GDP by Industry: Provinces and Territories, 2020

May 4, 2021

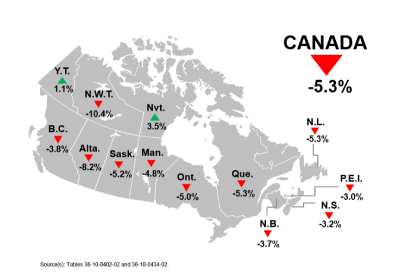

Real gross domestic product (GDP) fell in every province and the Northwest Territories in 2020 and rose in Yukon and Nunavut after the World Health Organization declared COVID-19 a pandemic on March 11.

Pandemic impacts gross domestic product in all 13 Canadian jurisdictions

Over the course of the year, all levels of government in Canada implemented measures to limit the spread of the virus. Measures such as mandatory closures of non-essential businesses, schools and public institutions, travel restrictions and physical distancing rules, and the closure of Canada’s international borders, combined with a shift by many Canadians to work from home, affected almost every segment of the Canadian economy.

For most provinces, the economic contraction in 2020 was the most severe observed in 40 years. The impact on GDP varied across the country, reflecting differences in the extent to which new and continuing public health restrictions were imposed in the provinces and territories.

Ontario (-1.95 percentage points) contributed the most to the decline at the national level, largely because of the size of its economy. Alberta accounted for 1.25 percentage points of the national decline, as ongoing weak oil prices on world markets, combined with the impact of the pandemic, suppressed activity in the important oil and gas sector and related downstream industries. In turn, Quebec accounted for 1.05 percentage points of the total decrease at the national level, and British Columbia represented 0.51 percentage points of the decline.

Widespread contraction in services-producing industries main driver of decline in 2020

Both goods-producing and services-producing industries contracted in every province. However, services-producing industries contributed more to the overall decline. The contraction in services-producing industries was widespread, with the largest impact on those services that require in-person interaction and where online delivery is unfeasible or not economically viable. Particularly hard hit were transportation and warehousing, arts, entertainment and recreation, accommodation and food services, and other services (except public administration).

Transportation and warehousing fell significantly across Canada, led by air transportation as severe restrictions on travel were imposed. Transit, ground passenger and scenic and sightseeing transportation saw a marked drop in ridership, due to measures to promote work from home and limit non-essential trips. Along with these travel restrictions, government-imposed limits on gatherings led to a sharp contraction in accommodation and food services, arts, entertainment and recreation industries, as well as other services (except public administration).

Health care and social assistance were down in 2020 as offices of physicians, dentists and medical and diagnostic laboratories reduced many of their in-person visits and activities in response to restrictive health measures. Education services also declined across Canada as public authorities closed schools and universities, though the contraction was mitigated as classes moved online and eventually returned to an in-person or hybrid model.

In contrast, finance and insurance industries rose in all jurisdictions. Real estate and rental and leasing activities and residential construction increased in most regions in spite of lockdown measures. In many provinces, activity at the offices of real estate agents and brokers surged as the desire for more personal space, including room for home offices, combined with low mortgage rates and higher disposable income, bolstered the housing market.

Goods-producing industries contribute the most to the percentage change

Activity from goods-producing sectors was generally more variable from jurisdiction to jurisdiction than services-producing sectors, in part because it was somewhat less affected by the public health measures adopted to contain the pandemic. And, while services as a whole contributed more to the annual GDP declines in all provinces and territories, except Saskatchewan and Yukon, on an individual sector basis, goods-producing industries recorded the most significant contributions to percentage change (CPC) in most jurisdictions (whether growing or contracting). In Alberta (-2.07 CPC), Saskatchewan (-1.50 CPC) and all three territories, mining, quarrying, and oil and gas extraction impacted total GDP the most. Manufacturing was the primary driver in Quebec (-1.26 CPC) and Ontario (-1.25 CPC), while construction (-2.61 CPC) was the largest factor in the Newfoundland and Labrador economy in 2020.

