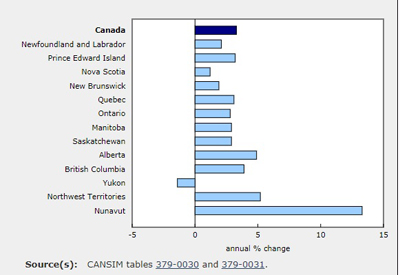

Every Province Scored GDP Gains in 2017

May 10, 2018

Real gross domestic product (GDP) by industry increased in every province in 2017 for the first time since 2011. Goods-producing industries’ growth outpaced services-producing industries in every province except Nova Scotia and Ontario. Among the territories, GDP rose in Nunavut and Northwest Territories and declined in Yukon.

Nationally, real GDP by industry rose 3.3% in 2017, the strongest pace of growth since 2011. Following declines in 2015 and 2016, Alberta posted the highest growth rate among the provinces at 4.9%. Economic growth in British Columbia (+3.9%) outpaced the national average for a fourth consecutive year.

Newfoundland and Labrador

In Newfoundland and Labrador, GDP rose 2.1% in 2017, following a 1.7% increase in 2016. Goods-producing industries increased 4.1% on the strength of contributions from mining, quarrying and oil and gas extraction, construction and manufacturing, while fishing and hunting declined for the fifth consecutive year.

Mining, quarrying and oil and gas extraction was up 4.9% from higher oil production at the Hibernia and the North Amethyst oilfields (see chart 3) and from a rise in iron ore mining that offset a decline in copper, nickel, lead and zinc ore mining. Support activities for the oil and gas extraction industry increased 15.7%.

Construction grew 5.0% led by engineering construction, as work continued on the Muskrat Falls electric power project and the development of a new open pit at an existing iron ore mine operation got underway. Residential construction declined for the fifth consecutive year and non-residential construction fell 14.3%.

Manufacturing was up 6.8% in 2017, its highest growth rate since 2012. Petroleum and coal product manufacturing increased 22.3%, the result of an expansion project at the refinery in Placentia Bay the previous year, and output of non-ferrous metal products rose as production at the Long Harbor nickel processing plant ramped up for a second year. Fabricated metal product manufacturing fell as work on projects related to the Hebron oilfield were completed.

Services-producing industries grew 0.7%. Transportation and warehousing rose 3.3% from increased activity in water and air transportation. After declines in 2015 and 2016, wholesale trade increased 3.0% with gains in seven of nine subsectors. Retail trade rose 1.0%.

Prince Edward Island

In Prince Edward Island, real GDP expanded 3.2% in 2017, the highest growth among the Atlantic provinces, after 2.2% growth in 2016. Goods-producing industries increased 6.1%, outpacing services-producing industries (+2.3%) for the first time in four years. Growth was broad-based with 18 of 20 industry groups recording higher output.

Construction rose 18.1% in 2017, largely due to a 32.7% increase in residential building construction, the result of a notable inflow of international immigrants over the last two years. Construction of non-residential buildings increased 11.9%, mainly due to commercial, institutional and government structures.

Manufacturing output rose 5.5%, largely driven by increases in food products, as well as increases in pharmaceuticals and medicines, industrial machinery, and aerospace products and parts. Crop production (except greenhouse, nursery and floriculture production) fell 6.4% as a dry growing season led to lower potato yields. Fishing, hunting and trapping was up as good weather contributed to a higher lobster catch.

Strong population growth and another good tourism season contributed to growth in services-producing industries. Retail trade increased 5.2% and accommodation and food services grew 4.2%, the highest growth rate among the provinces. Wholesale trade and truck transportation grew in tandem with goods production.

Nova Scotia

Nova Scotia’s GDP rose 1.2% in 2017, the fourth consecutive year of growth. Services output advanced 1.5% and contributed more to growth than goods-producing industries, which was up 0.3%.

