Electrical Wholesaler Study 2016 Part 1: Operating Successfully in a Disruptive Market

Technological change has often been the cause of major market disruption. Consumers tend to benefit from these kinds of disruptions through improved service levels or radically lower prices.

Manufacturers have the potential and often the resources to lead the transition towards a completely different market environment. Wholesalers and distributors, however, have fewer means to drive changes themselves. They face the risk of being squeezed on multiple sides by demanding digital customers, changing value chains resulting from new digital competitors, and strong manufacturer brands.

The needs and strategies of electrical wholesalers facing disruptive change have not been researched nearly as much as other parts of the value chain. This paper focuses on those wholesalers and how they can successfully meet their customers’ needs.

We analyzed the disruptive character of LED (“LEDification”), smart home technology and digitalization to see how these trends have changed the behaviour and expectations of installers and contractors as the key customer group of electrical wholesalers. We selected the lighting industry because it proves to be a dynamic example of how recent technology shifts can shape market changes. We believe that our findings are also relevant to wholesalers in other technology sectors without claiming generalization across industries.

In addition to our findings, we provide a number of practical “checklist questions” aimed at the improving “day-to-day business at the counter”, especially for low- to mid-tier players. We also provide a “how-to-win” guide for wholesalers who strive to further build their brand in the higher end of the market.

Approach: ask the customer!

In spring 2016, the global lighting industries’ most important trade fairs, Light + Building (Frankfurt) and Lightfair International (San Diego), provided strategic impetus on the latest industry trends and key technology innovations. Considering these fairs, we conducted an international study that draws on both empirical findings and theory to capture a wide-angle view of both wholesaler and installer perspectives.

How the research was conducted

Directly after Light + Building and Lightfair International 2016, we conducted a number of dedicated surveys among electrical wholesalers and their customers across Europe, the United States, and Latin America. We

- conducted an online survey among 3,686 electrical installers (in other words, the customers of wholesalers) in six countries to gain insights of their opinions and needs

- applied advanced statistical methods to the mentioned dataset to evaluate significant differences between various groups of installers and to identify clusters of installers with similar expectations across multiple countries

- carried out face-to-face interviews among 141 wholesaler representatives (primarily owners or high-level managers) from eight regions in onsite workshops

- analyzed data from four in-depth case studies of other technology sectors in order to incorporate cross-industry insights in our research.

What the researchers learned

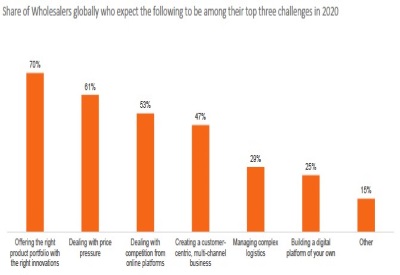

When asked about key business issues over the next five years, electrical wholesalers painted a relatively consistent picture globally (see the figure below):

Almost three quarters claim that offering an up to-date and innovative product portfolio will be among their top three headaches in 2020. In times of shortening technology cycles, it is becoming increasingly challenging to “bet on the right horse” and consistently offer a state-of-the art product range.

Almost three quarters claim that offering an up to-date and innovative product portfolio will be among their top three headaches in 2020. In times of shortening technology cycles, it is becoming increasingly challenging to “bet on the right horse” and consistently offer a state-of-the art product range.- At the same time, wholesalers are struggling with price pressure due to a combination of a cheap supply from unbranded Asian LED manufacturers and new distribution channels such as online B2C shops.

- In light of emerging online competition, nearly half of all wholesalers worry about how to become well-managed, multi-channel businesses considering resource constraints caused by pressure on margins. Almost 50 percent of the interviewed wholesalers see this as one of their top three challenges for 2020.

“Offering the right product portfolio with the right innovations” is the key challenge for electrical wholesalers

Within this global picture, there is also a number of differences between individual countries and types of businesses:

- Although product portfolios and innovation challenges are hot topics across all regions, they appear to be particularly important in Western Europe and South America. Looking at the different wholesaler types, these are the most important issues for International wholesalers, but they are slightly less of a challenge for buying groups and local independents.

- In general, price pressure is understandably more of a headache for buying groups considering the very nature of these corporations. Interestingly, North American wholesalers across the board, compared to other regions, consider price pressure as the top challenge by far.

- The price pressure in America does not seem to originate primarily from online competition. According to our interviews, this issue is more likely to be a challenge in Europe. Competition from internet platforms is also a key factor for international wholesalers rather than local wholesalers and buying groups.

- Supply chain management (SCM) seems to be a much more widespread worry among wholesalers in America. Almost half of the respondents rate SCM as one of their top four challenges, compared with only 15% in Europe. Of course, buying groups are affected more often by this challenge than more centralized wholesalers are.

Based on our interviews, it became obvious that wholesalers find themselves under more pressure compared to the past. Normal market dynamics continue to squeeze margins. At the same time, shorter technology cycles and new forms of competition resulting from digitalization exacerbate the situation. This first trend makes product range and portfolio decisions more challenging than ever, while the second one threatens traditional value chains and business models.

The big picture: technology shifts drive market disruption

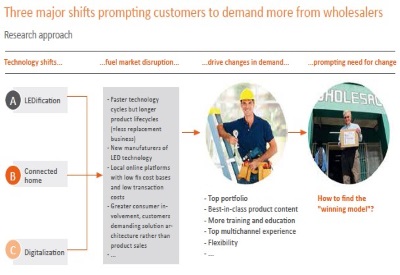

Changes in technology cause the majority of the wholesaler-challenges listed above. These technological developments fuel market disruptions in a number of ways, for example, by allowing new players to enter the market, driving down unit costs, prolonging product lifetimes, and opening the way for new supply chain configurations.

These kinds of market disruptions are changing the expectations and demands of installers. This is creating new wholesaler challenges – as outlined above – and putting pressure on wholesalers to adapt accordingly.

The figure below provides a systematic view of changing customer demand in the lighting industry.

In Parts 2 and 3: how three major disruptive technology trends are affecting the lighting industry, and how electrical wholesalers can operate in the higher end of the market. Watch for Part 2 in the June 2 issue.

About the authors

Dr. Claudia Bünte is an international marketing and branding expert. She has held a number of leading positions at global companies across the world: Associate Principal at McKinsey & Company, Global Vice President Brand and Marketing Strategy at Volkswagen AG, Director Europe for Knowledge & Insights, Director Strategy and Planning for Germany and three other markets (both at The Coca- Cola Company). Other engagements include strong brands such as NIVEA, Apple and Siemens. She teaches marketing at international institutions and holds a PhD in Brand Strategy.

Sascha Stürze is the founder and CEO of Analyx. He has dealt with the pragmatic application of advanced data analytics to top management issues in sales and marketing for more than fifteen years. Initially working as a consultant at McKinsey & Company in Berlin and San Francisco and then since 2006 at his own marketing analytics firm, he supports clients across Europe by bringing the power of big data to the desks of CMOs. He holds a Master’s Degree in Management Information Systems and serves on the Advisory Board of multiple analytics start-ups that he has co-founded.

Dr. Oliver Vogler is Global Vice President for Strategy and Marketing at LEDVANCE. He has worked in the lighting industry for more than five years in different strategy, sales and marketing functions with a strong focus on the electrical wholesale business. Dr. Vogler previously worked for McKinsey & Company as a consultant serving high-tech clients primarily in the lighting and semiconductor industries. He holds a PhD in Empirical Economics.

This white paper has been lightly edited and abridged. Read the full paper: http://electricalwholesalestudy.de/wp-content/uploads/2016/09/160923_WhitePaper_FINAL_Web.pdf