Newfoundland and Labrador

In Newfoundland and Labrador, GDP fell 5.3% in 2020, as the impact of COVID-19 led to declines in 17 of 20 major industrial sectors. Services-producing industries (-5.6%) were adversely affected by restrictions on travel and gatherings, as all major service sectors declined except finance and insurance.

Construction dropped 25.9%, mainly because of a 35.1% decline in engineering construction as work at the White Rose project was put on hold and the Muskrat Falls project neared completion. Oil and gas extraction grew 5.8%, buoyed by increased oil production from the Hebron oil field. Iron ore mining rose 8.8%. However, copper, nickel, lead and zinc ore mining fell 32.0%, as the Voisey’s Bay mine closed temporarily because of the pandemic. Manufacturing was down 4.8%, as higher output in seafood product preparation and packaging (+9.7%) was more than offset by declines in petroleum refineries (-66.5%), with the closure of the North Atlantic refinery, and on lower output of primary metal products (-11.1%) and paper products (-19.8%).

Prince Edward Island

GDP in Prince Edward Island fell 3.0% in 2020. While this was the smallest decline among the provinces, it was the province’s largest contraction since the series began in 1981. Despite the influence of strong population growth on demand for services, public health measures aimed at slowing the spread of COVID-19 led to lower output in many tourism-related services. The contractions in accommodation and food, arts, entertainment and recreation, and transportation and warehousing together accounted for more than half (1.52 out of 2.97 percentage points) of the overall decline in the province.

Output was scaled back in aquaculture (-23.0%) and fishing, hunting and trapping (-8.3%) on lower demand from food-serving establishments around the world. Crop production fell 7.7% as a result of severe drought conditions. Manufacturing fell 4.4%, most notably in food products (-4.6%) and aerospace products and parts (-11.6%), although pharmaceuticals and medicines (+13.1%) posted robust growth. Construction output increased 4.8% as all subsectors advanced except repair construction. Residential construction (+6.2%) was up for the sixth consecutive year.

Nova Scotia

In Nova Scotia, real GDP declined 3.2% in 2020 as the pandemic pushed down growth. Services-producing industries fell 3.5%, while goods-producing industries were down 2.3%. Tourism-related industries declined sharply in response to lockdown measures. In addition, health care and social assistance (-5.2%), educational services (-3.7%), retail trade (-2.5%), owing mostly to lower sales of motor vehicles (-17.5%), and wholesale trade (-1.3%) fell. Meanwhile, gains were reported in finance and insurance (+5.2%) and real estate and rental and leasing (+2.7%). Demand for more living and home office space supported by low mortgage rates contributed to a 22.3% increase in offices of real estate agents and brokers and activities related to real estate.

Manufacturing fell 5.3% as sharp declines in plastic and rubber products (-15.9%) and transportation equipment (-10.0%) more than offset gains in pharmaceuticals and medicines (+33.2%). Construction activity increased 3.4%, led by transportation engineering projects (+24.1%). Utilities output fell 6.5% in tandem with lower economic activity.

New Brunswick

In New Brunswick, GDP fell 3.7% in 2020, the largest decline since the 1982 recession. Goods-producing industries dropped 6.2% and services-producing industries decreased 2.9%. In addition to declines in tourism-related industries, health care and social assistance (-3.9%) and educational services (-5.6%) were also down. Conversely, finance and insurance services grew 5.7% and offices of real estate agents and brokers increased 21.3% as Canadians sought out more personal and home office space amid the pandemic.

Manufacturing was down 5.1%, because of declines in food products (-4.8%), plastics and rubber products (-29.0%), primary metal products (-96.4%)—due to the closure of the Belledune smelter—and fabricated metal products (-15.4%). Construction output contracted 4.5%, as lower non-residential construction (-26.4%) due to fewer commercial and office building projects was partly offset by higher residential construction (+4.0%). Mining and quarrying (except oil and gas) dropped 28.7% with the closure of the Caribou mine in March. Electric power generation, transmission and distribution fell 8.6% on lower demand.

