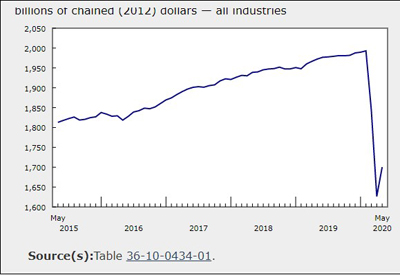

First Quarter GDP Fell 2.1%

May 29, 2020

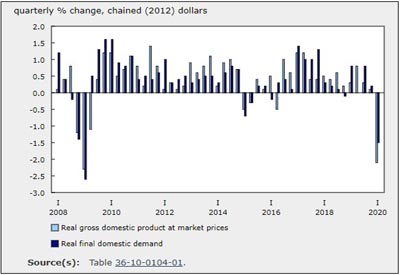

Real gross domestic product (GDP) fell 2.1% in the first quarter, owing to reduced household spending and widespread shutdowns of non-essential businesses in March, in response to the COVID-19 pandemic. Final domestic demand fell 1.5%.

Expressed at an annualized rate, real GDP fell 8.2% in the first quarter. By comparison, real GDP in the United States fell 5.0%.

The downturn in GDP — the sharpest since the first quarter of 2009 — reflects measures imposed in March to contain the pandemic, such as school and non-essential business closures, border shutdowns, and travel restrictions, as well as events earlier in the quarter, mainly the Ontario teachers’ strike and rail blockades in February.

Household spending was down 2.3% in the first quarter of 2020 — the steepest quarterly drop ever recorded. Spending reductions were influenced by substantial job losses, income uncertainty, and limited opportunities to spend because of the mandatory closure of non-essential retail stores, restaurants and services, and restrictions on travel and tourism activities.

Governments’ final consumption expenditure fell 1.0%, the largest decline since the first quarter of 2013, reflecting school closures and curtailed government administration.

Exports fell 3.0%, and imports declined 2.8%, as major trading partners — notably, the United States, China, and most European countries — implemented similar public health measures.

Businesses drew down $3.7 billion in non-farm inventories, owing to supply chain disruptions. Despite the inventory draw down, a substantial decline in sales volumes, which resulted from store closures and lower household demand, raised the economy-wide stock-to-sales ratio from 0.863 in the fourth quarter of 2019 to 0.872 in the first quarter of 2020.

Measurement impacts of COVID-19

The COVID-19 pandemic impeded Statistics Canada’s measurement activities. These include unforeseen constraints on data collection and statistical operations for essential source data, which, in turn, has necessitated modifications to standard conceptual treatments and compilation methods. The most important impacts of these modifications are outlined below, along with efforts to mitigate potential effects on data quality.

Data gaps and operational constraints

• Building construction investment — Technical and operational delays were encountered in the production of source data on building construction investment, including work-put-in-place for residential and non-residential buildings. Because this information was not available in time for incorporation, first quarter results were estimated using proxy indicators of labour and material costs, as well as data from the Canada Mortgage and Housing Corporation. Larger than usual revisions may be made in the future as the full range of information becomes available by province and type of structure.

• Financial data on corporations — Starting with the first quarter of 2020, the Quarterly Survey of Financial Statements underwent a planned transition to a new design to better harmonize and integrate operations and update content. While survey response was not markedly impacted, unanticipated operational complexities resulted in delays for some sectors. Estimates of operating surplus were, therefore, based on in-progress estimates and do not incorporate the final results. Larger-than-usual revisions in the future may be anticipated.

• Spending on motor vehicles — Estimates of household spending and business investment on new motor vehicles normally draw on data from the monthly New Motor Vehicle Sales Survey (NMVS). Due to operational constraints, data for the month of March were not available at the time of compilation of the first quarter. Results had to be estimated using alternative sources, including the volume of motor vehicle registrations combined with prices from the auto industry. Normal updates for 2019 were postponed, and larger-than-usual revisions may be made when NMVS data are incorporated later.

• Government finance statistics — Operational delays with the onset of the pandemic led to later-than-usual receipt of data files for federal and provincial governments and created new complexities associated with estimation of current quarter results for Government Financial Statistics. Auxiliary information was incorporated wherever possible. The resulting estimates are likely to have larger-than-usual revisions as new information is received and validated at a detailed level.

Specific conceptual treatments and adjustments

In Canada, as in other countries, governments imposed wide-ranging restrictions and implemented support measures in response to COVID-19, generally beginning in mid-March 2020. To produce first quarter estimates, each of these support measures was examined, and the appropriate treatment in macroeconomic statistics was determined, in accordance with international standards. Several support measures were not implemented until April and therefore did not have an impact on the first quarter estimates. Two important exceptions are highlighted below.

• Measuring the volume of government and non-profit services — Government and non-profit services are generally not provided in exchange for market prices. According to international conventions, the final consumption expenditure of governments and non-profit institutions in nominal terms is often estimated by the wage and material costs associated with their production. The volume of their activity is estimated using actual hours worked for the wage component. In cases where employees continue to be paid while activities are constrained (public education, for example), nominal values may be maintained while the volume of actual hours work declined, resulting in a short-term upward impact on implicit prices.

• Recording the timing of subsidies on production — According to international standards, subsidies on production are recorded in the period to which they pertain, regardless of the timing of the cash payment. This treatment is necessary to avoid distortions in production measures, such as the GDP. Although Parliament approved the Canadian Emergency Wage Subsidy (CEWS) in early April, entitlements could be applied retroactively to wage costs incurred in the last two weeks of March. Therefore, an estimated amount of the subsidy pertaining to that period was included in the first quarter estimates, amounting to approximately $10 billion at annual rates. This conceptual adjustment has no direct impact on GDP at market prices, as offsetting amounts are implicitly recorded in other components of the GDP.

