Evaluating eCommerce Companies, Forrester-style

June 24, 2020

By David Gordon

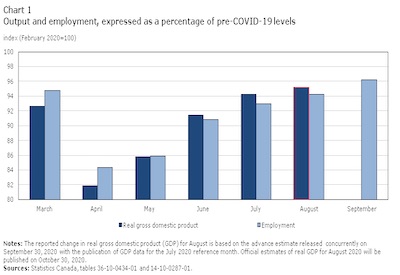

COVID-19 has heightened the benefit of, and interest in, eCommerce for electrical distributors. Our second and third COVID-19 Electrical Market Sentiment Reports have shown that those with an eCommerce offering have seen online sales increases. Further, from conversations with distributors, their site activity increased. The benefit is that these companies had lower sales declines (and some increases), and were able to better serve their customers.

A further benefit is that their remote workforce had access to an online resource, other than manufacturers, for quick, easy, product research.

With increased awareness and interest, we’ve heard of increased interest from “non-users.” While most US$100M+ distributors have already made the investment, those below express frustration at the investment level when they hear mid six-figure investment levels and 12+ month deployments for an “industry-recognized” software brand.

And most of these companies are not overly familiar with conducting a software package evaluation, other than for an ERP system or add-on module.

The functionality of these systems has become standardized, so finding first sufficiency versus your competitors is step one.

Last month Forrester released The Forrester Wave: B2B Commerce Suites, Q2 2020, which provided reviews on 13 eCommerce providers. Two of them, Episerver (whose Insite offering is used by a number of mid-larger distributors) and Unilog, are known in the industry. Many of the others have name recognition but either little traction in the industry or focus on other markets.

While the analysis of these two companies is interesting, and both are in the “Challenger” category with Episerver rated as a slightly stronger current offering, they are not viewed as Contenders, Strong Performers or Leaders. Remember, focus on “sufficiency”, but if “challengers”, perhaps other criteria (i.e. affordability) should be considered.

Forrester criteria

Forrester ranked the companies in three areas with multiple criteria. They are:

1. Current offering

• Sales channel support

• Personalization

• Business intelligence and analytics

• AI and machine learning

• Commerce suite

• Commerce management

• Platform

2. Strategy

• Product vision and roadmap

• Delivery model

• Supporting services

• Delivery and extensibility ecosystem

3. Market presence

• Customers and customer acquisition

• Total gross merchandise value (GMV)

• Product revenue

Forrester is, for the most part, evaluating the company, not specific functionality in the offering.

Some key points from the report that could be of value as distributors conduct their own evaluation:

• “Providers that lead the pack demonstrate deep, prebuilt integrations and strong user tooling.”

• “More of the leading platforms are opting to assemble a suite of best-fit solutions.”

• “B2B businesses expect to choose the best-fit solution for their vertical industry-specific needs.”

• Look for app stores for add-ons.

• Prioritize the business user experience.

• Personalized catalogues have become a commodity (expected feature).

Since the report covered only two systems that are used in the electrical industry, and there are a number of others, we’ll leave it to you to obtain the report (you can get a free copy from Adobe’s site by registering, from CommerceTools, or reach out to us for input), so we can remain neutral.

Determining a platform is only a piece of the decision. Travelling the eCommerce is not “buying an eCommerce system.” It’s a long investment. It is similar to what many hear regarding boats… you are always investing in it because there are new, desirable, features; new tools to help drive utilization or mine data; new ways to serve customer needs, and the software obsoletes itself. Further, the pricing models are essentially set-up plus monthly fees. The trend is to SaaS models, where upgrades and new functionality are included. Some still nickel and dime. Some require an integrator (a third party to handle the implementation), which adds costs.

When making a decision, consider product content early in the decision-making process. Will you need to build it, pay per SKU, source from manufacturers, or…??? Make sure it can be easily integrated into the system. And depending upon your planned usage, a PIM is not needed.

Forrester’s insights outline a supplier decision roadmap. Understanding your competitive environment, your customer needs, how you will use the system, and our expected benefits based on your business plan are keys to setting your budget and developing something that works for you. It’s not like building a branch (literally), where you own the land and moving can be cost-prohibitive. It’s software and you can change if you outgrow it. Speed to market and iterative development (innovation) are key to supporting your customers.

What eCommerce platform are you using? If your company offers eCommerce, has it benefitted your customers throughout COVID-19?

David Gordon is President of Channel Marketing Group. Channel Marketing Group develops market share and growth strategies for manufacturers and distributors and develops market research. CMG’s specialty is the electrical industry. He also authors an electrical industry blog, www.electricaltrends.com. He can be reached at 919-488-8635 or dgordon@channelmkt.com.