Quebec

In Quebec, GDP posted a 5.3% decrease in 2020, larger than the decline from the 1982 recession, when GDP fell 3.7%.The contraction was broad-based, with 18 of the 20 major industry groups declining as a result of the COVID-19 pandemic. Services-producing industries (-4.9%) contributed more to the contraction than goods-producing industries (-6.3%). Limitations on travel and physical distancing measures contributed to sharp declines in transportation, accommodation and food, and arts, entertainment and recreation services. School closures contributed to a 5.0% decline in educational services. Retail trade decreased 1.2% on weakness from motor vehicle and parts dealers and clothing stores, which more than offset gains for non-store retailers, building material and garden equipment and supplies dealers, and food and beverage stores. Credit intermediation and related services grew 7.2% and computer systems and design, which include video game and design development, increased 9.6%—the fifth consecutive year of strong growth.

All goods-producing sectors declined in Quebec, led by manufacturing, which accounted for nearly one-quarter (23.8%) of the overall economic decline. All major manufacturing industry groups reported lower output, led by aerospace products and parts (-15.2%), machinery (-14.7%) and fabricated metal (-12.5%). Utilities fell 4.0% in tandem with the weaker economy. Construction activity was down 2.8%, mainly because of a 23.5% decline in electric power engineering. This was partly offset by higher transportation engineering work, while residential building activity was virtually unchanged. Metal ore mining was scaled back 5.5% on lower output of gold and silver mining (-16.0%) and copper, nickel, lead and zinc ore mining (-13.7%), which more than offset gains in iron ore mining (+5.4%).

Ontario

GDP in Ontario fell 5.0% in 2020—the largest decline since records started in 1981—as both goods-producing (-5.7%) and services-producing industries (-4.8%) were down. The decrease in services-producing industries, which stemmed from restrictions on travel and public gatherings, accounted for nearly three-quarters of the overall decline.

Educational services were down as a teacher’s strike starting in February at elementary and secondary schools (-9.3%) preceded COVID-19 lockdowns in March. Physical distancing requirements put in place to combat the spread of the disease contributed to the 6.8% decline in local, municipal and regional public administration services. Conversely, federal government public administration grew 3.2%. Finance and insurance rose 5.0%, driven mainly by credit intermediation (+6.7%) and financial investment services (+8.5%). Real estate and rental and leasing grew 1.6%, as higher output of offices of real estate agents and brokers (+11.7%) was partly offset by lower output from rental and leasing.

Construction activity edged up with higher residential (+4.5%) and non-residential building (+3.6%) construction offsetting a decline in engineering (-10.1%) projects. Manufacturing output contracted 10.8%, the largest decline among all provinces and territories, led by transportation equipment (-24.3%) as producers scaled back production in response to travel restrictions. Consolidation of the automotive sector led to a plant closure in 2019, which also contributed to the decline. Primary metal manufacturing slumped 22.2% and machinery was down 14.1% as a result of a weaker global economy. In contrast, crop production grew 15.3%, largely because of a 58.6% increase in licensed cannabis production.

Manitoba

In Manitoba, GDP decreased 4.8% in 2020, the largest decline since the series began in 1981. The decline was extensive, with 15 of 20 industrial sectors posting lower output as the economy reacted to the COVID-19 pandemic. A 4.6% decline in services-producing industries was mainly attributable to restrictions on travel and gatherings. Wholesale trade grew 2.2%, while retail trade edged down 0.1% despite gains in non-store retailers (+21.5%).

Goods-producing industries fell 5.3%. Construction declined 10.7%, largely because of a 32.3% fall in engineering construction, most notably in electric power engineering (-43.4%) as major hydro power projects were completed. Non-residential building construction increased 11.7%, owing to government investment in schools and institutional structures. Residential construction fell 2.3%. Manufacturing output decreased 7.0% as producers of transportation equipment scaled back output by 17.3%, because of restrictions on travel. Primary metal manufacturing fell 52.4%, largely as a result of the cessation of all operations at the nickel smelter in Thompson.