Real estate and rental and leasing services increased 2.4%, its highest growth rate since 2012. Wholesale trade grew 5.6% with widespread gains, particularly in machinery, equipment and supplies, which rebounded from three consecutive years of declines. Retail trade advanced 3.7% with gains in 10 of 12 subsectors. Transportation and warehousing grew, with notable contributions from truck, air and water transportation. Health care and social assistance, and professional, scientific and technical services contributed to the growth, while public administration declined 0.4% with decreases in both federal government and provincial government public administration.

Manufacturing grew 2.9%, a the third consecutive year of growth, as significant gains in plastics and rubber products, ship and boat building, and chemical products more than offset losses in machinery, food products, fabricated metal products and wood products.

Mining, quarrying, and oil and gas extraction declined 20.2%, largely due to a 51.0% decline in conventional oil and gas extraction that was attributable to lower production at offshore projects. Pipeline transportation of natural gas fell sharply in tandem. The new Touquoy gold mine began production late in 2017 and non-metallic mineral mining and quarrying increased significantly with the introduction of a new product line at the Cabot gypsum mine. Commercial coal mining resumed for the first time in 15 years.

Construction rose 2.3%. Engineering construction increased 4.1% as an increase in work on the Maritime Link project was partly offset by the completion of the Touquoy gold mine. Residential construction rose 4.9%, while non-residential building construction declined as work on the convention centre in Halifax was completed and finishing touches continued on a new hotel.

New Brunswick

In New Brunswick, GDP grew 1.9% in 2017, following a 1.2% increase in 2016. Goods-producing industries grew 3.3% on higher output from manufacturing and construction. Services-producing industries rose 1.5% with contributions from retail trade, transportation and warehousing, and finance and insurance.

Manufacturing industries grew 3.1%, led by an 8.8% rise at petroleum refineries following an increase in processing capacity in 2016. There were increases in the manufacturing of wood products, fabricated metal products and plastic products.

Construction rose 6.3%, largely the result of a 28.5% increase in non-residential building construction with significant gains in the building of both industrial and commercial structures. Residential construction increased 4.1% after declining for four consecutive years. Transportation engineering construction declined 14.2% following three years of increases.

Retail trade rose 4.9%, the largest gain since 2000, with notable increases in motor vehicle and parts dealers, health and personal care stores, and building materials and garden equipment and supplies stores. Wholesale grew 5.9%, with seven of nine subsectors showing higher output. Truck transportation rose 7.3% while pipeline transportation declined sharply as a result of significantly lower throughput of natural gas from Nova Scotia to the United States. In the public sector, higher output from federal government public administration was partly offset by a decline in provincial government public administration and lower output from hospital services.

Quebec

Quebec’s GDP grew 3.1% in 2017, the strongest pace of growth since 2000 and more than twice the rate of growth in 2016 (+1.5%). Services output rose 2.9% and due to its larger weight in the economy, contributed more to growth than the 3.5% rise in goods-producing industries.

In the services-producing industries, wholesale trade grew 6.3% after declining in 2016 with notable contributions from wholesalers of machinery, equipment and supplies, food, beverage and tobacco products, and personal and household goods. Transportation and warehousing increased 5.8%, led by truck and air transportation and support activities for transportation. Professional, scientific and technical services was up 5.1% on the strength of an 8.9% gain in computer systems design and related services (which includes video game design and development). Retail trade rose 4.3% as 10 of 12 subsectors grew.

Manufacturing output rose 3.7% with growth in 15 of 19 subsectors. There were significant increases in food manufacturing, plastics and rubber products, fabricated metal products and machinery manufacturing. Aerospace products and parts manufacturing declined for the third consecutive year and alumina and aluminium production was down as in 2016.

Construction output grew 3.3% as all major components rose with the exception of a decline in engineering construction. Mining and quarrying increased 6.6% as higher output from gold and silver ore mines and the first full year of production from the Renard diamond mine more than compensated for a decrease in copper, nickel, lead and zinc and iron ore mining.

