Energy Statistics, March 2020

June 10, 2020

In March, energy production and consumption were affected by the measures taken to contain the spread of COVID-19. Domestic consumption of motor gasoline for transportation and natural gas used by commercial and institutional consumers were particularly impacted, as activities in these sub-sectors were significantly reduced in the second half of the month.

With a full month of physical distancing policies in place, production and disposition of most energy products are expected to continue on a downward trend in April.

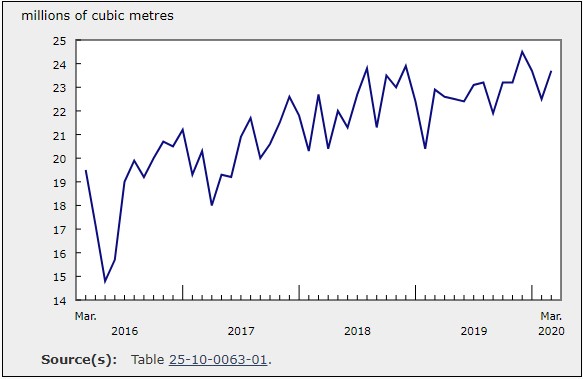

Lower energy prices and COVID-19 impact crude oil production

Canada produced 23.7 million cubic metres (148.9 million barrels) of crude oil and equivalent products in March, up 3.5% from March 2019, when ongoing government-imposed production cuts limited crude output in Alberta. Over the past year, crude production has been slowly ramping up due to the gradual easing of these production cuts.

Despite the year-over-year increase, daily production of crude oil (excluding equivalent products) fell 1.8% from February to 692.7 thousand cubic metres in March—the lowest daily production level since October 2019. The main contributor to the decrease was oil sands extraction, which includes crude bitumen and synthetic crude oil, down 1.9% to 478.6 thousand cubic metres. Extraction of heavy, medium and light crude oil declined 1.7% to 214.1 thousand cubic metres per day.

Exports of crude oil and equivalent products were largely unaffected by the pandemic in March as contracts from previous months were filled. Total exports rose 7.7% year over year to 19.7 million cubic metres.

Exports to the United States by pipeline rose 3.4% to 16.6 million cubic metres and accounted for 84.3% of total exports. Exports to other countries and exports to the United States by other means (rail, truck and marine) also increased in March, mostly due to higher volumes exported from Alberta and Newfoundland and Labrador.

Imports of crude oil and equivalent products declined year over year for the second consecutive month, down 0.6% to 3.9 million cubic metres in March, due to lower volumes imported by Canadian refineries.

Domestic consumption of motor gasoline affected by COVID-19

Refinery activity slowed in March as a result of lower demand following physical distancing measures. Some refineries also postponed their usual spring maintenance work as a result of the pandemic to avoid the risk of exposing workers and contractors.

Net production of motor gasoline (including blending components and ethanol fuel) decreased 5.3% to 3.6 million cubic metres in March. Domestic consumption of motor gasoline declined 13.4% year over year to 3.0 million cubic metres as drivers stayed home.

Net production of diesel fuel oil rose 4.5% to 3.4 million cubic metres, while domestic consumption of diesel fuel oil increased 3.8% to 2.6 million cubic metres.

Natural gas production declines on lower demand

Canadian marketable natural gas production decreased 3.2% year over year to 596.4 million gigajoules in March.

Total deliveries of natural gas to Canadian consumers declined for the second consecutive month, down 2.0% year over year to 483.4 million gigajoules in March, due to lower demand for heating from the commercial and institutional (-7.5%) and residential (-3.7%) sectors. Deliveries of natural gas to industrial consumers edged up 0.6%.

Exports of natural gas by pipeline to the United States declined 13.4% to 237.4 million gigajoules in March, the largest year-over-year decrease since April 2019. This was also the lowest level of exports for the month of March since the data series began in January 2016. Demand for Canadian natural gas fell in tandem with the slowdown in economic activity in the United States.

Imports of natural gas from the United States by pipeline were down 6.7% to 105.8 million gigajoules, the second consecutive monthly year-over-year decline.

Electricity generation down

Electricity generation in Canada decreased 0.7% year over year to 57.6 million megawatt-hours (MWh) in March. The decline was mainly attributable to electricity generated from combustible fuels, down 15.5% to 10.8 million MWh.

The overall decrease in electricity generation was partially offset by renewable generation (including hydro, wind, solar, tidal and other sources), up 3.8% year over year to 39.7 million MWh, and nuclear generation, up 12.8% year over year to 7.9 million MWh.

Electricity exports to the United States rose 19.7% to 5.3 million MWh in March. Most exports originated from Quebec, Ontario and Manitoba. Imports of electricity from the United States, which tend to be volatile, decreased 29.9% to 1.1 million MWh. Over half of all electricity imported went to British Columbia.

Coal and coke production declines

Coal production continued on a downward trend, declining 20.5% year over year to 4.0 million tonnes in March. Coke production decreased 10.8% to 183.6 thousand tonnes.

Source: Statistics Canada, www150.statcan.gc.ca/n1/daily-quotidien/200603/dq200603b-eng.htm