Copper — A New Year, Same Story, Just at a Higher Level

January 16, 2017

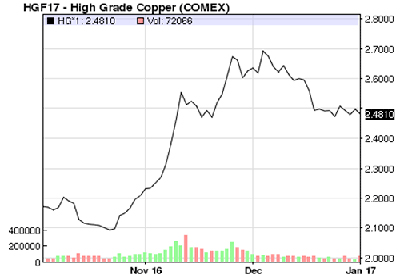

The price of copper has levelled off considerably since we last visited the red metal. After the chart skyrocketed to nearly US$2.70 a pound following the November election, the price has come back to reality.

That being said, the new level to judge copper is somewhere around US$2.30 to US$2.50 a pound. That is a far cry from the recent past when investors were happy to see copper top the US$2.00 plateau.

tED contributor Jesse Colombo points out that the break above the US$2.30/pound resistance level in November gave a bullish signal that led to another 20% advance to US$2.75/pound. Since then, copper has pulled back a bit.

“What is notable about this sudden copper surge is how it’s primarily driven by speculators at the same time that the true ‘smart money’ have been building their largest short position in approximately 13 years,” Colombo stated as the copper price peak started to drop late in Q4. “In this case, the ‘smart money’ refers to commercial hedgers in the copper futures market — the actual producers and end users of the physical metal. The hedgers tend to be correct at major market turning points, while the trend-following speculators or ‘dumb money’ tend to get caught on the wrong side of the market. This massive ‘smart money’ short position suggests that caution is warranted by anyone who is considering going long at this point.”

Colombo adds, the next major hurdle to clear is the $3/pound resistance level.

Other views

Goldman Sachs, traditionally known to be pessimistic when it comes to predicting what copper will do, may be on the same wavelength with the US$3 level. They predict prices to hit US$6,200 a ton over the next six months and have lifted its 3, 6 and 12-month forecasts to US$5,800, $6,200 and $5,600 a ton. That’s up from US$5,000, $4,800 and $4,800.

“Although it is tempting to blame this on speculative positioning, the materially stronger fundamental developments that contributed to this surge in speculative interest are likely to underpin a more bullish environment for copper,” Goldman analysts wrote in early December.

The investment bank now believes that increased demand from China will leave the market tighter than previously expected, which will support a more bullish environment for the metal at least to mid-2017.

Andrew Cole, editor of the Base Metals Forecaster, says it was evident investors were coming back to commodities. “Copper itself looks like it could be one of the top performers. It was undervalued for much of 2016, weighed down by perceptions of a weak China and rising supply,” he says. “Since both of those views have swung around completely, there may still be some catching up to do in terms of investors who had been underweight copper moving to reposition to a more bullish stance, by increasing allocations and building long positions.”

Latest news

While the calendar has turned to a new year, the story seems to stay the same. The yo-yo battle of copper continues as the U.S. dollar hit a 14-year high overnight only to be countered by positive early morning buying news out of China to push LME Copper down 0.6%. Typically, the higher the dollar, the lower the price of copper —the last two months that analogy has been blown out of the water.

The Chinese New Year, to be celebrated on January 28, could also keep some participants out of the market.

“Given the uncertainty that comes with the U.S. administration change-over and the early Chinese Lunar New Year, we would not be surprised if buyers stayed on the sidelines for longer. If prices do not regain upward momentum soon, further stale long liquidation could follow,” Metal Bulletin analyst William Adams said.

We will keep an eye out for the FOMC minutes and look ahead on the calendar to bring you the latest copper news.

Jim Williams is a columnist for tED Magazine, where this article first appeared, www.tedmag.com.