Ontario

Ontario’s GDP rose 2.8% in 2017, following a 2.6% increase in 2016. Services-producing industries grew 3.0% and accounted for more than 80% of the province’s growth, while goods-producing industries rose 2.1%.

Wholesale trade rose 7.1%, the highest growth rate since 2011, led by wholesalers of machinery, equipment and supplies, personal and household goods and miscellaneous wholesalers. Retail trade advanced 5.8% with all types of retailers recording higher activity. Professional, scientific and technical services were up 3.9%, largely from increased activity in computer systems design services and architectural and engineering services. Public administration was up 2.3%, mainly from an increase in local, municipal and regional public administration.

The introduction of provincial government regulations governing the housing market in the Greater Golden Horseshoe area around Toronto in April contributed to a 7.5% decline in offices of real estate agents and brokers and activities related to real estate. This industry had posted increases of 8.1% in 2015 and 9.7% in 2016.

Total construction increased 4.6%, with gains in all three major industry categories. Engineering construction increased 3.9% as work continued on major transportation engineering projects in Toronto and Ottawa.

Manufacturing rose 1.5% as 14 of 19 industry subsectors increased. The most significant gains in output were by manufacturers of machinery, food products, non-metallic mineral products and plastics and rubber products. Transportation equipment manufacturing fell 5.0% as motor vehicle and motor vehicle parts manufacturing declined in part as the result of a strike at an assembly plant and also due to changes to certain models being manufactured in Canada. Mining and quarrying (except oil and gas) was down for a second consecutive year.

Manitoba

Manitoba’s GDP increased 2.9% in 2017, the highest growth rate since 2012, following growth of 2.1% in 2016. Growth was broad-based as 17 of 20 industrial sectors increased.

The output of goods-producing industries was up 4.0%. Construction rose 7.9% as all major categories contributed to growth. Engineering construction increased 7.8%, led by electric power engineering as work on the Keeyask dam and the Bipole III transmission line projects continued. Residential construction increased 10.9% and non-residential building activity rose 9.2%, following two years of declines.

Crop production (except greenhouse, nursery and floriculture production) grew 12.1%, benefiting from excellent growing conditions and good harvesting weather which resulted in record production for most types of crops. Manufacturing increased 1.8% with gains in 13 of 19 industry subsectors, led by machinery and chemical manufacturing.

Mining, quarrying and oil and gas extraction was down 2.2% as oil and gas extraction fell 6.1%, the fifth consecutive year of contraction. Higher oil prices contributed to a 39.9% increase in support activities for oil and gas extraction which remained below their 2014 level. Mining and quarrying was down 1.4%, as copper, nickel, lead and zinc ore mining declined 4.0% while gold and silver ore mining rose 41.3%.

Services-producing industries increased 2.5%. Higher crop production was also reflected in the 4.9% increase in transportation and warehousing. Despite a backlog in the movement of grains, rail and truck transportation increased. Wholesale trade grew 5.3% with higher activity reported by wholesalers of machinery, equipment and supplies, food and beverage products and miscellaneous products. Retail trade rose 4.2% with 9 of 12 subsectors increasing.

Saskatchewan

In Saskatchewan, GDP increased 2.9% in 2017, following declines of 1.2% in 2015 and 0.4% in 2016. Saskatchewan was one of three provinces where goods-producing industries (+3.7%) contributed more to total growth than services-producing industries (+2.3%).

Mining, quarrying and oil and gas extraction rose 7.8%, more than offsetting the declines of the previous two years. Higher oil prices contributed to a 5.6% increase in oil and gas production and a 35.6% rise in support activities for oil and gas extraction. Strong export demand largely from the United States contributed to a 13.1% increase in potash mining. Continuing weak market conditions for uranium resulted in a significant decline in other metal ore mining, causing the closure of the Rabbit Lake mine in 2016 and a temporary shutdown of the McArthur Lake and Key Lake mines in the summer of 2017.