Mining, quarrying and oil and gas extraction was down 17.9%, as oil and gas extraction (-16.7%), copper, nickel, lead and zinc mining (-24.6%), and support activities for mining and oil and gas extraction (-37.6%) all decreased. Crop production grew 5.7%, benefiting from good growing and harvesting conditions.

Saskatchewan

In Saskatchewan, GDP fell 5.2% in 2020, the largest decline since 2009. Goods-producing industries (-6.7%) contributed more to the decline than services-producing industries (-4.1%). Saskatchewan was the sole province where the goods-producing industries contributed more to the overall decline in its economy.

Mining, quarrying and oil and gas extraction dropped 9.2%, as oil and gas extraction fell 12.8% because of weak demand and an excess supply of oil on world markets. Support activities for mining, and oil and gas extraction dropped 32.9%. Potash mining grew 7.8%, but other metal ore mining (uranium) was down 39.3%. Construction activity decreased 10.9%, owing to a significant decline in oil and gas engineering (-35.3%), with the completion of the Enbridge Line 3 in December 2019 and a drop in non-residential building construction (-24.4%). Manufacturing industries decreased 8.2%, led by petroleum refineries (-15.2%) and fabricated metal products (-16.9%). Agriculture, forestry, fishing and hunting (+1.8%) was the lone goods-producing sector to post a gain in the province, bolstered mainly by crop production (except cannabis) (+2.1%).

As a result of public health restrictions on travel and social gatherings, transportation and warehousing (-10.5%), accommodation and food services (-25.4%), and arts, entertainment and recreation services (-34.3%) all declined. Health care and social assistance fell 5.4%, mainly in ambulatory care, while educational services were down 4.9%. Conversely, finance and insurance services rose 4.9%, mostly as a result of higher output of credit intermediation services.

Alberta

Alberta’s GDP dropped 8.2% in 2020, the largest decline among the provinces and its fourth annual contraction in 12 years. Goods-producing industries (-10.1%) and services-producing industries (-7.0%) both fell.

Oil and gas extraction decreased 6.4% as a result of weak demand and a glut of oil on world markets. Oil sands extraction dropped 5.6%—the first drop for this industry since 2007, when separate estimates for oil sands were first compiled. Support activities for oil and gas extraction were down 40.8%. Construction fell 12.0%, the third consecutive year of declining activity. The pullback was largely attributable to a significant drop in engineering and other construction activities, with Alberta (-0.12 percentage points) accounting for more than half of the national decline.

Manufacturing fell 9.8%, as 14 of 19 industry groups declined, most notably petroleum refineries (-14.3%), machinery manufacturing (-23.2%) and fabricated metal products (-22.0%). Crop production grew 8.9% on higher output of crops (+6.0%) and licensed cannabis (+54.0%).

Wholesale (-7.5%) and retail (-4.0%) trade were both down. Truck transportation decreased 11.8% and rail transportation fell 7.3%. Limitations on travel and in-person activities contributed to sharp declines in the services that required in-person interaction. Health and social assistance (-6.3%) and educational services (-7.4%) were also impacted by measures put in place to slow the spread of COVID-19. Conversely, finance and insurance expanded 5.5%, driven mostly by higher output of credit intermediation services (+6.8%).

British Columbia

In British Columbia, GDP decreased 3.8%—the largest contraction since the 1982 recession—as 15 of 20 industrial sectors posted lower output in response to COVID-19 restrictions and shutdowns. The decline was almost entirely driven by services-producing industries (3.75 of 3.83 percentage points), with the decline in goods-producing industries the smallest among all provinces.

Government-imposed restrictions on travel affected air transportation (-72.5%), urban transit systems (-47.6%) and support activities for transportation (-22.8%). Lockdown measures due to public health guidelines led to lower output in accommodation and food services (-31.1%), health care and social assistance (-8.0%), and arts, entertainment and recreation services (-39.6%). Conversely, credit intermediation services grew 4.8%, and real estate services advanced 4.1%.

