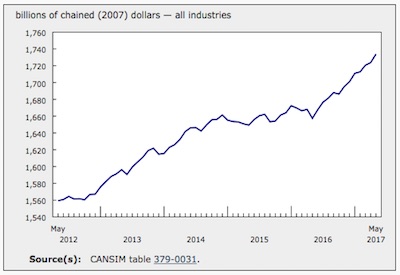

Canada’s GDP Grows 0.6% in May

August 7, 2017

Real gross domestic product (GDP) grew 0.6% in May, as 14 of 20 industrial sectors increased. This was the seventh consecutive monthly increase.

Goods-producing industries rose 1.6%, led by mining, quarrying, and oil and gas extraction, more specifically non-conventional oil extraction. Service-producing industries were up 0.2%, led by finance and insurance services.

Retail and wholesale trade grows

Retail trade grew 0.9% in May with 8 of 12 subsectors increasing. The motor vehicle and parts dealers subsector was up 2.7% on increased activity at new and used car dealers as well as automotive parts, accessories and tire stores. Food and beverage stores and gasoline stations also posted gains. The largest declines in activity were at clothing and clothing accessories stores and general merchandise stores.

Wholesale trade increased for the sixth month in row, up 0.7% in May as the majority of subsectors rose. The largest gains in terms of output were posted by miscellaneous wholesalers (+1.5%), which include agricultural supplies and chemical product wholesalers, followed by wholesalers of personal and household goods (+1.0%) and petroleum products (+3.7%). Wholesaling of farm products was down 2.9% on lower activity at oilseed and grain dealers.

Mining, quarrying, and oil and gas extraction sector continues to expand

The mining, quarrying, and oil and gas extraction sector grew for the fourth time in five months, up 4.6% in May.

The oil and gas extraction subsector expanded 7.6%, with non-conventional oil extraction rising 13% following two months of declines. There was a rebound in activity at an upgrader facility in Alberta that experienced ongoing production difficulties following a fire and explosion in March. Conventional oil and gas extraction was up 3.2% as both crude petroleum and natural gas extraction expanded.

Support activities for mining and oil and gas extraction declined 4.0% following nine consecutive monthly increases.

Mining and quarrying (except oil and gas) was unchanged from April. Metal ore mining (-3.1%) declined for the third time in four months on weaker output at iron mines. Coal mining decreased 3.6%. These declines were offset by a 6.7% rise in non-metallic mineral mining as potash extraction expanded 12.8%.

Manufacturing increases

The manufacturing sector was up 1.1% in May as most subsectors grew. Output of manufacturing has been alternating between increases and decreases since the beginning of 2017.

Non-durable manufacturing rose 0.8%, offsetting the decline in April. Five of eight subsectors rose, led by manufacturers of petroleum and coal products (+3.0%), printing and related support activities (+5.8%) and paper (+2.5%).

Durable manufacturing was up 1.4% as 6 of 10 subsectors grew. Leading the growth was the transportation equipment manufacturing subsector (+2.7%) on higher output by manufacturers of motor vehicles, motor vehicle parts and miscellaneous transportation equipment. Machinery was up 2.9% while electrical equipment manufacturing increased 6.8%. Miscellaneous manufacturing increased 0.4%, following six consecutive monthly declines.

Finance and insurance services expand

The finance and insurance sector increased 0.9% in May. Depository credit intermediation and monetary authorities grew 1.5% on increased activity at banking, monetary authorities and other depository credit intermediaries. Insurance carriers and related activities edged up 0.2% while financial investment services, funds and other financial vehicles were virtually unchanged.

Construction sector declines as Quebec workers go on strike

Construction was down 0.6% in May, as a strike in the last week of the month affected unionized construction workers in Quebec. The strike largely contributed to the declines in non-residential building (-1.8%) and residential (-0.8%) construction. Engineering and other construction activities contracted 0.9% after rising the previous three months. Repair construction grew 1.6% — the largest increase since November 2016.

Real estate and rental and leasing declines

Real estate and rental and leasing declined 0.2% in May after five consecutive months of growth. Following a 0.6% decline in April, activity at offices of real estate agents and brokers declined 6.3% in May as housing resale activity slowed in the Greater Toronto Area following new provincial housing regulations introduced on April 20.

The decline in real estate activity had an impact on legal services, which fell 2.9%. As a sector, professional, scientific and technical services edged up 0.2% as the decrease in legal services was more than offset by increases in all other industries.

Other industries

Utilities (+1.4%) increased for the third month in a row in May, on higher electric power generation, transmission and distribution (+1.2%) and natural gas distribution (+3.5%).

Arts, entertainment and recreation declined 3.5%, more than offsetting the 2.8% gain in April, as all subsectors were down. Output in performing arts, spectator sports and related industries, and heritage institutions returned to March’s level following increased activity in April—primarily attributable to the number of Canadian teams involved in the early rounds of the National Hockey League playoffs.

Transportation and warehousing edged up 0.1%. Pipeline transportation rose on higher shipments of crude oil and natural gas. The output of postal service and couriers and messengers rose after three months of declines. These increases were mostly offset by the third decline in four months in rail transportation (on lower freight of most commodities) and a decline in air transportation.

The public sector (education, health care and public administration) was unchanged in May.

Accommodation and food services declined 0.3%. Food services and drinking places were down while accommodation services edged up.

Source: Statistics Canada, http://www.statcan.gc.ca/daily-quotidien/170728/dq170728a-eng.htm