Manufacturing output increased 7.8%, the highest growth rate in more than a decade, as there were significant increases in pesticide, fertilizer and other agricultural chemicals (+28.8%), grain and oilseed milling (+8.9%) and agricultural, construction and mining machinery (+19.6%). Crop production fell 3.0% as lower output from wheat and specialty crops such as lentils and mustard seed more than offset a record canola crop.

Construction activity decreased 3.2%, the third consecutive year of lower activity. Non-residential building construction fell 14.5% due to the completion of major projects such as new elementary schools and a new stadium in Regina. Engineering construction decreased 5.0%, largely the result of a decline in other engineering with the completion of a new potash mine.

The higher production of goods influenced the gains in wholesale trade (+6.2%) and transportation and warehousing (+4.9%). The increase in wholesale trade came mainly from wholesalers of machinery, equipment and supplies. In transportation and warehousing, the gains were mainly in pipeline, rail and truck transportation.

Public administration was up 2.1%, the highest growth rate since 2009. Retail trade was up 0.4% after edging up 0.1% in 2016.

Alberta

In Alberta, GDP increased by 4.9% in 2017, following declines of 3.9% in 2015 and 3.6% in 2016. Goods-producing industries rose 7.9% after decreasing 7.7% in 2015 and 7.8% in 2016. Employment rose by 23,100 (+1.0%) in 2017, but was still below the peak level of 2015. The 2.9% rise in services-producing industries more than offset the declines of the previous two years. A recovery in oil prices contributed to a 12.7% increase in output in the energy sector.

Mining, quarrying and oil and gas extraction was up 13.3%. Oil and gas extraction rose 7.8% and support activities for mining and oil and gas extraction rose 56.7% after declining by more than 60% over the two preceding years. Together, these two subsectors accounted for 50% of Alberta’s growth in 2017.

The recovery of oil and gas extraction was a major factor in the manufacturing sector rebounding 8.1% as 17 of 19 subsectors reported higher output. The leading contributor to the sector’s growth was machinery manufacturing (+45.8%), followed by petroleum and coal products manufacturing (+9.7%)

Construction activity was down 0.7%. Engineering construction declined 3.9% as a decrease in oil and gas projects more than offset an increase in electric power engineering projects. After two years of decline, residential construction rose 3.7% in part due to rebuilding activity following the Fort McMurray wild fires in 2016.

Wholesale trade grew 10.1%, largely due to significant increases in wholesaling of machinery and equipment and building materials and supplies. Transportation and warehousing was up 6.6%, as truck and rail transportation increased in tandem with goods production.

Real estate and rental and leasing increased 3.9% in part as offices of real estate and brokers posted their first increase since 2014. Retail trade rose 5.8% after two years of declines with increases in 11 of 12 subsectors.

British Columbia

In British Columbia, GDP rose 3.9% in 2017, following a 3.6% gain in 2016. British Columbia recorded the second highest rate of growth among the provinces after reporting the highest growth the two previous years. The contribution to the province’s growth from services-producing industries (+3.6%) was more than twice that of goods-producing industries (+5.1%).

The 3.2% rise in real estate and rental leasing was tempered by a 6.5% drop in offices of real estate agents and brokers and activities related to real estate. This decrease, which follows double-digit increases in each of the previous three years, was partly due to the implementation of an additional 15% property tax on residential real estate property purchases by non-Canadian citizens or non-permanent residents in Metro Vancouver in August 2016.

Transportation industries grew 7.5%, with significant contributions from all modes as well as from support activities for transportation. Retail trade posted the highest growth among provinces for the third consecutive year, increasing 6.3% on gains across all 12 subsectors. Wholesale trade increased 8.3%, as all subsectors increased.

