December Wholesale Sales Decline for the First Time in 7 Months

Feb 12, 2021

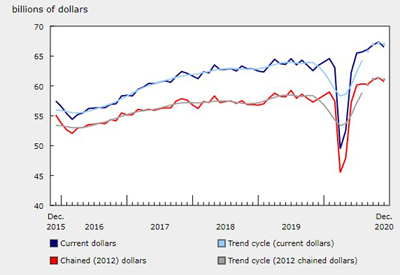

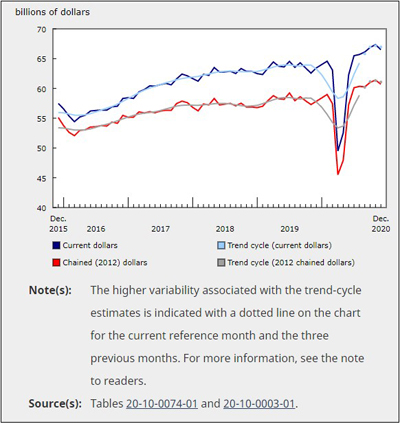

Wholesale sales fell 1.3% in December to $66.5 billion, the first decline after seven consecutive increases. The decrease was attributable to sharply lower sales of motor vehicles and motor vehicle parts and accessories; and machinery, equipment and supplies. These declines were modestly offset by higher sales in the miscellaneous subsector.

Wholesale sales fell 1.3% in December to $66.5 billion, the first decline after seven consecutive increases. The decrease was attributable to sharply lower sales of motor vehicles and motor vehicle parts and accessories; and machinery, equipment and supplies. These declines were modestly offset by higher sales in the miscellaneous subsector.

Wholesale sales in constant dollars dropped 1.1%.

Wholesale sector sales still exceed levels observed before the COVID-19 pandemic

Notwithstanding the 1.3% decline in December, sales for the month were still 3.0% higher than levels observed before the COVID-19 pandemic, with all 10 provinces recording higher sales than in February 2020. December sales were the third highest for the sector on record. Sales in five of the seven subsectors were higher than the pre-COVID-19 benchmark, led by building material and supplies (+12.2%), and machinery, equipment and supplies (+6.6%).

Despite provincial governments’ increased restrictions on business activity in December, the drop in the sector was consistent with previous monthly fluctuations. In 2019, for example, the average monthly movement was plus or minus 1.2%, and no individual month moved more than 1.7% one way or the other.

Sales drop in the three largest subsectors

The three largest wholesale subsectors all posted lower sales in December, with the greatest decline seen in the motor vehicle and motor vehicle parts and accessories subsector, followed by the machinery, equipment and supplies subsector, and the food, beverage and tobacco subsector.

Motor vehicle and motor vehicle parts and accessories sales fell for the second consecutive month, down 4.3% to $10.7 billion, their lowest level since July. Sales declined in all industries. Lower sales for the subsector in December reflected weakness in the domestic demand for Canadian-built vehicles, parts and accessories, as imports of motor vehicles and parts rose 2.4%, while exports fell 0.4%—less than the subsector’s overall decline.

Sales of machinery, equipment and supplies dropped 3.1% to $13.8 billion, the third decline in the past five months. Sales fell in three of the four industries in the subsector, with the largest decline in the computer and communications equipment and supplies industry.

Food, beverage and tobacco sales fell 1.3% to $12.0 billion in December, largely as a result of a 15.4% drop in the sales of cigarettes and tobacco products. Sales of cigarettes and tobacco products have declined in four of the past six months and in December were 20.6% below their 2020 high reached in June.

Partially offsetting the declines was a 2.9% increase in sales in the miscellaneous subsector. Higher sales were driven by the agricultural supplies industry and the recyclable material industry.

Sales decline in seven provinces

Lower sales were recorded in seven provinces, accounting for 96% of total wholesale sales in December. Ontario and British Columbia posted the largest decline in monthly sales.

