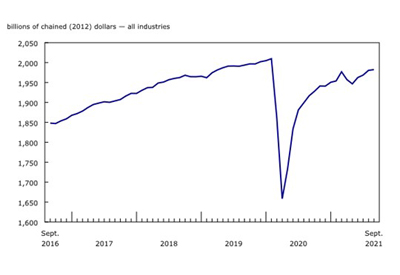

Copper Prices for 2015

We have all seen the impact of copper prices over the last 10 years. If you had stock or had the right contract, you did well during the upward swing. However, if you did foresee the down turns we all lost profits and sales during this time of uncertainties.

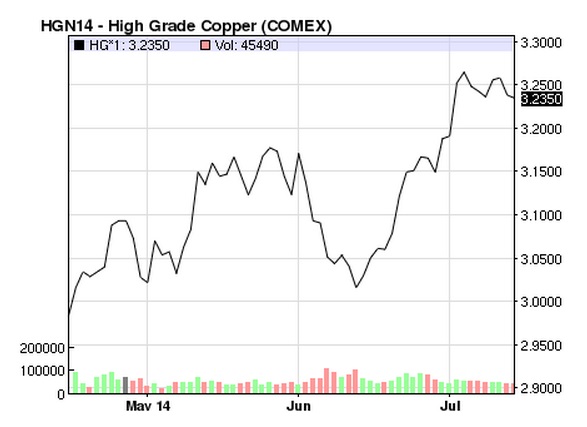

The chart below shows a low of US$.65/pound in 1999 and a high of US$4.50/pound in 2010. Currently we are trading around $2.54. The real question is where is going to be during the 2015 fiscal year? If we had the answer we all would share in this profit opportunity.

One item some people tend to forget that copper mining is an important part of the Canadian economy.

Canada is the third largest copper producer in the world, after Chile and the U.S. In Canada, copper is always produced in conjunction with another metal, most often as a co-product with nickel, zinc, lead, gold and molybdenum.Copper, as well as most of the base metals mined in Canada are hosted in massive sulphide sources and porphyry deposits.

Copper is widespread in Canada. However, areas where the metal is concentrated enough to be mined profitably are limited. British Columbia is the largest copper-producing province, followed by Ontario. Large-scale copper mining began in Quebec, the third-largest producer, with the opening of the Horne mine at Noranda late in 1927. The smelter now recycles copper and produces primary copper. Copper production in Manitoba, Canada’s fourth largest copper-producing province, is centred on the copper smelter in Flin Flon. Elsewhere in Canada, copper is recovered only in minor amounts.

Chile accounts for over one third of world’s copper production followed by China, Peru, the U.S., Australia, Indonesia, Zambia, Canada and Poland. Major exporters of copper ores and concentrates are Chile, Peru, Indonesia, Australia, Canada, Brazil, Kazakhstan, the U.S., Argentina, and Mongolia. The biggest importers of copper are China, Japan, India, South Korea and Germany. Copper market participants use the COMEX Division of high-grade copper futures and options to mitigate price risk. Copper is the world’s third most widely used metal, after iron and aluminum, and is primarily used in highly cyclical industries such as construction and industrial machinery manufacturing. Profitable extraction of the metal depends on cost-efficient high-volume mining techniques, and supply is sensitive to the political situation particularly in those countries where copper mining is a government-controlled enterprise.

Although mining is in a multi-year global slump, prices are significantly higher than they were a decade ago, said Pierre Gratton, president of the Mining Association of Canada, in a recent article. “It’s a cyclical industry and we have to weather this.”

Gratton went on to state, “Mining companies are very focused on reducing costs and will benefit from both the weakened Canadian dollar and dramatically lower energy prices.”

They’ve seen this a million times. They will weather this and prepare for the next upswing and when (it) comes I think the general view is it is going to be pretty significant.

BMO Capital Markets forecasts its commodities price index for metals and minerals will decrease 9% this year to its lowest level since 2009, but then increase about 4% in 2015.

The bank expects precious metal prices will face further downward pressure from the rising U.S. dollar. Copper should decrease further but industrial metals like aluminum and zinc, which rallied in 2014, should “consolidate” those gains in 2015.

As you can see, even the experts have a hard time to actually help us in the area.

Paul Eitmant is President and CEO of IP Group International, which serves the needs of business-to-business enterprises in over 30 countries worldwide by adding specialized expertise to the business planning and implementation process; Tel: 480.488.5646; paulipgroup@cox.net.Content for this article has been drawn from several sources, including Copper Investing News and Canadian Press.