Among goods-producing industries, the construction sector contributed most to the growth, rising 9.9%. Engineering construction was up 48.7% mainly from oil and gas engineering construction partly due to new projects such as the Saturn Compressor Facility Expansion and the Towerbirch Expansion project in Dawson Creek, and the Ridley Island Propane Export Terminal in Prince Rupert. Residential building construction rose 2.2% while non-residential building construction fell 7.3%.

Manufacturing grew 4.5% as 15 of 19 industry subsectors showed increases. Primary metal manufacturing rose 9.8% as alumina and aluminum production and processing was up 12.4%. Wood product manufacturing, the largest manufacturing subsector in the province, declined 2.1% as sawmill and wood preservation operations were temporarily shut down due to the worst wildfire season in British Columbia since 1958.

Mining, quarrying, and oil and gas extraction decreased 0.5%, led by declines in copper, nickel, lead and zinc ore mining (-9.5%) and coal mining (-1.4%) while natural gas production edged up 0.3% following 13.8% growth in 2016. Support activities for mining and oil and gas extraction (+10.2%) was up for the first time since 2011.

Yukon

In Yukon, GDP decreased 1.4% in 2017, following an 8.3% increase in 2016. The decline was almost entirely due to a 43.4% drop in copper, nickel, lead and zinc ore mining following a 78.2% increase in 2016. In tandem, support activities for mining fell 26.3%, while gold and silver ore mining declined 4.6% following a 56.6% increase in 2016.

Construction rose 52.1%, led by other engineering construction as the development of the Eagle gold mine got underway. Non-residential building construction increased 28.0%, largely due to higher spending on institutional and government buildings as work on the Whitehorse General Hospital and the Whistle Bend care facility continued.

Services-producing industries grew 2.0%, down slightly from the 2.3% increase in 2016, as 12 of 15 industrial sectors increased. Higher tourism activity contributed to growth in air transportation and accommodation and food services.

Northwest Territories

In Northwest Territories, GDP grew 5.2% in 2017 after growing 0.8% in 2016. Goods output expanded 14.0% and contributed almost 90% of the territory’s growth, while services output rose 0.8%.

Mining, quarrying and oil and gas extraction activity was up 29.0%. Diamond mining increased 68.2% as the Gahcho Kue mine completed its first full year of production. Conventional oil and gas extraction declined sharply when production at Norman Wells was brought to a halt in February as a result of pipeline safety concerns.

Construction decreased 10.7% as engineering construction declined 39.7% with the completion of the new diamond mine in 2016 and the opening of the all-weather road from Inuvik to Tuktoyaktuk. Non-residential building construction grew 25.9% as construction of a school expansion in Yellowknife began and work continued on the Stanton Territorial Hospital and the Hay River arena.

Among services-producing industries, retail trade grew 4.3% while wholesale trade declined for the fifth straight year. The halt in activities at Norman Wells was the main reason for the 1.2% decline in transportation and warehousing coming from lower pipeline transportation. Air transportation gained 11.3% as the territory saw an influx of international visitors and twice weekly trips from Calgary to Gahcho Kue began in July.

Nunavut

In Nunavut, GDP increased 13.3% in 2017, following a 1.9% gain in 2016. Mining, quarrying and oil and gas extraction (+29.0%) and construction (+48.9%) contributed the most to growth.

In mining, quarrying and oil and gas extraction, gold and silver ore mining increased 27.3% with the opening of the Doris gold mine, while iron ore mining increased 42.7% as production ramped up for the second year at the Mary River mine. The increase in construction mainly reflects the rise in other engineering construction as the development of the Meliadine gold mine got underway. Electric power engineering construction rose 29.1% as work progressed on major new power stations and upgrades to existing infrastructure. Transportation engineering construction declined 36.5% as the new airport in Iqaluit opened in August. Residential construction rose 17.8%.

Services-producing industries increased 3.6%. Wholesaling of machinery, equipment and supplies grew in line with higher construction activity. Retail trade was up 2.2%, the lowest growth rate in four years. Public sector services, which include education, health care and social assistance and public administration all contributed to growth.

Source: Statistics Canada,