Sales in Ontario declined for the second consecutive month, down 1.2% to $34.4 billion, following a 0.2% decrease in November. The drop partly reflects the province-wide COVID-19 lockdown that started on December 26, and the fact that the largest population centres were on lockdown throughout the month. Lower sales were recorded in six of the seven subsectors, led by the motor vehicle and motor vehicle parts and accessories subsector (-3.1% to $7.5 billion), with all three industries within that subsector reporting sales losses. Sales in the machinery, equipment and supplies subsector dropped 1.3% to $7.1 billion, reflecting lower sales in the computer and communications equipment and supplies industry, and the other machinery, equipment and supplies industry. Notwithstanding the COVID-19 resurgence and the reintroduction of lockdowns, fourth-quarter wholesale sales in Ontario were still 1.6% higher than in the third quarter.

In British Columbia, sales fell 2.6% to $6.9 billion, largely reflecting a decline in the machinery, equipment and supplies subsector. Sales in this subsector were down 10.9% to $1.3 billion, with all four industries in this subsector recording declines. Sales in the machinery, equipment and supplies subsector had reached a record high of $1.4 billion in November after six months of consecutive increases. Similarly, because of lower sales in all three of its industries, sales in the food, beverage and tobacco subsector declined 3.6% to $1.3 billion. Partially offsetting the decrease were higher sales in the miscellaneous subsector (+5.4% to $765 million) and the building material and supplies subsector (+1.2% to $2.1 billion). Overall, sales in British Columbia were 4.3% higher in the fourth quarter of 2020 than in the previous quarter.

Decline in inventories

Inventories slipped 0.1% in December to $90.0 billion. Lower personal and household goods inventories (-2.5% to $15.8 billion) and inventories of machinery, equipment and supplies (-1.2% to $26.2 billion) generated the decline. The building material and supplies subsector saw the largest increase in December, up 2.4% to $14.5 billion, followed by the motor vehicle and motor vehicle parts and accessories subsector, up 2.3% to $11.7 billion. Wholesale inventories were 1.7% lower in December 2020 than in December 2019.

The inventory-to-sales ratio for December 2020 rose to 1.35 from 1.34 in November—the first increase in the ratio since September. This ratio is a measure of the time (in months) required to exhaust inventories if sales were to remain at their current level.

Annual review of wholesale sales in 2020

In 2020, sales in the wholesale sector in Canada decreased for the first time since 2009, shrinking 1.0% to $754.0 billion as a result of the COVID-19 pandemic. These lower sales offset previous gains made in 2019 (+1.5%) and 2018 (+3.6%). In the second quarter, sales dropped 14.3% to $164.3 billion, when the pandemic’s impacts on the economy were the most severe. A subsequent record increase of 20.1% in the third quarter showed the resilience of this sector, and, although fourth-quarter sales also showed growth (+1.7%), the last two quarterly increases combined were not enough to offset the losses incurred in the second quarter.

After the effect of prices is removed, total wholesale sales were $689.3 billion in 2020, which was 0.9% lower than 2019.

Despite the overall decline, wholesale sales increased in five of the seven subsectors in 2020, led by the food, beverage and tobacco subsector. However, these gains were eclipsed by the decline in the motor vehicle and motor vehicle parts and accessories subsector.

Sales decreased in six provinces in 2020, with sales in Ontario declining the most because of the province’s high concentration in the motor vehicle and motor vehicle parts and accessories subsector. Sales in Alberta were lower because of a drop in sales in the machinery, equipment and supplies subsector. Quebec posted the highest increase in 2020, mainly because of higher sales in the miscellaneous subsector and the food, beverage and tobacco subsector.

According to the Survey of Employment, Payrolls and Hours, in November 2020, the wholesale trade sector employed 779,078 Canadians—5.8% lower than the employment in this sector in November 2019. The average weekly earnings (including overtime) of people employed by wholesalers grew 6.0% to an average of $1,337.78 per week in November 2020, compared with November 2019.

Motor vehicle and motor vehicle parts and accessories subsector most affected by the pandemic

When COVID-19 started to spread in the spring, wholesale sales in the motor vehicle and motor vehicle parts and accessories subsector dropped at an immediate and unprecedented rate. From February to April, sales fell 74.0%, making the subsector the most severely affected. The automotive sector has a complex international supply chain, which was disrupted during the pandemic because of unsynchronized lockdowns and plant and dealership shutdowns worldwide. Wholesale sales in this subsector remained relatively flat until they started to pick up in June, as sales grew 113.4% from May, but, following June, the subsector never recovered the losses. As a result, sales in this subsector were $18.2 billion lower than their 2019 level and the lowest since 2014.

