Exports Fuelled 0.9% Rise in Second Quarter GDP

Nov 29, 2019

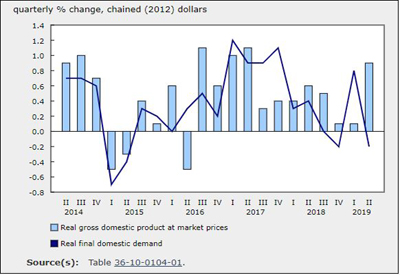

Real gross domestic product (GDP) grew 0.9% in the second quarter, after edging up 0.1% in each of the previous two quarters. This growth was led by a 3.2% rise in export volumes, while final domestic demand edged down (-0.2%).

Expressed at an annualized rate, real GDP advanced 3.7% in the second quarter. In comparison, real GDP in the United States grew 2.0%.

Exports of goods rose 3.7% in the second quarter, following declines in previous two quarters. The increase was led by energy products, which grew 5.9% after a 3.0% decline in the first quarter. Exports of services rose 1.1%, maintaining the pace of the previous quarter. Import volumes declined 1.0%.

GDP growth was moderated by a 1.6% decline in business investment; notable declines occurred in outlays on machinery and equipment and engineering construction. Growth in consumer spending slowed to 0.1%.

Businesses accumulated $11.9 billion in non-farm inventories in the second quarter, and the economy-wide stock-to-sales ratio remained at 0.85. Cannabis stocks contributed to the $2.1 billion accumulation of farm inventories.

Exports drive growth

The second quarter increase in export volumes was broad based. In addition to the growth in energy products, farm and fishing products rebounded 15.2%, following an 8.4% decline in the first quarter. Exports of non-metallic minerals rose 19.0%, the sharpest upturn since the third quarter of 2016, and exports of aircraft and related engines and parts grew 10.0%. Exports of travel services rose 2.4%, after a 1.4% increase in the previous quarter.

Exports of pulp and paper dropped 10.6%, the fourth consecutive quarterly decline.

Import volumes declined 1.0% in the second quarter, after a 2.1% rise in the first quarter. Imports of aircraft and associated engines and parts fell sharply (-32.1%), following a 41.1% rise in the previous quarter. Other notable declines occurred in pharmaceuticals and medicinal products (-3.9%) and in communication and audio and video equipment (-6.7%).

Imports of energy products rebounded 7.8% in the second quarter, after a 4.2% decline in the first quarter, while imports of motor vehicles and parts slowed to 1.4% growth.

Imports of services fell 1.8%, largely owing to a 4.0% decline in imports of transportation services.

Growth in household spending slows

Growth in household spending slowed to 0.1% in the second quarter, following a 0.7% increase in the first quarter. Outlays on durable goods fell 0.3%, largely as a result of a 1.4% decline in purchases of vehicles. Outlays on semi-durable goods slowed to 0.3%.

Outlays on non-durable goods edged down 0.1%, after a 0.8% rise in the first quarter. Outlays on services rose 0.3%, after a 0.5% increase in the first quarter.

Housing investment resumes growth

Following five consecutive quarterly contractions, housing investment rose 1.4%, on broad-based gains. Increases in multi-dwelling investments and conversions led the growth in new home construction (+0.9%). Higher resale activities boosted growth in ownership transfer costs (+3.8%), while renovation activities grew 0.7%.

Non-residential business investment declines

Business investment in non-residential structures and machinery and equipment fell 4.3% in the second quarter, following a 3.4% rise in the first quarter. The decrease was due mainly to a 9.3% decline in machinery and equipment investment, largely attributable to a 61.1% decrease in aircraft and other transportation equipment. Investment in computers and related equipment rose 7.7%, after a 1.7% decline in the first quarter.

Growth in business investment in non-residential buildings slowed to 1.1%, while investment in engineering structures declined 1.0%, the sixth consecutive quarterly decline.

Business investment in intellectual property products rose 0.6% in the second quarter, after a 1.3% decline in the first quarter. Mineral exploration and evaluation grew 1.3%, followed by software (+0.6%) and research and development (+0.3%).

Real gross national income continues to rise

Real gross national income, the real purchasing power of income earned by Canadian-owned factors of production, rose 1.3%, after a 1.1% gain in the first quarter. The GDP implicit price index, which reflects the overall price of domestically produced goods and services, rose 1.1%.

Canada’s terms of trade—the ratio of the price of exports to the price of imports—rose 0.9% in the second quarter, following a 2.7% increase in the first quarter. Export prices increased 1.3%, while import prices rose 0.4%. The price of exported crude oil and crude bitumen continued to increase, rising 15.2%, after a 31.8% boost in the previous quarter.

Corporate earnings and household disposable income grow

The growth in the gross operating surplus accelerated to 3.7% in the second quarter, after rising 2.1% in the first quarter. Growth in compensation of employees strengthened to 1.7% in the second quarter as both goods- (+1.5%) and services- (+1.8%) producing industries increased. This contributed to a 1.3% rise in household disposable income and a 1.7% increase in the household saving rate.

Source: Statistics Canada, www150.statcan.gc.ca/n1/daily-quotidien/190830/dq190830a-eng.htm