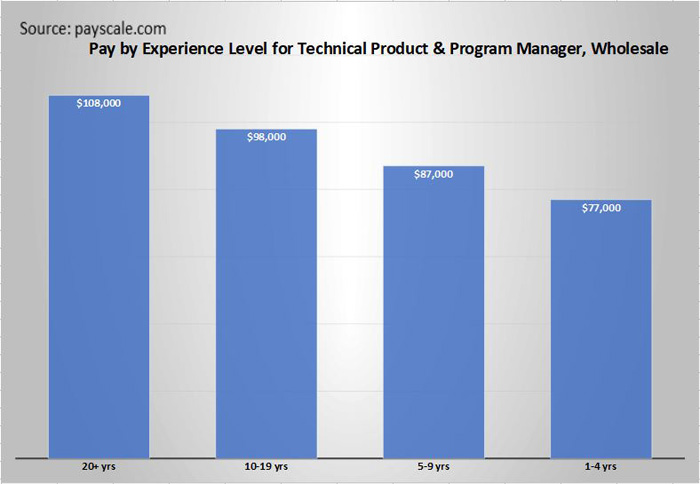

Wholesale decline more than offsets July’s growth

Wholesale trade was down 1.3% in August, more than offsetting July’s growth. The declines were broad-based as six of nine subsectors contracted. Machinery, equipment and supplies wholesalers (-2.7%) posted a third decline in four months, partly due to a decrease in imports of related products. Personal and household goods wholesaling decreased 3.8%, following record-high imports of pharmaceutical products from Germany and Switzerland in July. Building materials and supplies wholesalers (+1.6%) registered their fifth gain in six months after declines in the second half of 2018 and the first quarter of 2019.

Other industries

Utilities were down 1.5% in August. Electric power generation, transmission and distribution decreased 1.8% as many parts of the country experienced cooler than seasonal temperatures in August, resulting in lower demand for air conditioning.

The retail trade sector was up 0.3%, growing for the third month in a row after showing little upward movement since the end of 2018. Gasoline stations posted a 2.4% gain in August, in one of the peak demand months for motor gasoline. All types of retailers associated with back-to-school shopping registered increases, led by general merchandise stores (+1.8%).

The transportation and warehousing sector edged up 0.1% in August, following two months of decline. Increases in most subsectors more than offset a 0.6% decrease in air transportation, the third in four months and the largest since December 2018. Pipeline transportation edged up 0.2% as higher movement of natural gas was partly offset by lower movement of crude oil and other pipeline transportation. Rail transportation edged up 0.2% after declines in June and July.

Source: Statistics Canada, https://www150.statcan.gc.ca/n1/daily-quotidien/191031/dq191031a-eng.htm