Activity at goods-producing industries edged down (-0.3%), as a result of the large decline in manufacturing, which was mostly offset by strong growth in construction. Manufacturing decreased 7.1%, with 16 of 19 subsectors reporting declines. The decline was led by fabricated metals (-20.2%), wood products (-6.6%), paper products (-13.7%) and machinery (-12.3%). Despite solid demand for construction materials, the wood products industry, the largest manufacturing industry in the province, contended with higher operating costs and a lower volume of exports. Construction activity grew 4.2%, following a 9.0% increase in 2019. Oil and gas engineering construction was up 27.4%, as work on the LNG Canada project and the Coastal GasLink pipeline accelerated.

Mining, quarrying, and oil and gas extraction grew 0.6%, as conventional oil and gas extraction edged up 0.3% and copper, nickel, lead and zinc ore mining rose 39.8%, more than offsetting a decline in coal mining (-17.3%).

Yukon

GDP in Yukon grew 1.1% in 2020, following 0.7% growth in 2019. Goods-producing industries advanced 25.7%, almost entirely as a result of large increases in gold and silver mining (+121.9%)—with the ramp-up of production at the Victoria Eagle Gold mine—and copper, nickel, lead and zinc ore mining (+325.8%) as the Minto mine re-opened in 2019. Support activities for mining jumped 67.9% on higher mineral prices. Utilities increased 12.8% and manufacturing was up 15.0%. Construction activity dropped 7.1%, mostly because of a 31.9% fall in engineering projects, which outweighed growth in residential (+15.7%) and non-residential (+7.3%) building construction. Wholesale trade fell 10.8% in tandem with lower construction activity.

Strict limits on travel to Yukon and other measures due to COVID-19 resulted in a large drop in output of tourism-related industries, led by air transportation (-65.7%), accommodation and food services (-37.2%), and arts, entertainment and recreation services (-35.2%). Educational services decreased 4.4% and health and social assistance declined 4.9% as a result of physical distancing rules. In contrast, finance and insurance advanced 5.3%.

Northwest Territories

GDP declined 10.4% in the Northwest Territories in 2020. Goods-producing industries decreased 15.6% and services-producing industries dropped 8.3%. Diamond mining fell 30.3%, because of the Ekati mine’s suspension of production from March to November and the temporary closure of the Gaucho Kué mine. Conventional oil and gas extraction fell 30.7%, the result of a fire at the Norman Wells site. Output from utilities contracted 9.3%. Conversely, construction contributed significantly to economic activity, with engineering construction (+60.9%) and residential building construction (+11.3%) posting gains. However, non-residential building construction fell 22.7% on the heels of a 53.3% decline in 2019, as a number of public sector buildings were completed in the last few years.

The response to the COVID-19 pandemic led to large-scale reductions in tourism-related industries. Also, physical distancing restrictions contributed to declines in education services and health and social assistance, particularly at walk-in facilities. Wholesale trade fell 36.6%. However, retail trade advanced 4.4% and finance and insurance were up 4.1%.

Nunavut

In Nunavut, GDP increased 3.5% in 2020, and was one of two jurisdictions in the country to show growth. Gold and silver ore mining grew 23.2%, as two new mines completed their first full year of production, and iron ore mining advanced 34.4%. Higher mineral prices led to a 19.7% increase in support activities for mining. Construction output fell 23.4%, mainly because of a steep decline in other engineering construction (-30.3%) as work was completed at two mine sites. Wholesale trade was down 12.3% on lower movement of machinery, equipment and supplies, petroleum products and building materials, as work on mine sites was completed.

Services-producing industries fell 2.3%, as COVID-19-related restrictions on many in-person activities led to notable declines in air transportation (-42.6%), education (-7.9%), accommodation (-27.9%) and food and drinking places (-30.7%). Conversely, retail trade advanced 8.6% and finance and insurance industries grew 7.1%.