The infographic shows cumulative year-to-date wholesale sales in the motor vehicle and motor vehicle parts and accessories subsector and demonstrates the noticeable shift in the level of sales from 2019 to 2020.

The lower wholesale sales for this subsector were also reflected in lower exports and imports in 2020. Export of motor vehicles and parts dropped 20.3%, while imports declined 24.0% in 2020.

Higher sales in food, beverage and tobacco subsector

Sales in the food, beverage and tobacco subsector rose 3.5% following increases of 1.6% in 2018 and 0.6% in 2019. While sales in the food industry grew 1.7% in 2020, sales advanced 20.6% in the beverage industry and 9.6% in the cigarette and tobacco product industry. The last time sales in the beverage industry saw a double-digit increase was in 2011 (+10.0%).

As indicated in Statistics Canada’s Canadian Perspectives Survey Series (which monitors the effect of COVID-19), many Canadians have increased their alcohol consumption since the beginning of the pandemic, and, paradoxically, 14.6% of Canadians indicated that they lived in a household with food insecurity in May 2020.

The lumber, millwork, hardware and other building supplies industry makes a strong comeback

The lumber, millwork, hardware and other building supplies industry, within the building materials and supplies subsector, posted the largest increase in 2020 compared with 2019. Sales in the building materials and supplies subsector rose 1.7% in 2020, entirely because of higher sales in the lumber, millwork, hardware and other building supplies industry. Sales in this industry increased by 12.0% in 2020, reaching an all-time high of $59.2 billion. This was a notable rebound, as sales had decreased 4.4% in 2019, the first decline since 2011.

Higher sales in the lumber, millwork, hardware and other building supplies industry reflected a higher demand for lumber and other wood products and higher lumber prices in 2020. Exports of lumber and other wood products increased 22.2% in 2020. The annual average of the Industrial Product Price Index (IPPI) for lumber and other wood products rose 19.3% in 2020 after declining slightly (-1.0%) in 2019.

Sales decline in Ontario and Alberta

Sales in Ontario dropped 1.9% in 2020 because of lower sales (-15.8%) in the motor vehicle and motor vehicle parts and accessories subsector. This subsector’s share of total wholesale sales in Ontario dropped from 23.1% in 2019 to 19.8% in 2020. Excluding this subsector, sales in Ontario grew 2.3%, as higher sales in the food, beverage and tobacco (+5.8%) and the miscellaneous (+4.2%) subsectors partially offset the impact of the decline in the motor vehicle and motor vehicle parts and accessories subsector in this province.

In Alberta, sales declined 3.8% in 2020, mainly as a result of lower sales (-8.9%) in the machinery, equipment and supplies subsector. Weaker activity in this subsector partially reflected lower energy and petroleum product prices (the IPPIdeclined 27.5% on average) and capital expenditures in mining, quarrying, and oil and gas extraction (-30.4%) in 2020. Wholesalers in this industry are involved in selling machinery and equipment to companies in the oil, gas and mining industries.

Quebec achieved the highest gains

Despite the challenging year, Quebec saw its sales increase by 1.4%. Quebec wholesalers reported increases in all subsectors except the motor vehicle and motor vehicle parts and accessories subsector, in which sales decreased by 8.8%. Higher sales in the miscellaneous subsector and the food, beverage and tobacco subsector represented about three-quarters of the gains for the province.

Inventory-to-sales ratios increase in 2020

The average inventory-to-sales ratio in 2020 was 1.46, compared with 1.44 in 2019. At the subsector level, the motor vehicle and motor vehicle parts and accessories subsector had the highest inventory-to-sales ratio difference, at 1.53 on average in 2020, compared with 1.16 in 2019. While on average sales declined 13.8% in this subsector in 2020, inventories also declined (-4.9%) because wholesalers used inventories when supply was tight as a result of lower manufacturing sales and imports.

Source: Statistics Canada, www150.statcan.gc.ca/n1/daily-quotidien/210212/dq210212a-eng.htm