In sum, the first quarter GDP estimates are likely to have larger than usual revisions in subsequent releases.

Household spending falls

Declines in household spending were broad-based, affecting both goods (-1.7%) and services (-2.8%).

Outlays on durable goods fell 6.4%, the sharpest drop since the first quarter of 1982. Substantial declines occurred in purchases of new trucks, vans and sport utility vehicles (-9.4%), used motor vehicles (-10.1%) and new passenger cars (-8.8%), reflecting income uncertainty and reduced transportation needs as remote working became more common, as well as closure of car dealerships in some provinces including Ontario and Quebec.

Outlays for semi-durable goods fell 9.4% — the largest quarterly decline ever recorded — led by lower household spending on clothing and footwear (-16.4%).

Outlays on non-durable goods rose 3.1%, as consumers stockpiled products, such as food and non-alcoholic beverages (+7.2%) and alcoholic beverages (+6.0%); to some extent, this reflects a transfer of these expenditures away from restaurants and bars.

Lower household spending on services was attributable to food, beverage, and accommodation services (-10.9%), and air transport (-15.7%), resulting from shutdowns of restaurants and bars and restrictions on travel and tourism. These declines were partly offset by increases in imputed rents of owner-occupied housing (+0.6%) and paid rents (+0.7%).

Housing investment edges down

Housing investment edged down 0.1%, after rising 0.3% in the previous quarter.

Both renovation activities (-0.8%) and ownership transfer costs (-2.3%) dropped, reflecting the need for physical distancing advocated by public health officials and enforced by governments. These declines were partly offset by a 1.6% increase in new construction; construction of single-unit dwellings rebounded slightly, and construction of multiple-unit dwellings continued to grow for the fifth consecutive quarter.

Export and import volumes continue to decline

Both export (-3.0%) and import (-2.8%) volumes declined, owing to factors such as rail blockades in February, and shutdowns of production plants, border closing for tourism and non-essential travel, and lower demand in March as a result of COVID-19.

The impact of these events on exports outweighed any positive influence of depreciation of the Canadian dollar. Declines in export volumes were widespread, including intermediate metal products (-9.6%), passenger cars and light trucks (-10.0%), refined petroleum and energy products (-14.5%) and travel services (-16.3%). These declines were moderated by increases in exports of crude oil and crude bitumen (+3.9%), farm and fishing products (+10.0%) and non-metallic minerals (+19.7%).

Drop in demand and depreciation of the Canadian dollar contributed to the drop in import volumes. Declines were substantial in travel services (-12.4%), tires, motor vehicle engines and parts (-11.3%), industrial machinery and equipment (-4.4%), and communication, and audio and video equipment (-17.9%). These declines were partly offset by increases in imports of passenger cars and light trucks (+6.7%) and aircraft (+17.4%).

Non-residential business investment falls

Business investment in machinery and equipment (-3.5%) fell for the fourth consecutive quarter. Decreases were notable in communications and audio and video equipment (-16.8%) and in industrial machinery and equipment (-3.6%), largely due to reduced imports. These declines were partly offset by a 12.9% increase in aircraft and other transportation equipment.

Investments rose 1.2% in engineering structures and were up 0.5% in non-residential buildings. Investment in intellectual property products edged up 0.3%, after falling 1.8% in the previous quarter.

Terms of trade deteriorate

Export prices edged down 0.3%, largely reflecting a 3.6% drop in prices of exported crude oil and crude bitumen, while import prices rose 0.4%, partly because of depreciation of the Canadian dollar. Consequently, the terms-of-trade—the ratio of the price of exports to the price of imports—fell 0.7%. Decreased terms-of-trade contributed to lower real gross national income (-2.2%), which captures the real purchasing power of income earned by Canadian-owned production factors.

The GDP implicit price index, which reflects the overall price of domestically produced goods and services, rose 0.5%. The increase was partly attributable to a 1.5% rise in governments’ final consumption expenditure deflator, as nominal expenditure was relatively unchanged, but real expenditure — measured using the number of actual hours worked — declined.

Corporate earnings fall, but household savings rise

In nominal terms, the gross operating surplus of both non-financial corporations (-3.7%) and financial corporations (-3.2%) fell. The sharp drop in oil prices affected the revenue of businesses involved with the oil and gas sector; COVID-19 related restrictions affected all non-essential businesses including those involved with transportation, tourism and accommodation services. Further declines were mitigated by wage subsidies. Demand for financial products, such as stocks, bonds, and mortgages, fell owing to reduced profits and increased risk.

Compensation of employees decreased 0.9% — the first decline since the first quarter of 2016. The majority of industries experienced declines, led by manufacturing, trade (both wholesale and retail trade), and personal and professional services. These declines were mitigated slightly by initiation of the CEWS, retroactive to March 15, whereby government assistance made it possible for employers to continue to pay employees. This benefit will remain in effect for the entire second quarter.

Although compensation of employees declined, household disposable income increased 0.4%, because of higher property incomes and net government transfers (including sizeable federal fuel charge distributions to the household sector). Additionally, owing to travel and tourism restrictions and restaurant and retail closures, the decline in household spending (in nominal terms) was significant (-2.1%). Consequently, the household savings rate rose from 3.6% in the fourth quarter of 2019 to 6.1% in the first quarter of 2020. The household savings rate is aggregated across all income brackets; in general, savings rates are higher for higher income brackets.

Source: Statistics Canada, www150.statcan.gc.ca/n1/daily-quotidien/200529/dq200529a-eng.htm?CMP=mstatcan